Grayscale’s spot Bitcoin ETF market share falls to 50%

Crypto asset manager Grayscale’s spot Bitcoin ( BTC ) exchange-traded fund (ETF) has fallen below 50% market share for the first time since spot Bitcoin ETFs began trading in the United States on Jan. 11.

As of March 12, the total assets under management (AUM) in the Grayscale Bitcoin Trust (GBTC) slumped to $28.5 billion — with Grayscale now accounting for 48.9% of the total $56.7 billion held between ten U.S. Bitcoin ETFs, according to Dune Analytics data .

On the first trading day of the ten U.S. spot Bitcoin ETFs, Grayscale’s fund accounted for around 99.5% of their total AUM.

Over time, consistent daily outflows from the GBTC — which averaged $329 million per day last week — have eaten away at the ETF’s market share.

GBTC outflows were most sizeable within the first month of Bitcoin ETFs going live — with $7 billion leaving the fund in a little over a month — but began slowing in late January, leading some analysts to suggest that they could be coming to an end .

However, in mid-February, bankruptcy courts allowed crypto lender Genesis to liquidate roughly $1.3 billion worth of GBTC shares as part of efforts to reimburse investors, seeing outflows pick up again.

In total to date, GBTC outflows have reached just over $11 billion, per Farside Bitcoin ETF flow data .

Grayscale’s ETF was initially a trust that allowed institutional investors to gain exposure to Bitcoin by locking up funds for at least six months.

However, after a court win over the Securities and Exchange Commission in August and the regulator’s following approvals of other spot Bitcoin ETF applications, the trust was converted into an ETF.

This allowed institutional investors — who took advantage of a GBTC arbitrage trade — to remove their capital from the fund for good or simply shift their assets to Bitcoin ETFs with lower fees.

Related: SEC radio silence on Ethereum ETF ‘not a good sign’ — Bloomberg analyst

While the market was initially spooked by increasing outflows from the GBTC, growing net inflows into BlackRock’s iShares Bitcoin ETF (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) funds have been cause for optimism, both of which have now generated a total of $16.9 billion worth of inflows since inception.

Several market commentators have credited the growing inflows into the nine newly launched ETFs as being one of the fundamental driving factors behind a rapid appreciation in the price of Bitcoin, which notched a new all-time high of $72,900 on March 11.

BlackRock’s fund now holds a little over 200,000 BTC — worth roughly $14.3 billion at current prices, per K33 Research data .

Web3 Gamer: Sweatcoin says shaking is faking, MotoDEX review, Gods Unchained 2024

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

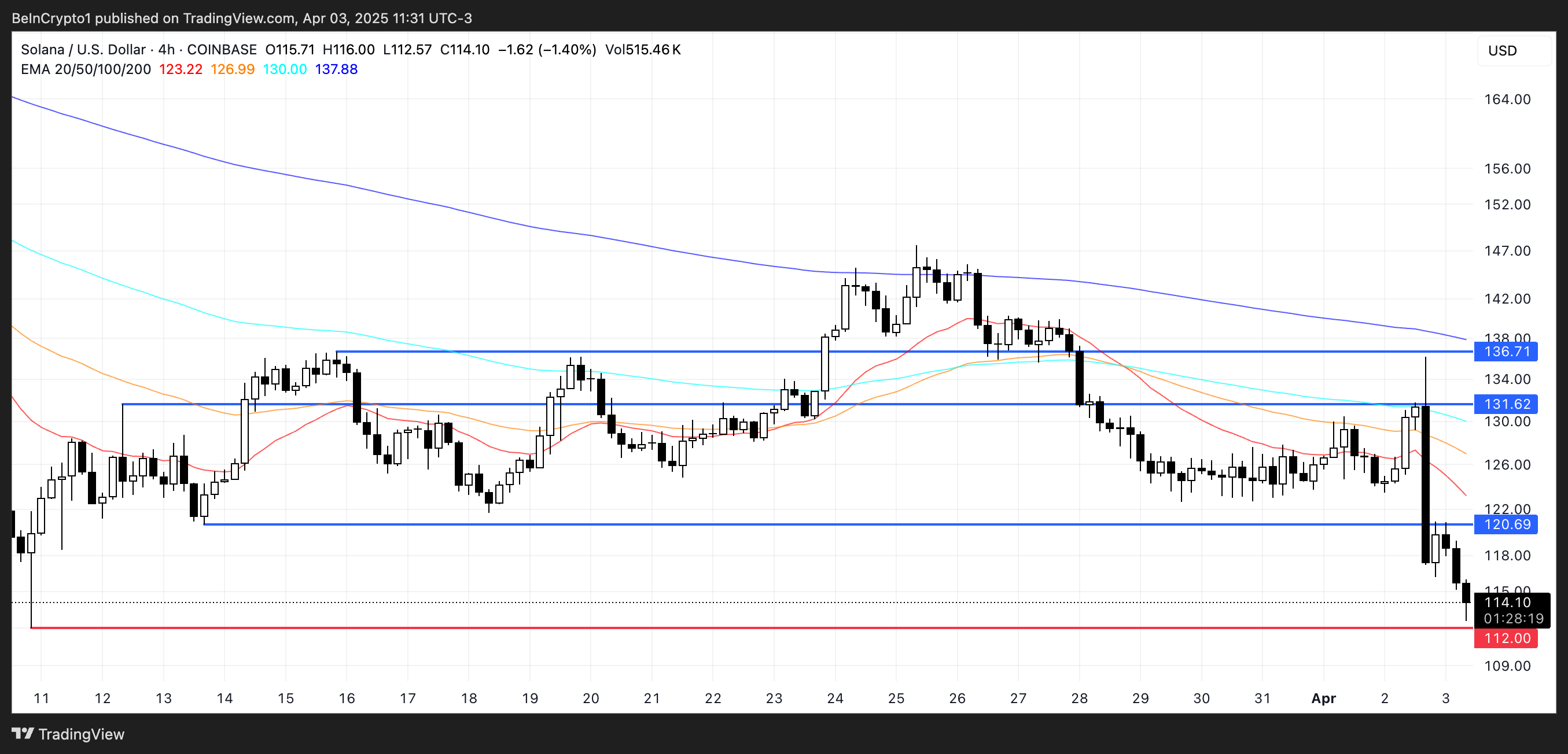

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin