JOE Coin Price is Rising: What's Next?

Recently, Joe Coin has been gaining a lot of attention due to its rising price. Many investors and crypto enthusiasts are curious about what’s causing this surge and what the future holds for this digital currency. In this article, we’ll take a closer look at why Joe Coin is on a bullish trend, what factors are driving the growth, and what to expect next.

How has the JOE Coin Price Moved Recently?

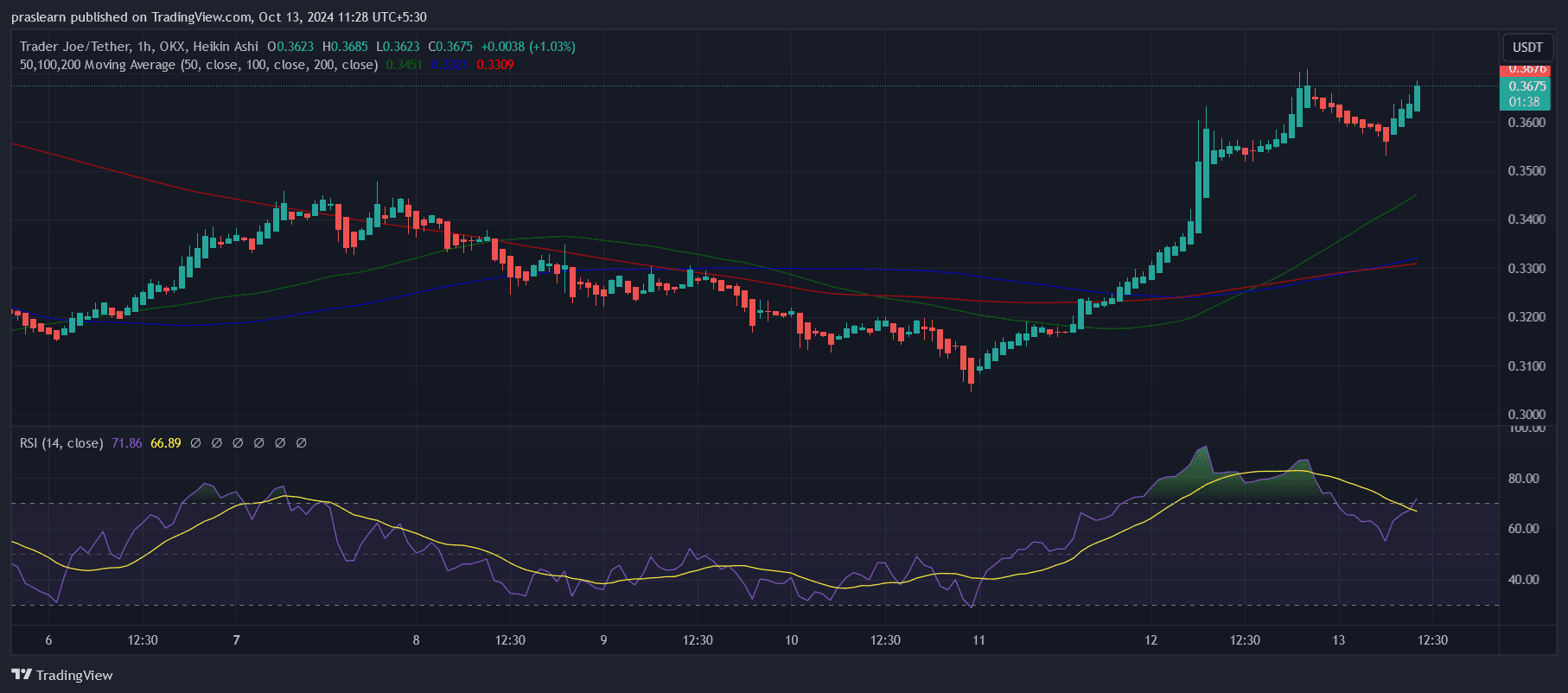

JOE/USDT 1 Hr Chart- TradingView

JOE/USDT 1 Hr Chart- TradingView

The current price of JOE is $0.367958 , with a 24-hour trading volume of $21.37 million. It has a market cap of $132.35 million and holds a market dominance of 0.01%. Over the past 24 hours, JOE’s price has increased by 3.84%.

