RWA plate cutting-edge Artfi (ARTFI) market investment and research analysis

Bitget2024/06/17 09:08

By:0xCarlos

Project introduction

Artfi is an art technology company with a mission to democratize the $1.70 trillion fine art market. By leveraging the power of NFT and blockchain technology, Artfi allows collectors to own the stock of valuable artworks. The tokenization of real-world assets will be an important trend over the next decade, and Artfi is at the forefront of this process. The project side divides physical works of blue-chip art so that they can be jointly owned by token holders around the world.

II. Project highlights

1. The track is innovative and has market hype expectations. The project side relies on cryptocurrency and NFT technology to discover, collect and invest in world artworks, with the concept of RWA. This round of institutional hype and promotion of real asset tokenization promotes the close integration of blockchain and real life. Artfi happens to be in the midst of the wave and has market hype expectations.

2. The team has a deep background and empowers many projects. The project is incubated by Polygon, and the information of the members is transparent, which eliminates the risk of rug to a certain extent. Many core members are well-known and have rich experience in the industry. At the same time, the project forms a partnership with the payment platform Venom. DWF invests and is a market maker. The contacts and resources brought by the team background can deeply empower the project.

3. Broad prospects and high business demand. Previous data show that the global art sales volume will reach 64.1B US dollars in 2024, and the global market value of art and collectibles will be 1.7 T US dollars. According to the project research report, 86% of the wealth management institutions surveyed recommend investing in art. Artfi is established in a huge market. As a rapidly expanding platform for art connoisseurs and investors, it has broken the previously solidified investment status and democratized the ownership of art through blockchain and NFT.

III. Economic model

Artfi tokens will be used for NFT market payments, reward collectors, and act as a deflationary store of value asset, designed to appreciate as the company grows and use its revenue to consume a fixed supply. Artfi's profitable consignment business model is designed to add value to Artfi tokens. Artfi will also allocate 30% of the commission income from consignment and art sales to the token burning program for repurchase and destruction.

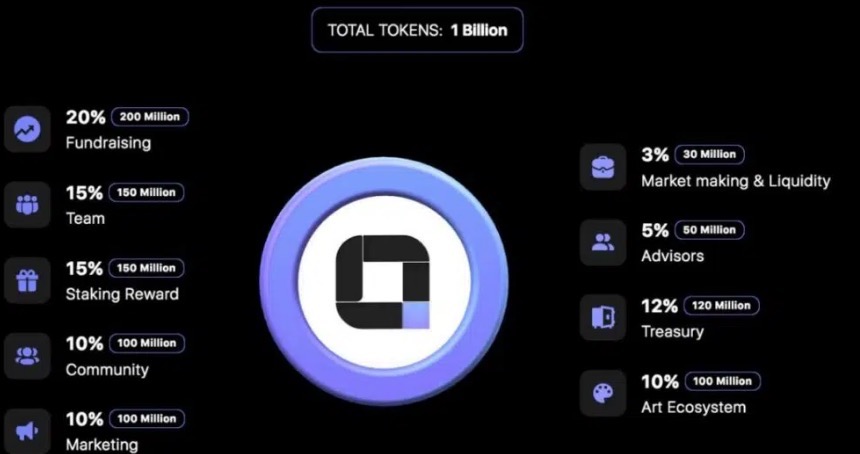

The total fixed supply of ARTFI tokens is 1 billion. The distribution is as follows:

- Fundraising: 20%

- Team: 15%

- Staking Bonus: 15%

- Market making and liquidity: 3%

- Consultant: 5%

- Ministry of Finance: 12%

- Community: 10%

- Marketing: 10%

- Art ecosystem: 10%

Team and financing

Artfi was founded by Asif Kamal, a well-known art collector and founder of Alturaash Art, an international art company headquartered in Dubai and Delhi. The co-founder and Chief Operations Officer is Aly Raza Beig, a well-known Web3 technologist, and Beig is also the founder of BoredPuma, a leading creative company in the Middle East focused on cryptocurrency, NFT, and blockchain development.

Artfi is backed by the likes of Sui and DWF Ventures to help realize the project vision and provide the necessary resources for development and platform scaling. According to CryptoRanks, the Pre-Seed financing round in July 2022 successfully raised $3.26 million, valuing the company at $100 million.

At the same time, Francis Gurry, an internationally renowned intellectual property expert and Director General of the World Intellectual Property Organization (WIPO) from 2008 to 2020, also supported the project, which can be seen as a celebrity endorsement to a certain extent.

