Will Polymarket and UMA Implode if the US Election Result is Disputed?

Polymarket is the breakout app of crypto but could its days be numbered?

Polymarket and the UMA token might not survive a disputed US presidential election outcome, and here’s why.

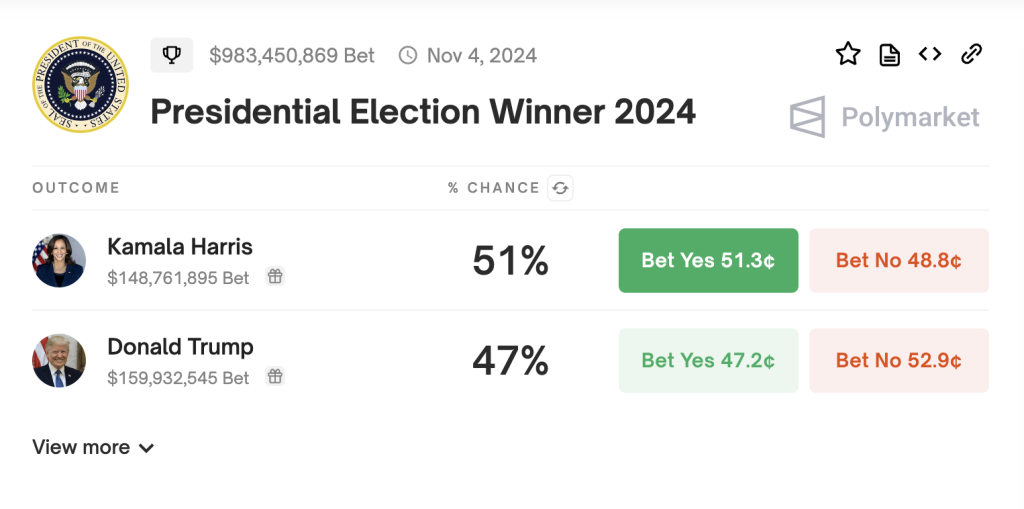

While betting site Polymarket’s US presidential election market volume is racing toward $1 billion, there are nevertheless growing worries about how a disputed outcome could impact the platform.

In the wake of the second assassination attempt on former President Donald Trump, the fractured political environment means there is a strong possibility of a disputed election outcome.

It is no longer beyond the bounds of possibility that Polymarket US presidential market payouts could be affected and the betting markets themselves subject to manipulation. In fact, the decentralized systems that are Polymarket’s bedrock might come under attack.

Could the crypto industry’s breakout product, which just last week signaled that it might be launching its own token , be on the verge of imploding?

As things stand the Polymarket betting market for the US presidential campaign winner settles under the following rules:

This market will resolve to “Yes” if Kamala Harris wins the 2024 US Presidential Election. Otherwise, this market will resolve to “No.”

The resolution source for this market is the Associated Press, Fox News, and NBC. This market will resolve once all three sources call the race for the same candidate. If all three sources haven’t called the race for the same candidate by the inauguration date (January 20, 2025) this market will resolve based on who is inaugurated.

Note: An update may be made to this market to allow for early expiration if the candidate is definitively no longer in contention for the presidency.

The rules have been amended to include an early expiration clause, presumably to account for the possibility of one of the candidates being assassinated or dropping out for some other reason.

Will Polymarket’s rules stand the test of a fractious election?

Leaving that aside, the rules as they stand provide for either of two sets of conditions to be met. The first condition states that the market resolves if three named news organizations call the race for the same candidate – resolving to ‘Yes’ if Kamala Harris wins (currently $148 million wagered) and ‘No’ ($159 million) if Trump wins.

If all three news outlets do not call the race by the inauguration date, Monday, January 20 2025, then the market will resolve depending on who is inaugurated on that day.

However, given the attempt to stop the certification of the previous presidential election result four years ago and the level of division and distrust in the US political system, the chances of a challenge to the result, especially if Trump loses, are high.

As of the time of writing, Harris is leading Trump 51% to 47% , with the markets increasingly favoring Harris since the ABC-hosted debate on 10 September.

Polymarket has, until the last fortnight or so, shown a bias towards Trump despite the much-vaunted Harris surge registered in rival betting markets such as PredictIt.

The bias is thought to have crept in because the audience of wagerers skews heavily toward crypto-enthusiasts. They assume, rightly or wrongly, that Trump will be better for the industry and therefore have been more likely to discount the rising favorability scores of Harris as against Trump, and other similarly bullish Harris poll indicators. However, that bias seems to be correcting now.

Can the oracle used by Polymarket be manipulated?

At the heart of Polymarket’s operation is the UMA Optimistic Oracle (OO) , which has been dubbed the decentralized truth machine.

But as one Reddit poster notes, the market capitalization of the UMA token used to resolve markets and any disputes that may arise is just $180 million. As mentioned earlier, the Polymarket US presidential election market has $920 million wagered.

How easy might it be for a bad actor to corner the market and resolve disputes in their favor?

Optimistic oracles work by incentivizing honesty – disputes are rare because of the incentive to be honest, hence the ‘optimistic’ in OO. In other words, those who predict the right outcomes get the reward. Unlike oracles for market data, the UMA OO can consume natural language inputs. That’s fine until there is a dispute.

Early in-person voting started last week and the battle lines of soon-to-come election disputes are already being drawn:

Here’s how Polymarket disputes are meant to be resolved

In the event of a dispute, those holding $UMA tokens vote on how to settle the market. The majority vote will decide on the outcome the market settles on.

All of this is handled through bond issuance. Depending on the voting, a proposer or disputer receives the other party’s bond. If the $UMA tokenholder chooses the correct outcome they are rewarded for that or, alternatively, penalized for voting for the wrong outcome. Token holders are also penalized in the event of a no-show.

According to its website, the optimistic oracle seeks to ”build a source of truth for the world.” In addition to Polymarket, a number of high-profile projects, such as Bookies, PolyBet, and FORE, use the OO system.

There are high hopes that $UMA OO will secure mass adoption should proposals such as ERC-7683 be adopted to allow smoother fiat payment onboarding, as Vitalik Buterin has noted ; although Butrein was not talking specifically about Polymarket. Polygon is an Ethereum Layer 2 solution.

So is there an incentive for those seeking to influence the outcome of the US presidential election by, in the first instance, wagering on, for example, a Trump win and then buying up UMA tokens to ‘fix’ the voting in the likely event of a dispute? The vast majority of Polymarket markets resolve without dispute.

Rumors persist that Trump billionaire supporter Peter Thiel has been putting money into Polymarket to back his chosen candidate. Although there is no evidence for this, betting on the market has shown a bias towards Trump when compared with the fiat-based PredictIt markets. It is only belatedly that the Harris improvement on Biden’s performance has shown up in the wagering.

On Polymarket wagerers buy ‘Yes’ or ‘No’ shares priced as a percentage/cents, where the market resolves to 100%/$1 for the correct outcome and 0 for incorrect.

After the first assassination attempt, the market quickly spiked to 70% for a Trump win. In the aftermath of the second assassination attempt, there has been no such bounce, with Harris extending her lead.

Could skewed betting odds influence voting intentions?

The betting markets on possible presidential election outcomes are closely followed, often being quoted in the same breath as regular opinion polls. There may be a feedback loop where voters are influenced by the direction of the betting markets, although it can be argued that this could work in both directions.

So if Trump is ahead in the betting markets like Polymarket where the odds are determined by the users, that might spur on the Harris side to turn out and vote, or, alternatively Trump ahead might encourage potential voters to ‘back the winner’, a known psychological bias.

Of course voting with your heart, not your head, can be costly – you want Harris or Trump to win but your head tells you something else, so you end up on the wrong side of the equation and lose your stake.

With the scenarios explored above in mind, we put a number of questions to Polymarket and UMA.

Is there a danger that resolution could be undermined by nefarious partisan actors seeking to determine a ‘correct outcome’ that favors their preferred candidate?

Admittedly, the distribution of token ownership shows that UMA is tightly held with more than 51% of supply in the hands of two addresses .

Assuming these are addresses controlled or owned by founders or team members, there is a low chance of a 51% attack on the UMA token. UMA is currently priced at $2.41, which is 94% off its all-time high of $43, reached in February 2021.

Would the self-harm an attacker inflicts be worth the political gain?

But this throws up another issue – namely, the token’s lack of decentralization. Could an insider be persuaded, after being enticed with sufficient monetary/political incentive, to vote in a dispute in a particular direction to serve the interests of a specific candidate?

Given that the market cap of the UMA token is only $180 million, while the US presidential market on Polymarket has soared to $983 million in betting volume, does Polymarket or UMA accept that there may be an incentive for billionaire backers of either candidate to attack the UMA Optimistic Oracle?

Admittedly this is a seemingly far-fetched prospect, but given the tightness of the race (at least in the swing states and electoral college terms) and the level of division in the US body politic, the chances of a long-drawn-out and litigious dispute regarding the outcome of the presidential race are high. As a consequence, Polymarket’s stated aim of establishing decentralized truthfulness could also be undermined.

A foretaste of the brewing trouble to come for Polymarket was seen in the furor around Robert F. Kennedy Jr. suspending his presidential election campaign and the confusion and dispute it set in train on the platform.

In the event of an attempted attack involving a bad actor building up a position (albeit one that is not able to surmount the 51% threshold), the price can be expected to rise, making such an attack increasingly expensive to maintain.

Also, by undermining the integrity of Polymarket and UMA OO, the attacker would ultimately destroy the value of the tokens they hold, even if their price initially rises during the attack. Nevertheless, despite the self-harm involved, there is still at least a theoretical risk of attack.

Another consideration for a would-be attacker is how many UMA tokens are actually available to trade on the open market?

Assuming a possible attack is detected, does Polymarket include a proviso in extremis to override the UMA OO? If so, how could this happen without rolling back Polygon blockchain transactions?

Polymarket competitors circle and CFTC threatens shutdown

Prediction markets and betting sites, more broadly, have not been slow to latch onto the popularity of politics. Specials markets where all manner of non-sporting bets can be made have long been a fixture of many betting sites.

For sure, Polymarket is the breakout app in the crypto world right now, but if the integrity of its system were to be brought into doubt, it would certainly be an opportunity for its competitors that don’t rely on oracles or customers betting against each other in a decentralized system like Polymarket to determine odds.

UK-based legacy betting exchange Betfair.com has attracted £71 million ($94.9 million) in wagers on its market for the US presidential election winner, showing brisk business across the board.

Instant Casino, which operates globally and allows its players to deposit both fiat and crypto, has busy markets on who will win in the US presidential election battleground states.

US presidential elections markets at Instant Casino

Greg Turner, the head of communications at Instant Casino was reluctant to knock Polymarket but did point to the safety, transparency, and flexibility of a fully licensed venue, where the house sets the odds and allows its players to deposit both fiat and crypto, and where payouts are instantaneous.

“Despite the possible risks, what Polymarket has achieved in the political betting space is impressive and speaks to the near-insatiable appetite for betting on politics and the US election in particular. We continue to see growing interest in these markets and plan to introduce more specials.”

Are Polymarket’s competitors about to start eating its lunch? Turner, as might be expected, says his firm offers advantages over the Polymarket approach.

“While Polymarket has attracted customers who are overwhelmingly already in the crypto space, venues such as Instant Casino have the great advantage of being able to introduce the much larger traditional audience that is still using fiat currency to the crypto opportunity.”

Turner continues: “In addition to seamless instant withdrawals, high betting limits, 10% weekly cashback and literally thousands of casino games and sportsbook markets to bet on, we have a Government of Curacao license. We are regulated in major jurisdictions around the world.”

That last point contrasts with Polymarket’s continuing run-ins with US regulators. It came to a $1.4 million settlement with the Commodity Futures Trading Commission (CFTC) in 2022, after it was accused of selling unlicensed securities.

Polymarket now operates offshore but that has not brought its troubles to an end. Just this week CFTC Chairman Rostin Behnam threatened Polymarket with enforcement actions – it could face a shutdown order.

Cryptonews.com has reached out to Polymarket and UMA for comment on the issues raised in this article, but neither has yet responded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Commerce Secretary Lutnick: All goods related to the USMCA may be exempted from tariffs

US President Trump: I will change the huge US trade deficit

New York Lawmakers Introduce Bill to Target Cryptocurrency Rug Pull Scams

Today, the US Bitcoin ETF has a net inflow of 80 BTC