Over 9 Million Russians Own Crypto – Report

More than 9 million Russians own cryptoassets such as Bitcoin , Ethereum , and USD-pegged stablecoins, experts claim.

Per the Russian-language media outlet Comnews , Valery Petrov, Vice President of the Russian Association of Crypto Industry and Blockchain (RACIB), said on June 4 that his organization thinks “approximately” nine million citizens hold crypto.

Do 9 Million Russians Really Hold Crypto? Experts Divided

Petrov was responding to the findings of an earlier report from Triple A , which claimed 9.2 million Russians own tokens.

Valery Petrov, Vice President of the Russian Association of Crypto Industry and

Blockchain (RACIB), speaking in 2023. (Source: Finversia/YouTube)

Valery Petrov, Vice President of the Russian Association of Crypto Industry and

Blockchain (RACIB), speaking in 2023. (Source: Finversia/YouTube)

If correct, this would represent a rise of almost 6% in the number of Russian crypto holders. The report’s data shows that over 12% “of the total working-age population of the Russian Federation” holds coins.

The state-run statistics agency Rosstat claimed recently that “76.235 million Russians are of working age.”

As such, this would indicate that roughly 12% of all of Russia’s workers own cryptoassets.

However, not all experts agree. The Finam analyst Nikita Stepanov said he was “wary” of the claims.

Stepanov explained that many crypto holders have multiple token wallets, a fact that may have skewed the report’s findings.

Do Sanctions Drive More Russians to Crypto?

Western sanctions may have also artificially inflated the Russian crypto market, he opined. Stepanov explained:

“The trend toward the increasing popularity of cryptocurrencies may affect the economy somewhat, but the effect is not large. Basically, the use of cryptocurrencies in Russia is largely limited to international transfers. [Russians have been using crypto] because it does not make use of traditional payment networks such as SWIFT. And therefore [it is a means of bypassing] sanctions.”

Stepanov also said that Russian crypto interest was likely transitory. The expert hinted the number of token holders would likely not climb much further above the current mark.

He claimed that state efforts to launch a Russian CBDC would ultimately undermine crypto adoption. Stepanov said:

“In the long term, it will be difficult for cryptocurrencies to become anything more than a ‘crutch’ for use in the remittances sector. The Russian state and the Central Bank are planning to spearhead the mass adoption of digital currencies.”

Digital Ruble Set to Dent Crypto Adoption Prospects?

Russian officials have already talked up the prospect of using the digital ruble in international trade deals.

The Central Bank wants to complete a fast-tracked pilot this year , ahead of a nationwide rollout in 2025.

Petrov, however, was more upbeat about crypto’s adoption chances in Russia. He said that a long-awaited crypto mining regulation law would likely come into force in the next few months.

However, he conceded that this law would likely limit the ways in which Russians could buy and trade crypto.

The law will likely ban almost all crypto exchanges from operating in Russia. Only a tiny clutch of authorized sandbox operators will be allowed to offer crypto trading services.

But these will – reports have claimed – exclusively serve industrial crypto miners and cross-border trade firms.

As such, Petrov said that “Russian cryptocurrency owners” will likely “have to operate only with fiat assets they hold outside the country.”

Petrov concluded that this would likely mean that the size of the Russian crypto market would not grow significantly in the coming months.

The claims appear to run counter to a report from the Central Bank in May . The bank claimed that 16.4% more Russians visited overseas crypto platforms in the first quarter of FY2024 “compared to the second and third quarters of 2023.”

The bank also flagged a sharp rise in Russian holders of United States dollar-pegged stablecoins such as USDT .

The bank has warned Russians that they face risks when trading stablecoins, as Western governments may eventually force operators to freeze Russian-linked wallets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

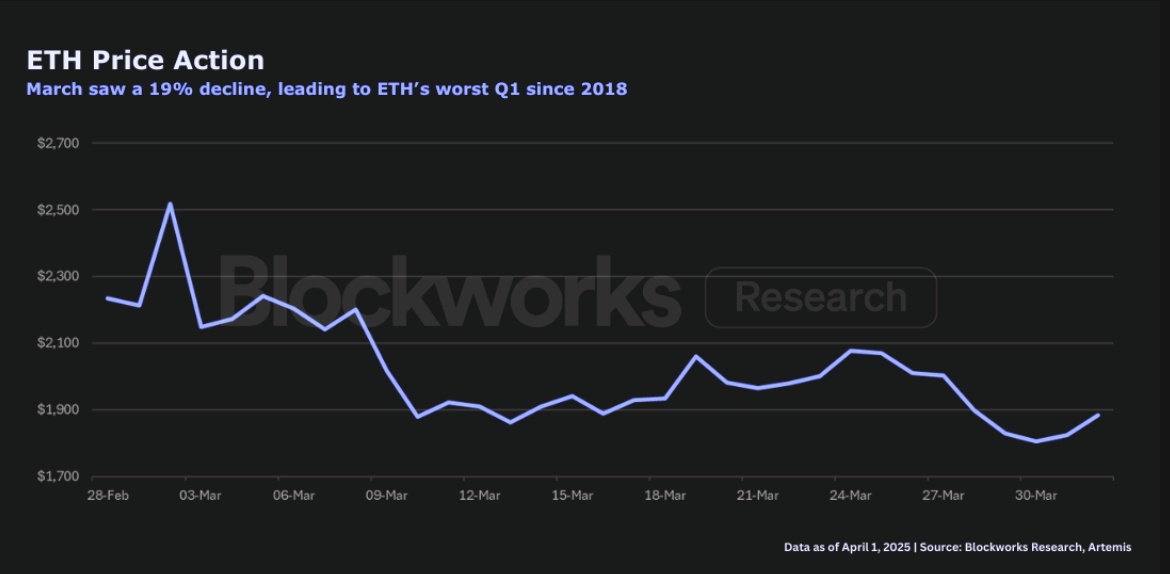

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far