As an industry liquidity solution, what is the market value prospect of Lumia token?

Renata2024/10/29 06:52

By:Renata

I. Project introduction

Lumia is a Web3 liquidity layer that focuses on cross-chain liquidity. By connecting liquidity resources from different blockchains and vertical fields, it provides deep, reliable, and optimal price on-demand liquidity for applications and businesses.

Lumia simplifies user trading processes, reduces transaction costs, ensures fund security and transparency, and provides efficient and seamless trading experience by integrating decentralized exchanges (DEX) and centralized exchanges (CEX), utilizing virtual order books, liquidity aggregation, and high-security cross-chain bridges. Lumia's goal is to become the preferred partner for all platforms and businesses that require liquidity, and to promote the integration between decentralized finance (DeFi) and traditional finance (Web2).

Ⅱ. Project highlights

1. Cross-chain liquidity aggregation: Lumia integrates the liquidity of different blockchains into a single access point through a highly secure cross-chain bridge, ensuring that users can obtain extensive liquidity coverage and the best transaction prices on one platform, greatly improving transaction efficiency and User Experience.

2. Virtual order book technology: Lumia's virtual order book technology combines traditional order books and AMM liquidity models to display the optimal path for direct trading and multi-step exchange, helping users optimize trading prices, improve trading efficiency, and capture more potential arbitrage opportunities.

3. Refer Earn Incentive Program: Lumia's Refer Earn program rewards users for recommending new users through ORN tokens, and both referrers and new users can receive rewards. This Incentive Mechanism not only helps to quickly expand the user base, but also achieves organic growth of the brand through community expansion, enhancing user participation and loyalty.

4. BTCFi cross-chain support: The BRC20 cross-chain bridge launched by Lumia enables the creation and trading of tokens on the Bitcoin network, providing key support for the expansion of the Bitcoin Finance (BTCFi) ecosystem. This not only enriches the application scenarios of Bitcoin, but also provides Lumia with a unique opportunity to connect BTCFi with the wider DeFi ecosystem.

Ⅲ. Market value expectations

Lumia ($LUMIA) is a Web3 liquidity layer that focuses on cross-chain liquidity. Through its innovative cross-chain bridge and virtual order book technology, it is committed to connecting different blockchains and providing users with reliable and efficient liquidity resources. Based on the current initial circulation of $LUMIA tokens of 74.95 million and a unit price of $1.08, Lumia's circulating market value is $79,610,000.

To estimate the market value of the $LUMIA token, which is consistent with similar DeFi and cross-chain interoperability projects, the unit price and corresponding increase of the token can be calculated as follows:

Benchmark project type and market value expectations:

Coin98 Finance ($C98) - All-in-One DeFi Platform

Token price: 0.123 dollars

Market capitalization: $106,218,819.338

If the circulating market value of $LUMIA is the same as $C98, the token unit price is about 1.42 dollars

Increase: about 31.48%

Coin98 Finance is a platform that provides users with an all-in-one DeFi experience, integrating multiple functions such as wallets, liquidity pools, and lending.

LayerZero ($ZRO) - Full-chain interoperability protocol

Token price: 3.58 dollars

Market capitalization: $397,290,544.06

If the circulating market value of $LUMIA is the same as $ZRO, the token unit price is about 5.3 dollars

Increase: about 390.74%

LayerZero is a cross-chain interoperability protocol designed to connect different blockchain networks, enhance interoperability and cross-chain flow of assets.

IV. Token Economics

LUMIA is a new native token of the Lumia ecosystem, aiming to become the core tool for decentralized finance (DeFi) and real assets (RWA) on the chain. LUMIA tokens are used for various scenarios such as payment of transaction fees, participation in governance, node staking, and liquidity provision, helping the sustainable development of the Lumia ecosystem.

Token Exchange : Existing ORN tokens will be converted to LUMIA at a 1:1 ratio, and all existing ORN token holders are eligible to participate in the token exchange.

Token supply :

Current ORN token supply: 92,631,255

New LUMIA token supply: 238,888,888

Increase in supply: 146,257,633

The purpose of increasing supply is to support the long-term growth and sustainable development of the Lumia ecosystem, including support for node operators, community rewards, and ecological incentives. The distribution of new tokens will ensure that 100% of the new supply is used for node rewards, community rewards, airdrops, and other community building incentives, with 0% allocated to teams. The new token supply will be gradually unlocked over 20 years to ensure the healthy growth of the market.

Token Usage :

1. Network transaction fees : LUMIA, as the native gas token of the Lumia L2 network, is used to pay transaction fees, ensuring efficient and economical on-chain operations.

2. Governance : LUMIA token holders can participate in the governance of the platform and decide on key protocol upgrades and parameter adjustments through voting. By locking LUMIA tokens, users can obtain veLUMIA (voting escrow LUMIA), which can be used to expand participation and obtain additional rewards.

3. Node Staking : LUMIA is used for network node staking, allowing token holders to contribute to cyber security and receive rewards.

4. Liquidity provision : LUMIA tokens can be used to provide liquidity in the liquidity pool of the Lumia ecosystem, actively participate in the network's liquidity mechanism, and receive additional rewards.

5. Access to advanced features : Holding LUMIA can obtain advanced features or preferential fees for Lumia network and future partners and ecological airdrops.

6. Economic Security and Ecological Growth : The role of LUMIA tokens in node staking enhances the economic security of the network, and its diverse uses encourage users to hold and actively participate in the construction of the ecosystem. At the same time, LUMIA will serve as a potential exchange unit for future real assets (RWA) on the platform, further promoting the expansion and integration of the ecosystem.

