Chainlink Introduces Upgraded Platform for Financial-Grade DApp Development

Chainlink’s CRE update boosts dApp scalability and integration, offering developers streamlined multi-chain capabilities and efficiency.

Chainlink has launched a significant architectural upgrade, known as the Chainlink Runtime Environment (CRE). The upgrade will potentially improve financial-grade dApps and streamline integration across blockchain networks.

CRE centers on Decentralized Oracle Networks (DON), a key component that powers code execution, orchestrates functions and enables communication between different Oracle networks.

New Upgrade Will Improve Chainlink’s Scalability

The new modular framework allows developers to efficiently integrate various tools, expanding the Chainlink network’s scale and supporting connectivity across different blockchains.

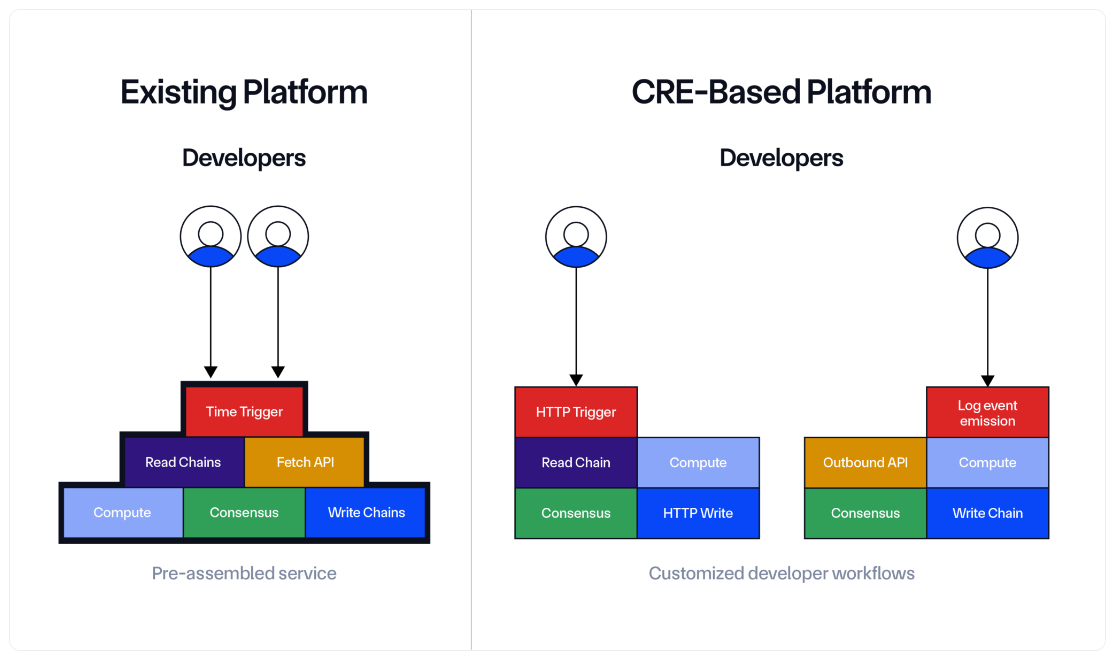

Previously, the network offered only prepackaged services, limiting developers’ options for building novel products. With the CRE’s modular setup, developers can now handle multiple workflows simultaneously, saving time on both development and maintenance.

Read More: What Is a Blockchain Oracle? An Introductory Guide

“With CRE, developers can compose capabilities directly on the Chainlink Platform without having to add Chainlink-specific code to their core onchain app logic. As a result, devs can leverage self-serve capabilities regardless of which blockchains their app is deployed to,” Chainlink wrote in an X (formerly Twitter) post today.

The upgraded platform’s design allows developers to harness all of Chainlink’s capabilities, creating apps that interact across multiple chains, offchain resources, and products, without constraint.

A visual explanation of the CRE upgrade. Source:

Chainlink

A visual explanation of the CRE upgrade. Source:

Chainlink

Following the announcement, LINK, saw a 5% price increase. Recently, LINK has struggled to stay above $12, attempting to regain ground after losses in July. Investor sentiment, however, remains optimistic, signaling potential for growth.

The upgrade coincides with recent adoptions by major platforms. GMX-Solana integrated Chainlink’s Data Streams for pricing and liquidations, while the network’s Cross-Chain Interoperability Protocol (CCIP) enabled cross-chain staking on Lido.

This integration has increased accessibility to staked Ethereum on Layer-2 networks.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

Despite these developments, altcoin faces tough competition in the Oracle space. Pyth Network surpassed Chainlink in transaction volume over the past month, despite having a lower total value secured (TVS).

Pyth’s pull-based Oracle model, which provides data only upon request, is optimized for high-frequency scenarios, such as trading, where real-time data is essential. This contrasts with Chainlink’s push-based model, which delivers regular updates.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Saylor Proposes US Purchase of 1 Million Bitcoin for Strategic Reserves

XRP Bulls Eye $222 Price Target Based on Historical Patterns

Solana Debates Inflation Cut That Could Reshape Network Structure

Ethereum Delays Major Pectra Upgrade After Test Failures