Bitcoin's Price Could Reach $74,000 Amid Institutional Demand and Soft U.S. Inflation Figures

Bitcoin's price could surge to $74,000 in the near future due to increased institutional demand and a bullish sentiment for riskier assets following softer-than-expected U.S. inflation figures. Large asset managers such as Millennium and Schonfeld have invested in bitcoin spot ETFs, indicating growing institutional interest. Short-term selling pressure on bitcoin appears to be easing off, according to on-chain and exchange data. This comes after weeks of low volatility in the market, with bitcoin trading within a range of $60,000 to $70,000 since March.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

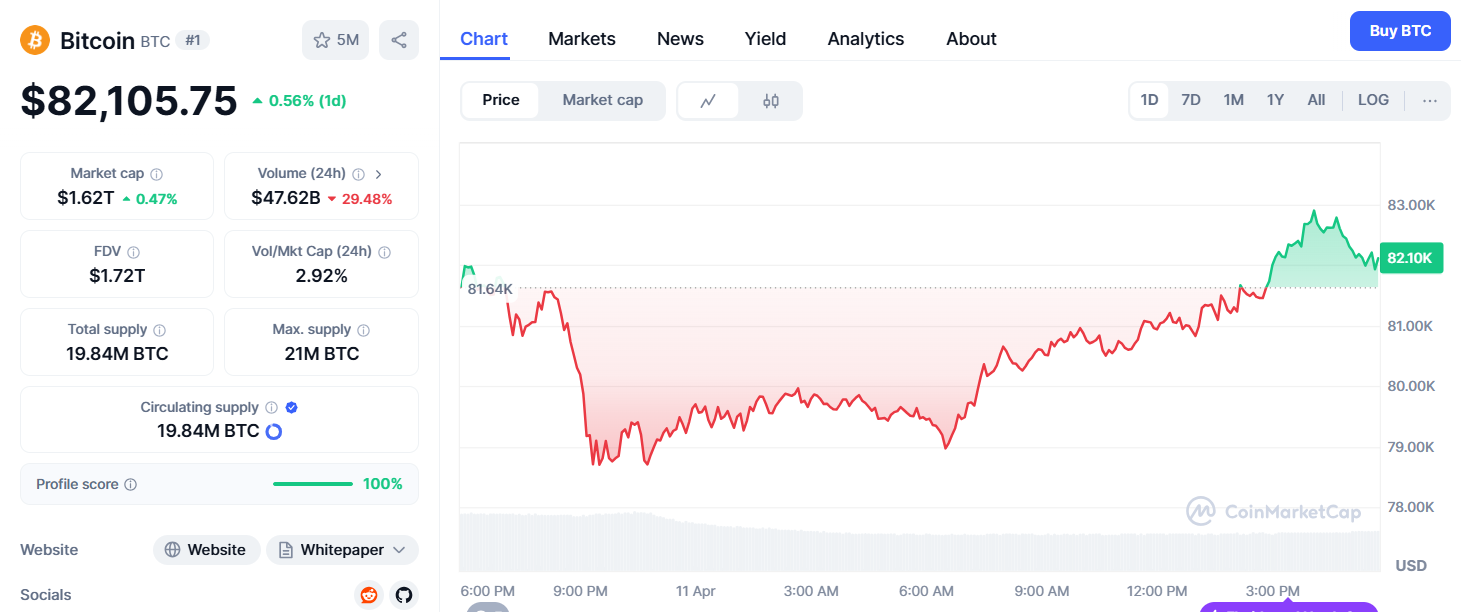

Crypto Price Today (April 11, 2025): Bitcoin Hovers at $82k, ETH Loses Momentum While SOL Spikes

Bitcoin may hit a wall at $84K if bullish conditions don’t pick up: CryptoQuant

Bitcoin could face resistance around $84,000, but if it breaks through, the next major hurdle sits at $96,000, according to CryptoQuant.

PEPE Mirrors Its Past Bottom – Will RSI Divergence Spark Another Rebound Rally?