V. Team and financing

In terms of team members, Lumia's core team includes:

U-Chyung Lim: Chief Commercial Officer

Yanush Ali: Chief Strategy Officer

In terms of financing, Lumia has completed two rounds of financing:

Strategic financing: Led by DWF Labs, on March 7.

Other financing: As of July 21, 2020, the amount of financing was $3.45 million.

VI. Risk Warning

1. Security risks of cross-chain bridges : Lumia integrates multi-chain liquidity through cross-chain bridges, and cross-chain bridges have always been a high-risk point for security bugs in DeFi, which may face the risk of hacker attacks and fund theft. Users need to use it cautiously to ensure the safety of funds.

2.

Sustainability risk of Incentive Mechanism : The Refer Earn plan expands the user base through token rewards. Although it can attract users in the short term, there is uncertainty in the sustainability of the Incentive Mechanism in the long run, which may affect the user retention rate of the platform and the stability of the ecosystem.

3.

Centralized risk of governance participation : Although LUMIA token holders can participate in governance, there is a risk of a small number of holders holding a large number of tokens, which may lead to insufficient decentralization of the decision-making process and affect the long-term fairness and development direction of the project.

VII. Official link

Website :

https://lumia.org/

Twitter:

https://x.com/BuildOnLumia

Telegram :

https://t.me/lumia_community

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Coinotag•2025/04/04 09:55

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

Coinotag•2025/04/04 09:55

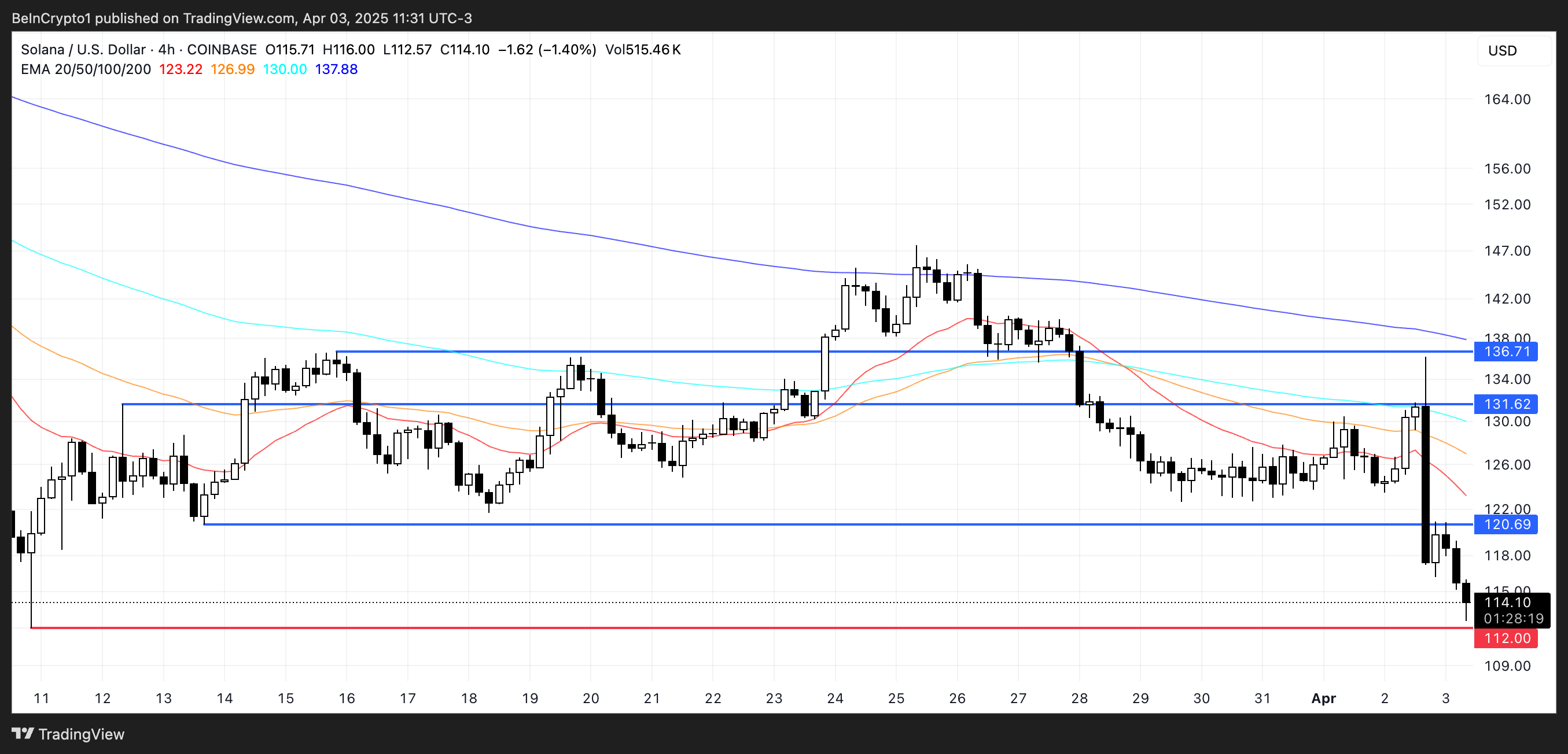

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

Coinotag•2025/04/04 09:55

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin

Coinotag•2025/04/04 09:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$83,382.93

+1.73%

Ethereum

ETH

$1,797.37

+1.10%

Tether USDt

USDT

$0.9995

-0.01%

XRP

XRP

$2.12

+5.58%

BNB

BNB

$594.18

+1.01%

Solana

SOL

$121.33

+6.49%

USDC

USDC

$0.9998

-0.01%

Dogecoin

DOGE

$0.1691

+7.08%

Cardano

ADA

$0.6574

+4.66%

TRON

TRX

$0.2402

+2.24%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now