Phenomenal Instability: How These Cryptos Are Shaping High-Yield Strategies

- High-volatility cryptocurrencies like OBSR and EIGEN are attracting speculative traders seeking short-term gains, despite (or because of) their extreme price instability.

- Several volatile tokens (SSTC, REEF) combine innovative technological solutions with high market risk, creating a trade-off between potential technological impact and investment stability.

- The DeFi sector appears to harbor particularly volatile assets, with tokens like REEF and OAX showcasing both superior technological potential and significant price instability.

Trading cryptocurrencies have been conducted in volatile conditions whereby high fluctuation is considered a strength and weakness at the same time. Some digital currencies have presented prominent volatility and violent swings that offer potential producers high profits in very short times, but which also cause corresponding losses.

OBSR: Unmatched in Volatility

As usual, OBSR (Observer) has always been in the spotlight when it comes to fluctuations, and it has won a reputation for being one of the most volatile projects. It is a rather volatile commodity and this kind of instability positively influences excitement and negative anxiety concerning trades among merchants. However, due to its high volatility which makes it unsuitable for long-term investment, it persists in the short-term speculative trader market. Its trading can be phenomenal at some times making it a crypto that anyone wanting to invest in must keep an eye on.

SSTC: Groundbreaking Potential with a Catch

SSTC (Sustainability Chain Token) is yet another low-stable crypto that has recorded incredible volatile movements in both directions. SSTC has been considered for its innovative blockchain solutions that concentrate on sustainability despite the fact that it is very volatile. SSTC’s price fluctuates uncontrollably which gives traders a tough time

EIGEN: Phenomenal Instability in the Market

As mentioned earlier, EIGEN is an outstanding cryptocurrency when it comes to its volatile price trends. It has volatile sorts of value fluctuation especially in a short span of time making EIGEN suitable for high-risk players. Its gainers are just as often losers, which makes it one of the most unpredictable assets in the entire crypto world. However, due to that revolutionary characteristic, many risk lovers continue to eye it.

REEF: Superior Performance but with Unparalleled Risk

High volatility is one of the hallmarks of REEF’s impressive performance in the decentralized finance realm. They have a higher appeal in the decentralized finance sector, but their price volatility has raised uncertainty among several investors. People willing and ready for unimaginable risks might find REEF to offer them the best business chances ever.

Read CRYPTONEWSLAND on google news

OAX: Remarkable yet Risky

This turns out to be true, and the volatility of OAX, like the other assets, is truly remarkable. It is an organization agilely opening up financial solutions coin, however, oscillates in price which appeals to but also may turn off various sorts of traders. While it is open to fluctuating in such a way as to incur losses, it is still one of the most innovative players in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