V. Market capitalization expectations

The Artfi project democratizes art ownership through blockchain and NFT technology, with innovation and market potential. The team has a deep background and good financing situation, which has the foundation to promote the success of the project. With the trend of real-world asset tokenization, Artfi is expected to become a star project in the crypto market. Currently, compared with the MKR of the RWA sector and the market value of $2.241 billion and $1.50 billion of ONDO, Artfi is optimistic about the future growth space of Artfi.

Risk warning

1. Although tokenized art is innovative, it remains to be seen whether traditional art collectors and investors are willing to accept this new form. Market education and promotion efforts need to be ongoing.

2. The value of the art market fluctuates widely and is significantly affected by the economic environment, market trends, and investor sentiment. Uncertainty in the valuation of artworks may affect investment returns.

VII. Official Links

Website:

https://artfi.world/

Twitter:

https://x.com/artfiglobal

Telegram:

https://t.me/Artfiglobalchat

Disagreement:

https://discord.com/invite/artfiglobal

4

3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Correlation between equities and crypto has increased due to adoption

The market selloff is heavily tied to the increased correlation between equities and crypto, as crypto-friendly institutions are going more risk-off

Blockworks•2025/03/12 01:22

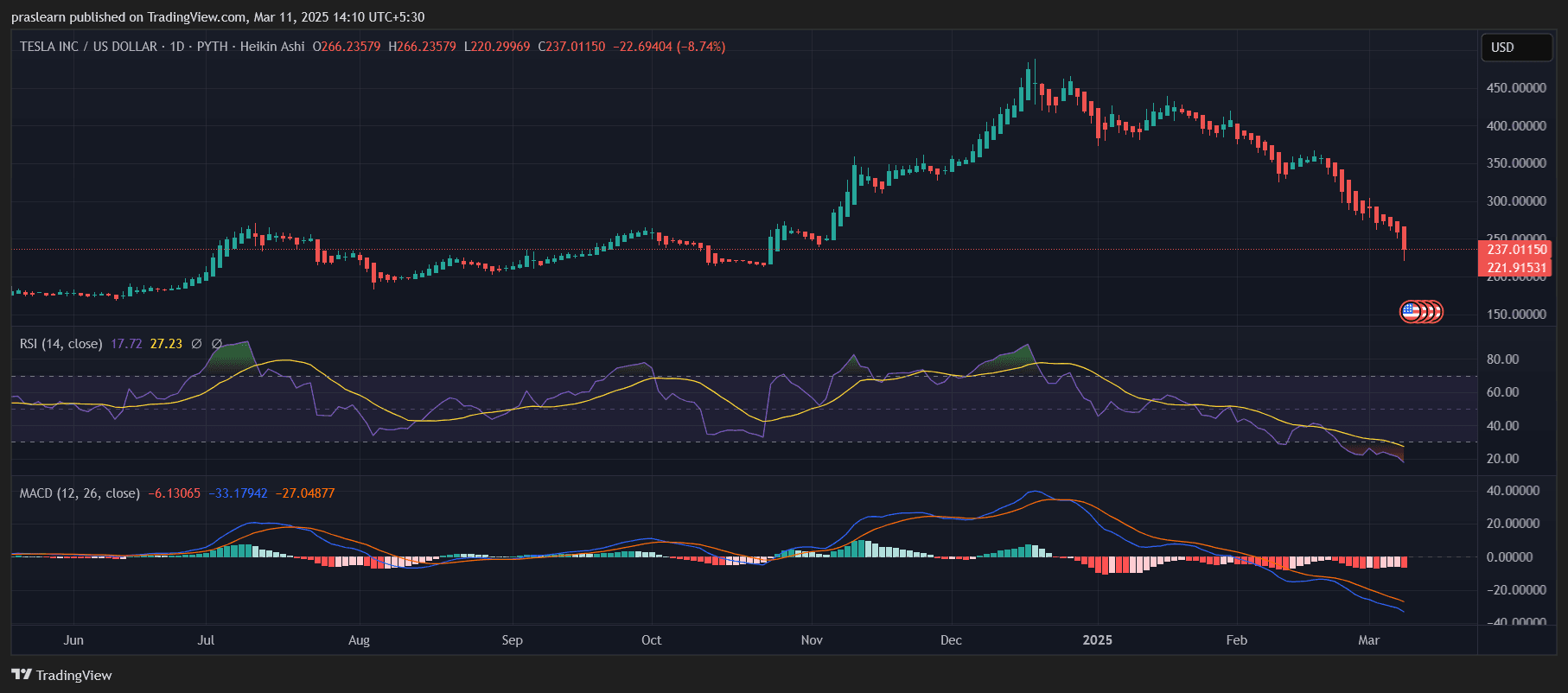

Tesla vs. Bitcoin vs. Gold: Which Is the Best Investment for 2025?

