JP Morgan: GBTC may face $2.7 billion in outflows when converted to ETF

Morgan Stanley analysts have stated that since the beginning of this year, traders have been buying Grayscale Bitcoin Trust (GBTC), with the trading price of GBTC being lower than the potential value of the Bitcoin it holds. This is likely in the hopes of earning a profit from the price difference when it is converted into physical Bitcoin ETFs. This means that many GBTC traders will seek to cash out when it is converted into ETFs. Morgan Stanley's analysts have reviewed the fund inflows of GBTC since 2023 to calculate the value of GBTC that may be sold during the conversion. The analysts estimate this number to be approximately $2.7 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

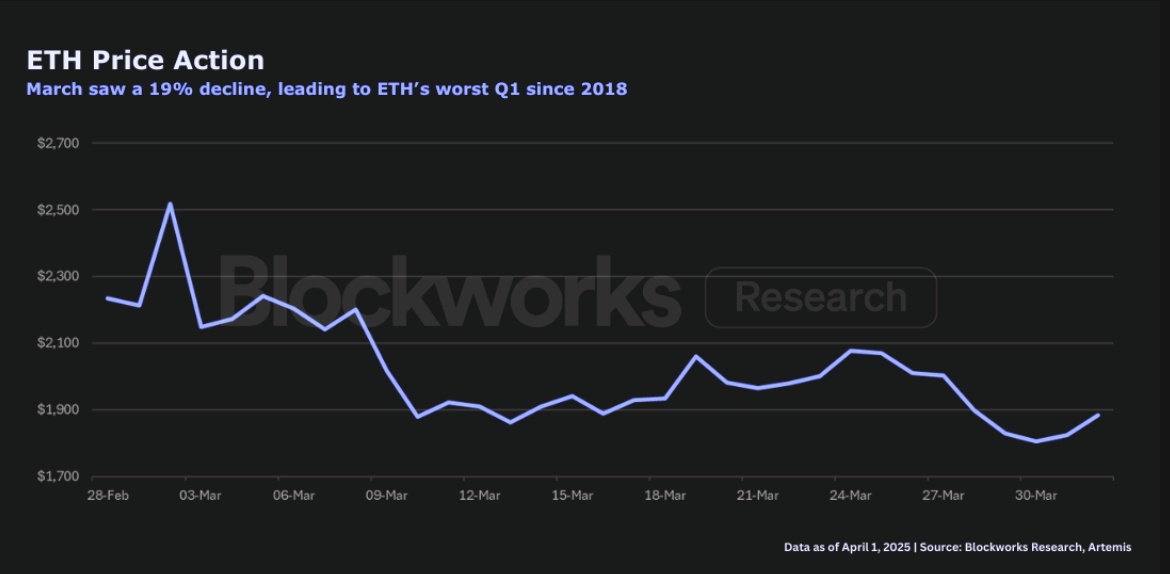

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far

GameStop just announced a $1.5 billion Bitcoin deal