Is XRP on the Brink of a Major Breakout?

Ripple's cryptocurrency has surprisingly withstood bearish trends and has even shown signs of recovery, despite a significant sell-off of 350 million XRP from its treasury reserves in September.

A notable prediction from crypto analyst Mikybull Crypto suggests that XRP may be on the verge of a substantial breakout.

In a recent post, Mikybull Crypto described XRP as resembling a “time bomb waiting to explode,” pointing to its technical chart patterns as evidence. The 50-period simple moving average (SMA) has recently crossed above the 200-period SMA, a formation known as the ‘golden cross’ that typically indicates bullish momentum. Additionally, the relative strength index (RSI) has been hovering between 40 and 60, suggesting moderate market momentum.

Currently, XRP’s price is consolidating within a narrow range. A breakout above the $0.60 resistance level could lead to upward movement, while a drop below the $0.58 support could trigger a downward trend.

READ MORE:

Curve Finance May Cut TrueUSD as crvUSD CollateralAnother analyst, Altstreet Bets, has also forecasted that XRP could exceed $1 by the end of this year, basing this on the Elliott Wave Theory, which predicts that XRP is in its final phase of growth. This potential surge is expected to materialize around October or November 2024.

This positive price action comes on the heels of Ripple’s assertion that the Federal Reserve’s FedNow initiative, which aims to bridge traditional banking with decentralized finance (DeFi), could enhance XRP’s adoption in the payment landscape.

Overall, the indicators appear favorable for XRP, and the predictions from experts may very well hold true, especially as the altcoin season appears to be underway. However, as always in the crypto market, fluctuations are common, and thorough research is essential for investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

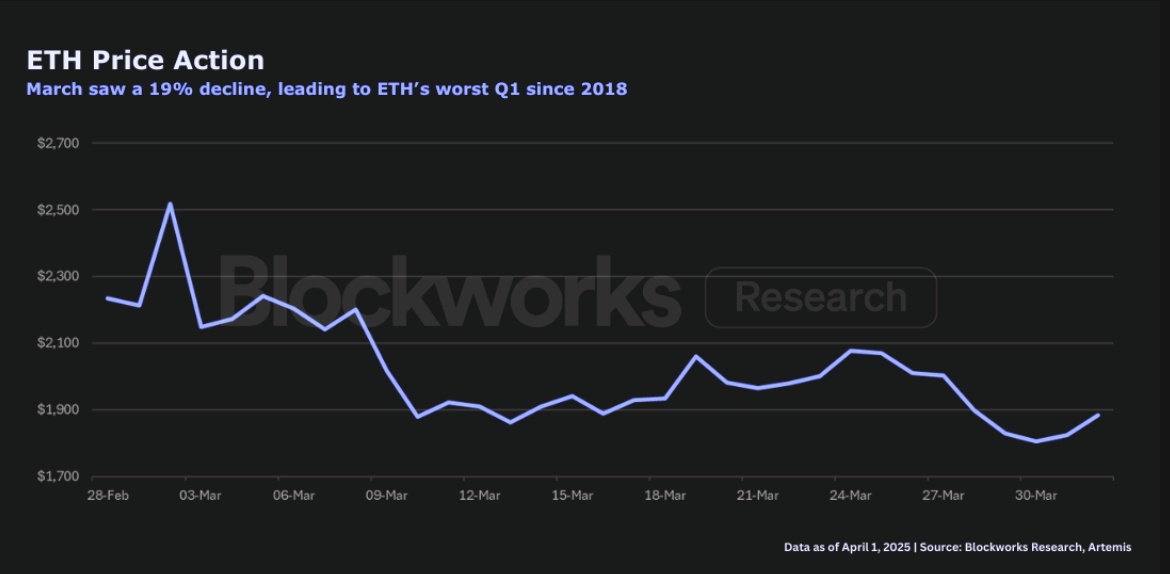

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far