Andrew Kang: Meme coins are not a zero-sum game, but a new asset class

Andrew Kang, co-founder and partner of the encryption risk investment company Mechanism Capital, wrote that many people compare meme coins to lottery tickets, but meme coins are assets, and the market size may be 100 times larger than the gambling industry. Some also view meme coins as a zero-sum game, which is incorrect. The market will continue to create higher highs and higher lows in various cycles. Over the next decade, the total market value of meme coins will increase. This marks the emergence of a new asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

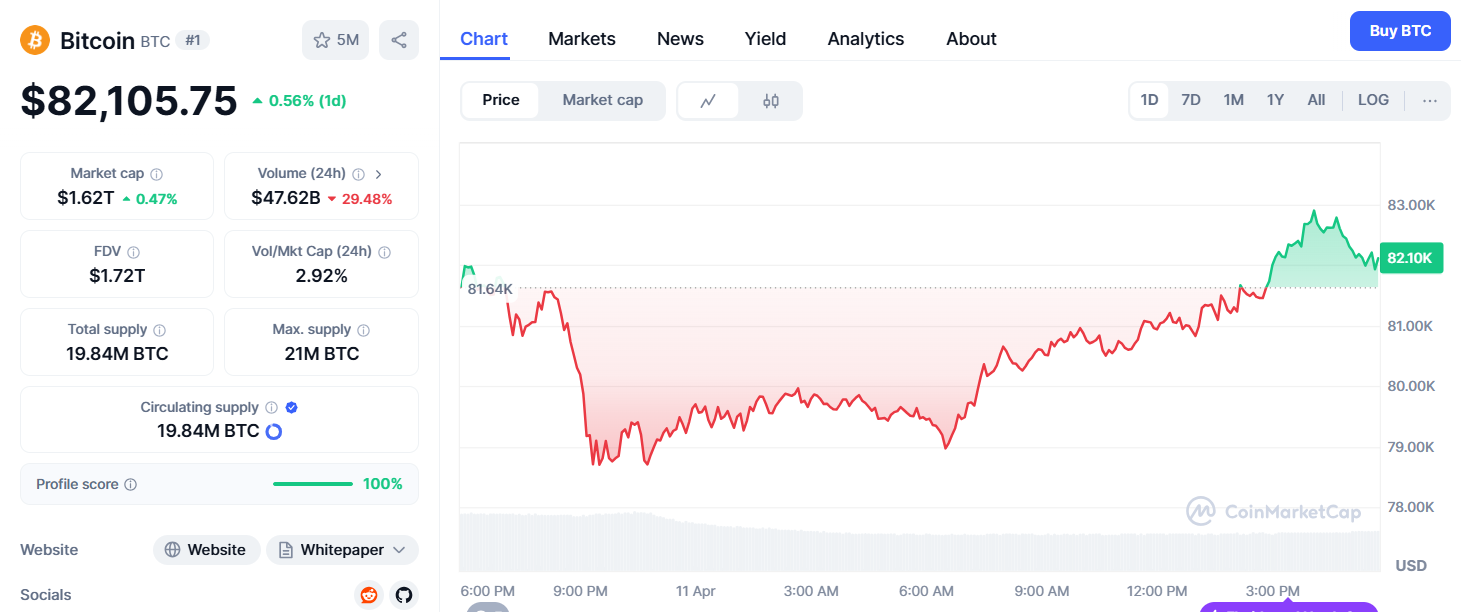

Crypto Price Today (April 11, 2025): Bitcoin Hovers at $82k, ETH Loses Momentum While SOL Spikes

Bitcoin may hit a wall at $84K if bullish conditions don’t pick up: CryptoQuant

Bitcoin could face resistance around $84,000, but if it breaks through, the next major hurdle sits at $96,000, according to CryptoQuant.

PEPE Mirrors Its Past Bottom – Will RSI Divergence Spark Another Rebound Rally?