- SuperVerse leads the GameFi sector, offering strong potential in gaming and NFTs with a 70% surge since recent recommendations.

- Bittensor is gaining attention in AI-driven infrastructure, positioning itself for notable growth in the next bull run.

- Mantra (OM) is tapping into real-world asset tokenization, emerging as a key player in blockchain-based asset management.

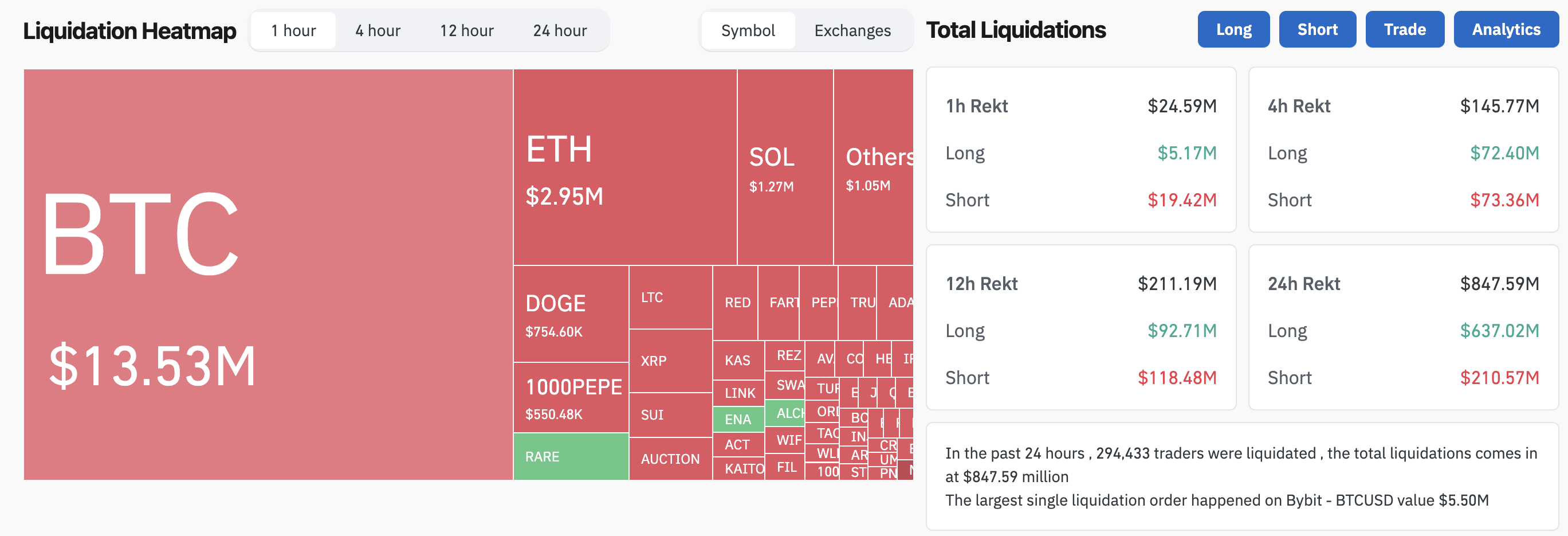

Bitcoin recently hit the seven-day high of $64,300, jumping 2.5% after China unveiled new economic stimulus measures. This surge follows last week’s dip below $60,000, which occurred as market volatility and U.S. inflation concerns rattled investors. Crypto analyst Miles Deutscher sees this as a turning point , predicting that several altcoins, including SuperVerse (SUPER), Bittensor (TAO), Mantra (OM), and Render (RNDR), could see gains of up to 10x.

With Bitcoin showing signs of stabilization, investors are shifting their focus to altcoins in emerging sectors like gaming, AI, decentralized infrastructure, and asset tokenization.

SuperVerse (SUPER): Gaming and NFTs Lead the Charge

SuperVerse (SUPER) is one of the altcoins that has caught the attention of investors, particularly in the GameFi space. SUPER has strong ties to the growing play-to-earn sector and is seen as a rising star in the gaming and NFT ecosystem.

The token has jumped 70% since Deutscher recently recommended it, and its role in the gaming economy offers significant utility. SUPER is currently valued at $1.33 , with a 24-hour trading volume of $27.3 million. Although SUPER has fallen 2.8% in the past 24 hours, its market cap is $647.8 million, with a circulating supply of 487.9 million SUPER coins and a maximum supply of 1 billion coins.

Bittensor (TAO): A Major Player in AI-Driven Infrastructure

Another altcoin Deutscher highlighted is Bittensor (TAO), a key player in the burgeoning AI space. TAO provides infrastructure for AI technologies, which are seeing increasing demand and interest from investors. The project has garnered attention from high-profile figures, including Elon Musk.

Read also: 5 Altcoins to Watch as Crypto Market Rebounds: TAO, W, ETHW, APT, PYTH

Additionally, TAO’s involvement in AI-driven innovations makes it a leader in this emerging niche. Its technical capabilities make it a promising long-term investment, especially for those interested in the intersection of AI and blockchain technology.

Bittensor is priced at $580.77 , with a 24-hour trading volume of $206.9 million. It has decreased by 3.29% in the last 24 hours but maintains a market cap of $4.28 billion, with a circulating supply of 7.38 million TAO coins and a max supply of 21 million coins.

Mantra (OM): Tokenizing Real-World Assets on Blockchain

Mantra (OM) taps into the rising trend of real-world asset (RWA) tokenization, which has gained considerable traction among blockchain enthusiasts and financial institutions alike. The concept of bringing traditional assets such as real estate and commodities onto the blockchain has been endorsed by influential figures, including the CEO of BlackRock.

Deutscher believes OM is well-positioned to benefit from the broader adoption of blockchain-based asset management. With increasing regulatory clarity and institutional interest, OM could become a major player in this growing sector. The ability to tokenize tangible assets is transforming financial markets, providing liquidity and accessibility for investors worldwide.

OM’s price is quoted at $1.53 , with a 24-hour trading volume of $66.1 million. Despite a slight drop of 0.80% in the past day, its market cap remains strong at $1.3 billion, with a circulating supply of 849.4 million OM coins.

Render (RNDR): Supporting Decentralized Infrastructure Needs

Render (RNDR) rounds out the list as a key player in decentralized physical infrastructure (DePIN). The project provides decentralized computing power for industries such as artificial intelligence (AI) and high-performance computing. RNDR’s role in powering decentralized infrastructure has made it a leader in this niche, with Deutscher noting its technical strength and price setup.

RNDR’s position within decentralized infrastructure solutions gives it strong potential for short-term gains and long-term growth. Its ability to deliver computing power to industries that require heavy workloads ensures its continued demand in the digital economy.

RNDR is priced at $5.36 , with a 24-hour trading volume of $331 million. The token is down 1.63% in the past 24 hours, but its market cap still stands at $2.77 billion, with a circulating supply of 517.6 million RNDR coins.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.