Cryptoticker•2025/03/12 00:33

US-Canada Trade Tensions Escalate: Is This the Precursor to World War 3?

Cryptoticker•2025/03/12 00:33

Better Buy for 2025: XRP vs. Nvidia?

Cryptoticker•2025/03/12 00:33

Trending news

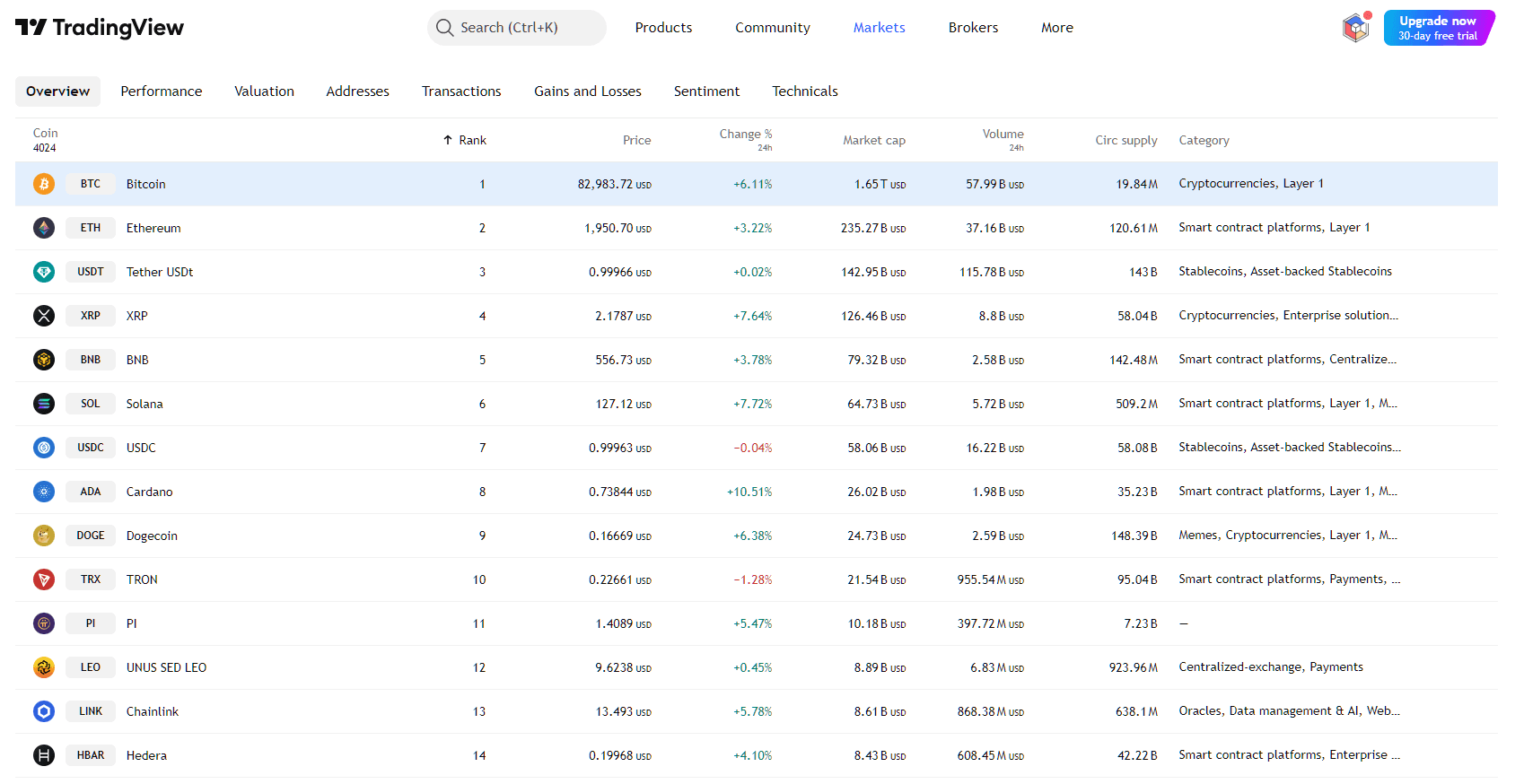

MoreCrypto prices

MoreBitcoin

BTC

$82,238.58

+3.25%

Ethereum

ETH

$1,873.88

+0.83%

Tether USDt

USDT

$0.9998

+0.02%

XRP

XRP

$2.18

+6.49%

BNB

BNB

$548.43

+2.82%

Solana

SOL

$123.04

+2.18%

USDC

USDC

$0.9999

+0.00%

Cardano

ADA

$0.7237

+3.12%

Dogecoin

DOGE

$0.1619

+4.42%

TRON

TRX

$0.2236

-3.29%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now