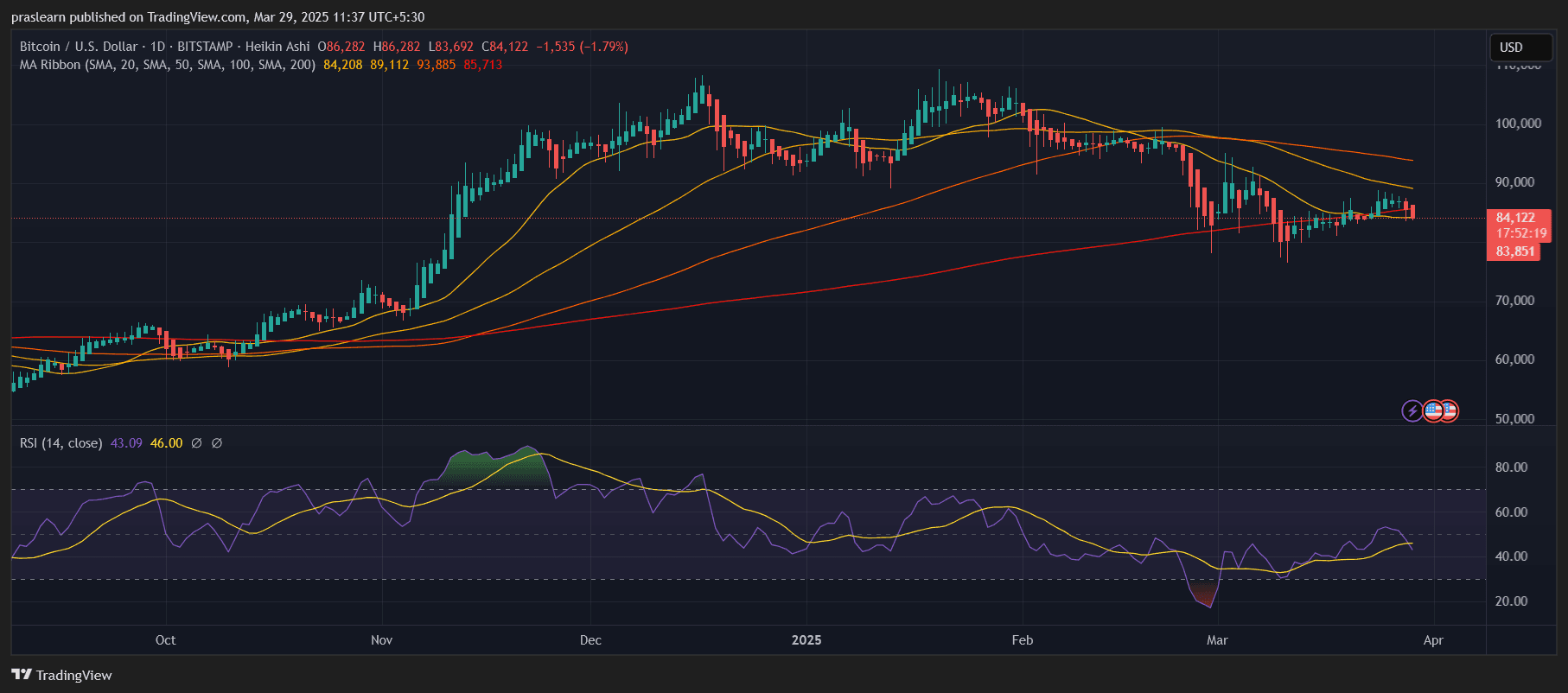

Bitcoin Holds Above $83K With Bullish Momentum Building Toward $91,300 Resistance Level

XRP Stuck at $2– Will It Soar to $2.50 or Sink Below $1.90 as Time Ticks On?

Will Bitcoin Price Crash to $25,000?

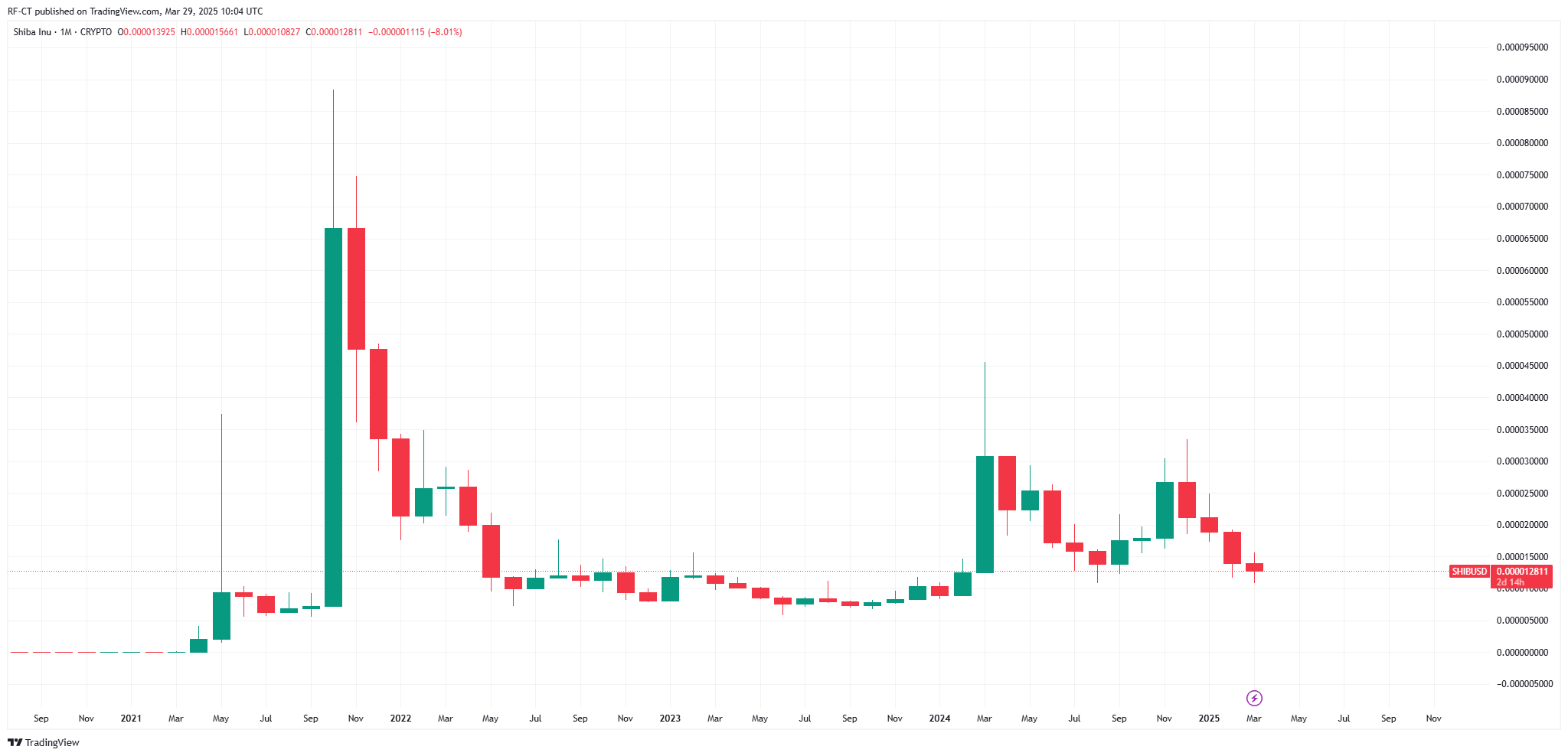

Shiba Inu Price Prediction: Can SHIB Crash to $0 in This Bearish Market?