Lawmakers push SEC chair for clarity on crypto airdrops policy

House Republicans have called on SEC Chair Gary Gensler to provide clarity on his position regarding crypto airdrops by the end of September.

Representatives Tom Emmer and Patrick McHenry have expressed concerns about the SEC’s recent handling of airdrops in lawsuits, warning that the agency's actions could hinder blockchain innovation.

In a letter dated September 17, the lawmakers questioned the SEC's classification of crypto airdrops as securities, citing cases against Hydrogen Technology Corporation and Justin Sun's firms.

The SEC's lawsuit against Hydrogen Technology alleged that the company manipulated the market by distributing over 11 billion Hydro tokens through airdrops, labeling these distributions as "unregistered offers and sales of securities."

Similarly, in March 2023, the SEC filed a lawsuit against Justin Sun and related entities for unregistered airdrops of BitTorrent (CRYPTO:BTT) tokens.

Emmer and McHenry argue that these actions reflect a misinterpretation of securities laws, potentially stifling the growth and decentralisation of blockchain technology.

The lawmakers are seeking answers to five critical questions, including how the SEC applies the Howey Test—a legal framework for determining if an asset is a security—to crypto assets given away for free.

They also inquired about how the SEC differentiates airdrops from other reward mechanisms, such as credit card points, and whether the agency has considered the broader economic impact of classifying airdropped tokens as securities.

Emmer and McHenry contend that by categorising these tokens as securities, the SEC is limiting American citizens' ability to fully benefit from blockchain technology and is preventing the U.S. from playing a leading role in shaping the future of the internet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

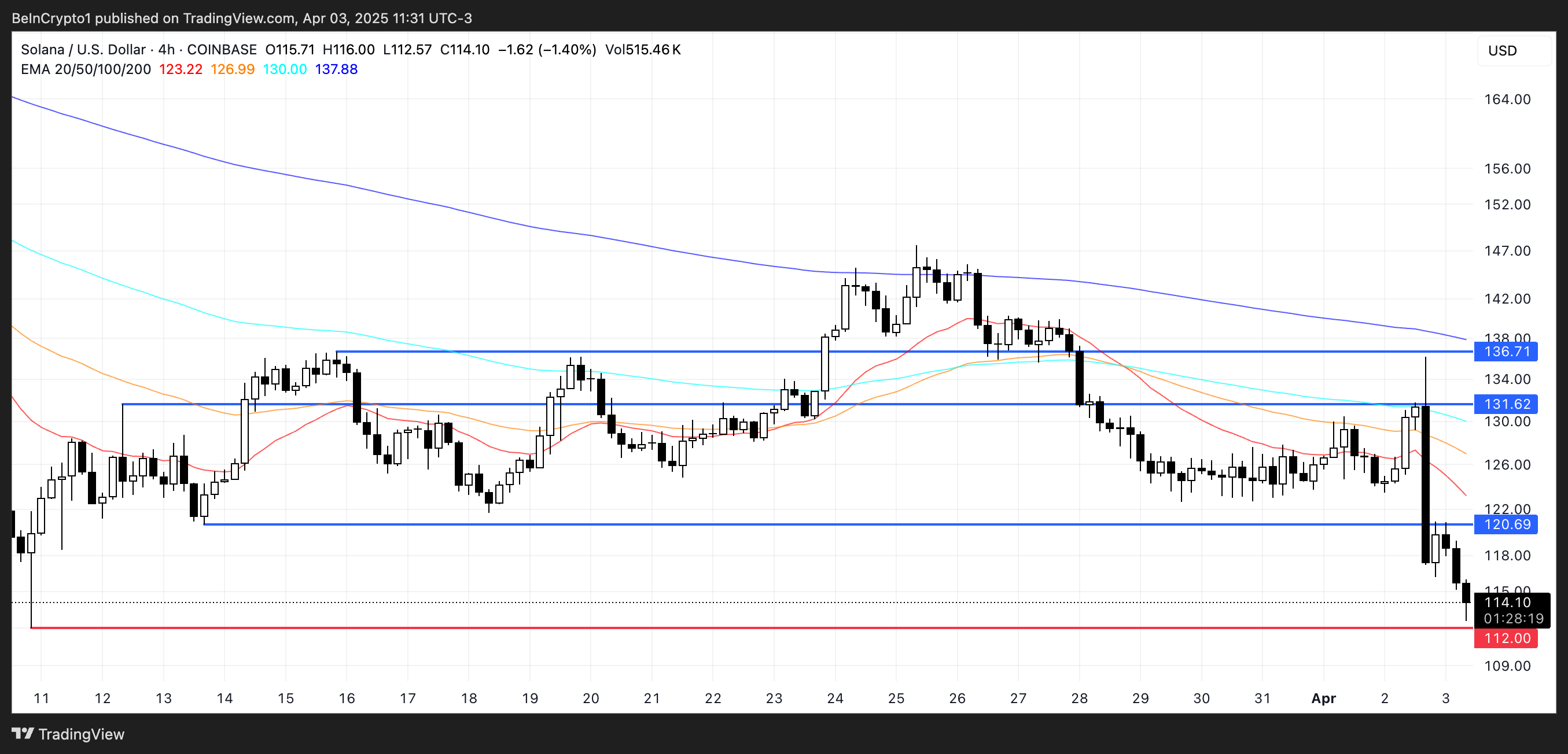

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin