Why do crypto protocols need incentivization?

Well-designed incentives can create a “positive-sum game” where everyone benefits from the growth of the protocol, not just the initial developers

Crypto protocols without incentives are at best glorified versions of “decentralized databases.” They primarily store data in specific areas, such as social interactions or user activity, but offer little utility beyond that. This is a problem because the “decentralized database” itself lacks an attractive product proposition: it is slow, expensive, and ultimately provides very limited value compared to more efficient Web2 solutions.

The Problem with “Decentralized Databases”

Because these crypto protocols are just a data storage layer, they must rely on applications to drive meaningful usage. However, relying solely on the application layer to achieve product-market fit in a decentralized environment is risky. The data stored by these crypto protocols is naturally portable, which means that even applications that successfully attract users and achieve growth may have their hard-earned data and network effects stolen by competing applications. This is a fundamental problem in the non-cooperative game between application developers, as no one is willing to contribute to a shared decentralized resource if they cannot extract value from it.

Challenges for Developers

As a result, decentralized databases become unattractive for developers. Why invest resources into developing an application when competitors can easily fork or freely exploit the data you generate? This challenge is particularly acute in the early stages of a protocol, because it is very difficult to gain user distribution and build a user base without a clear value proposition.

In response to this, crypto protocols often have to build applications themselves to initiate liquidity and usage. By doing so, they hope to activate activity and prove that their "decentralized database" has value. By creating vertically integrated applications that rely on the protocol, they can generate the initial momentum needed to attract users, liquidity, and ultimately third-party developers.

The Cost of "Product-Led Protocol Development"

However, this approach comes at a cost: it can be unfriendly to other developers who want to build applications on the protocol. When a protocol acts as both infrastructure and application and dominates an ecosystem, it may hinder the entry of third-party social applications. The resulting ecosystem will instead be more centralized around the protocol's own applications, which runs counter to the vision of a thriving, open, decentralized platform.

The Importance of Incentive Mechanisms

Incentive mechanisms are the missing link. Crypto protocols need to design mechanisms that actively encourage participants - including users, developers, content curators, etc. - to participate in the system. A well-designed incentive mechanism can create a "positive-sum game" where everyone benefits from the growth of the protocol, not just the initial developers. Incentive mechanisms can encourage developers to build applications with peace of mind without worrying about losing value because they can get corresponding rewards through their contributions to the protocol. This can also incentivize users to adopt the protocol, provide liquidity, and contribute to its success.

Examples of Effective Incentive Design

Several well-known crypto protocols have successfully embedded incentives to align the interests of participants and drive growth:

· Automated Market Makers (AMMs): AMMs like Uniswap have designed strong incentives for liquidity providers. By allowing anyone to contribute liquidity to the pool and earn a share of transaction fees, AMMs have successfully bootstrapped liquidity from a wide range of participants. This model ensures that liquidity providers are directly rewarded for their contributions, forming a self-sustaining ecosystem where traders benefit from deep liquidity and liquidity providers are incentivized to continue participating.

· Bitcoin Mining: Bitcoin's Proof of Work (PoW) consensus mechanism is an excellent example of incentive design that aligns network security with participant rewards. Miners ensure network security by contributing computing power and are rewarded with block rewards and transaction fees. This incentive structure helps Bitcoin maintain a high level of security and decentralization because miners are directly rewarded for validating transactions and protecting the network.

· Prediction Markets: Decentralized prediction markets like Augur or Polymarket incentivize participants to provide accurate information by allowing users to bet on future outcomes. Users are rewarded for their accurate predictions, ensuring that the market reflects the most likely outcome. This mechanism encourages participants to contribute valuable insights, and the collective wisdom of the market provides reliable predictions for everyone.

Rather than being just a "decentralized database", a protocol with a good incentive mechanism can become a dynamic ecosystem with an endogenous growth mechanism. This shift allows the protocol to stop being a passive infrastructure and become an active driver of its own growth - able to solve the cold start problem, attract developers, and ultimately build real network effects.

The Role of Financialization and Incentive Design

For decentralized social crypto protocols, financialization and incentive design are not just optional features, but necessary components to promote growth, ensure sustainability, and avoid the stagnation that many "decentralized databases" have experienced in the past. By embedding growth mechanisms and incentives at the protocol layer, we can create a more cooperative and prosperous ecosystem that aligns the incentives of all participants, rather than relying on individual applications to create value in isolation.

This article is from a contribution and does not represent the views of BlockBests

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

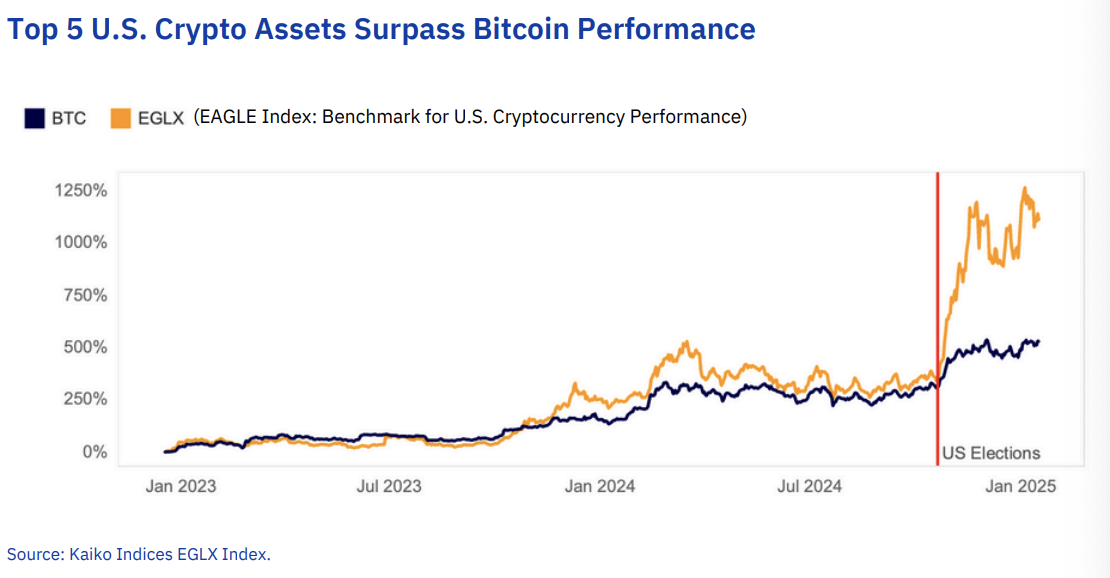

Altcoin volumes are ‘more concentrated’ than ever

Altcoin trade volume has returned to pre-FTX levels, but with a shrinking pool of market leaders

XRP price sell-off set to accelerate in April as inverse cup and handle hints at 25% decline

US Treasury Targets Houthi Crypto Wallets, Financial Network

Securitize Reports Highest-Ever Dividend of $4.17 Million for Tokenized Treasury Product