Crypto products see 4th week of inflows amid race for Bitcoin ETFs: CoinShares

Crypto investment products have recorded four weeks of inflows, as the market eagerly awaits the possible approval of a spot Bitcoin ( BTC ) exchange-traded fund (ETF) in the United States.

Asset management firm CoinShares’ Oct. 23 fund flows report revealed $179 million was added to digital asset investment products in the week ending Oct. 20, which has swelled the space’s assets under management to $33 billion.

Of the past week’s inflows, $55.3 million or 84% went to Bitcoin investment products which has brought year-to-date Bitcoin product inflows to $315 million, it added.

It seems that the anticipation of a spot #Bitcoin ETF has prompted further inflows for the 4th consecutive week. Here is our analysis with @Jbutterfill .

— CoinShares (@CoinSharesCo) October 23, 2023

Week 43 inflows: US$66m

Inflows are relatively low in comparison to June’s @BlackRock announcements, suggesting more… pic.twitter.com/6AkDGQJVOh

CoinShares Head of Research James Butterfill however noted that the recent week’s inflows still haven’t reached the levels seen earlier this year when BlackRock first filed for a spot Bitcoin ETF.

“While the most recent inflows are likely linked to excitement over a spot Bitcoin ETF launch in the U.S., they are relatively low in comparison to the initial inflows following BlackRock’s announcement in June.”

Butterfill added thaJune’s four-week inflow run saw $807 million enter the sector and the lower inflows recently “are indicative of investors adopting a more cautious approach this time.”

Flows by asset for the week ending Oct. 20 show Bitcoin and Solana as the most popular. Source: CoinShares

Flows by asset for the week ending Oct. 20 show Bitcoin and Solana as the most popular. Source: CoinShares

Meanwhile, Solana ( SOL ) products caught the second-largest share of inflows last week and the largest of all altcoins, netting $15.5 million. Ether ( ETH ) products saw outflows of $7.4 million — the only altcoin to suffer outflows last week.

Related: Bitcoin ETF to trigger massive demand from institutions, EY says

More recently, interest in a spot Bitcoin ETF surged late on Oct. 23 amid “positive signs” that BlackRock’s ETF was a step closer to approval and a U.S. Appellate Court issued a mandate to the Securities and Exchange Commission to review Grayscale’s spot Bitcoin ETF filing.

The moves sparked a Bitcoin rally which saw it gain 14% over the past 24 hours and briefly hit $34,000 for the first time since May 2022.

The price jump also saw over $193 million in Bitcoin short liquidations in the past 24 hours, according to CoinGlass data .

Magazine: Web3 Gamer: Minecraft bans Bitcoin P2E, iPhone 15 crypto gaming, Formula E

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

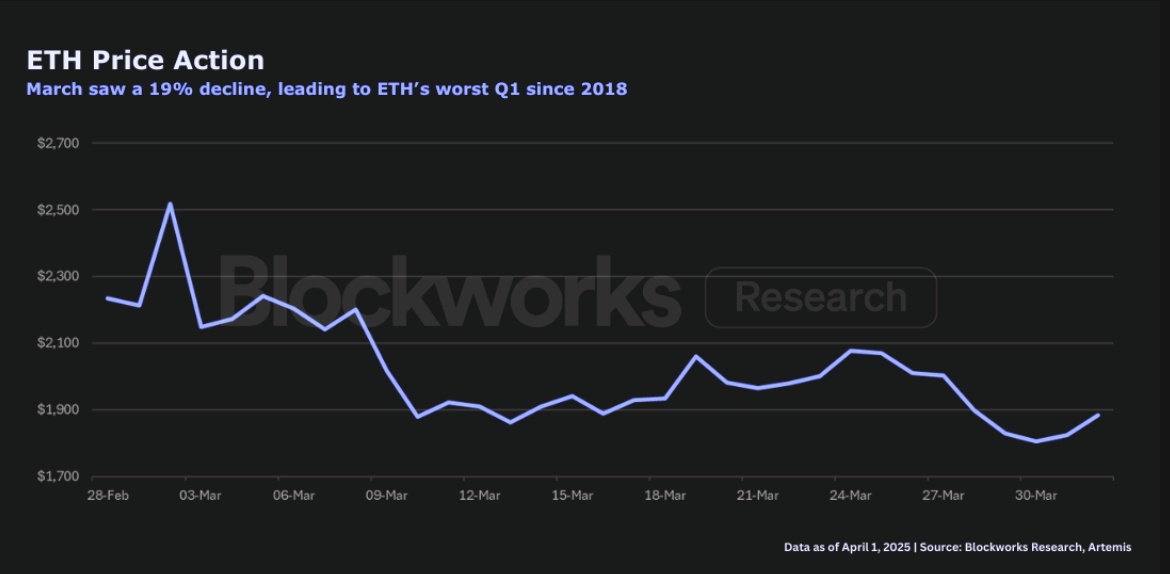

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far