JOE hit its all-time high of $4.98 on November 21, 2021. Its lowest recorded price was $0.026588 on August 11, 2021. Since that peak, JOE reached a cycle low of $0.132031, with a rebound to a cycle high of $1.23537. The current market sentiment for JOE is bullish, while the Fear & Greed Index sits at 50, indicating a neutral sentiment.

There are 359.69 million JOE tokens in circulation, out of a maximum supply of 500 million. JOE’s annual supply inflation rate is 6.91%, meaning 23.26 million new tokens were created over the past year.

Why JOE (JOE) Coin Price is UP?

The recent surge in JOE Coin's price can be attributed to a combination of strong technical and fundamental factors. From a technical standpoint, the JOE/USDT trading pair has shown strong bullish momentum, particularly after a consolidation phase from September 21 to October 1.

This consolidation, marked by sideways price movement, helped establish a solid support base around the $0.012 range, which has since propelled the price upwards. This pattern suggests a healthy price buildup, where buyers gained confidence, leading to increased buying pressure and a subsequent breakout.

Fundamentally, JOE Coin’s price is being boosted by its unique vision and offerings, such as the Liquidity Book (DLMM), Token Mill (BCAMM), and an upcoming Central Limit Order Book (CLOB). These innovations are creating a more efficient, low-cost, and accessible on-chain exchange, which appeals to both traders and investors.

The strategic integration of JOE's ecosystem with prominent blockchains like Avalanche (AVAX) , Arbitrum , and Monad further enhances its value proposition by leveraging these robust platforms for fast and scalable transactions.

Additionally, the revenue-sharing model, where stakers of JOE earn a portion of the platform’s revenue, is driving demand as more investors are drawn to the token’s passive income potential.

This model aligns with the broader market trend where tokens that offer utility and rewards tend to see increased interest. All these factors combined contribute to the current upward price trend for JOE Coin, with strong indications that it could continue its bullish trajectory as adoption grows and the platform’s ecosystem expands.

How high can the JOE (JOE) Price go?

The price of JOE (JOE) has shown solid growth, increasing by 62% over the last year, supported by its strong technical indicators and unique platform offerings. Trading above the 200-day simple moving average is a key bullish signal, suggesting that the coin is in an upward trend and gaining momentum.

Additionally, JOE has posted 15 green days in the past 30 days, representing a 50% success rate in positive daily performance, further reinforcing the current bullish outlook. With high liquidity relative to its market cap, JOE enjoys smooth trading and reduced price volatility, which is often a sign of confidence among traders and investors.

However, despite these strengths, JOE has been outperformed by 51% of the top 100 crypto assets over the past year and notably by Bitcoin, which indicates that while JOE is experiencing growth, it may not be as aggressive as some other major cryptocurrencies. It is also still down 93% from its all-time high of $4.98, which serves as a reminder that while JOE is on a positive trajectory, it has a long recovery path ahead to regain its previous highs.

Looking ahead, the price potential of JOE will depend on a mix of factors, including its ability to maintain the current momentum and continue delivering value to its ecosystem.

With innovations like the Liquidity Book and Token Mill enhancing the platform’s utility, coupled with the revenue-sharing model that incentivizes staking, there’s a strong foundation for future growth. However, the yearly inflation rate of 6.91% could exert downward pressure on the price if the new token issuance outpaces demand.

In terms of future price predictions, if JOE can sustain its bullish trend and continue attracting traders and investors to its ecosystem, it could aim for significant milestones, with potential resistance around $1.23 (its last cycle high).

Over the longer term, with continued adoption and favorable market conditions, it might challenge its all-time high, but this would require a significant shift in market sentiment and broader crypto market performance. Therefore, while the near-term outlook remains positive, it may take time before JOE approaches its previous peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Flash Monday: Buy crypto with a credit/debit card for zero fees

Celestia Price Prediction: TIA’s Rejections At $3.80 Could Expedite Further Drop

The Week Ahead Will Focus On These Altcoins: Major Events – Here’s the Watchlist

The cryptocurrency market is preparing to witness important events in many altcoins in the new week. Here are the details.

Ethereum Poised for Major Breakout, Analyst Predicts $10,000 Target