Whale Activity Soars, Major Investors Bet Big on Bitcoin Amid Price Dips

- Major Bitcoin whales bought 1,050 BTC, reflecting investor confidence even amid recent price dips and market volatility.

- Bitcoin’s price cycles align with the U.S. election showing repeated pre-election consolidation and post-election rallies.

- Ahead of the 2024 U.S. election, whale purchasing suggests a positive mood as Bitcoin consolidates close to its all-time high.

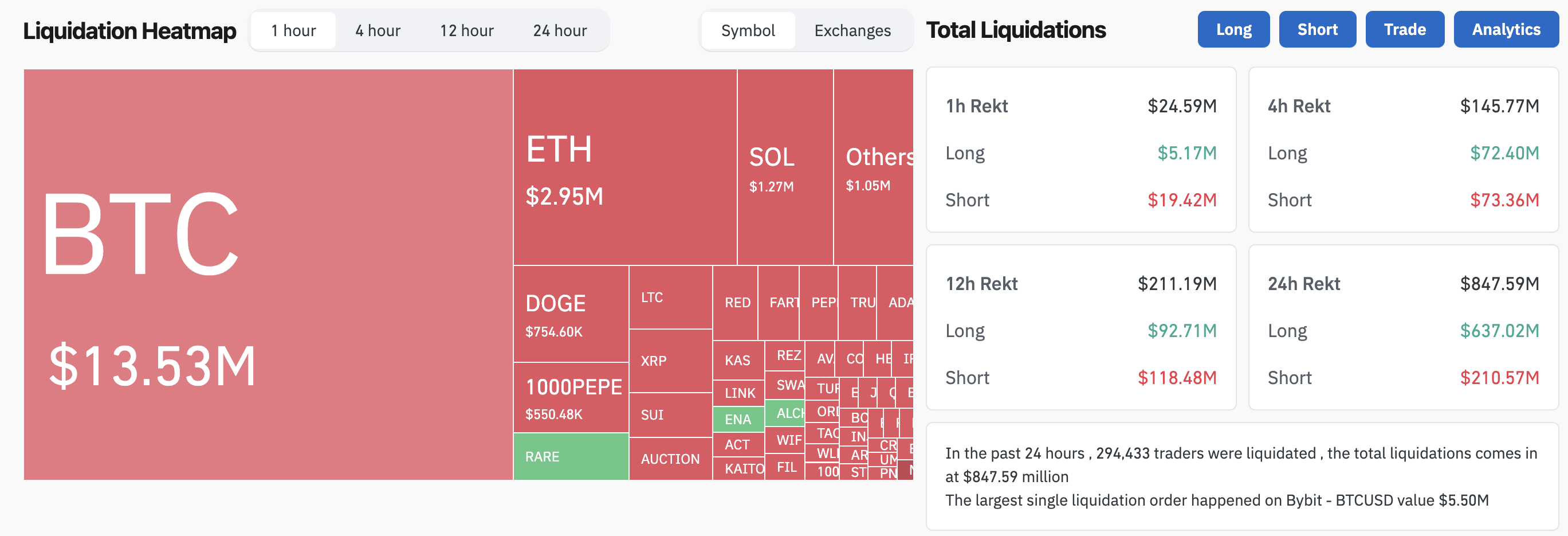

Bitcoin’s price dropped, and whales resumed the accumulation of BTC in large quantities. Lookonchain reported that one whale bought 500 BTC worth $34.9 million at $69,799. This whale had previously acquired 501 BTC at $30,233 in June 2023, resulting in an unrealized profit of $19.8 million. Another whale, only hours later, purchased 550 BTC valued at $38.68 million. These massive buys reflect strong investor confidence, even amid Bitcoin’s recent volatility.

Whales Buying Bitcoin Amid Election Cycles

The price of Bitcoin, ever since its creation, could well reveal an affinity for the four-year cycle that occurs with every United States presidential election . The price trends have captured and placed a cap on both major election years in 2020 and 2016, and now into 2024. It was the 2016 Republican election cycle where Bitcoin rounded out a bottom pattern and began to break out bullishly, sending it upwards on a lasting rally.

By 2020, Bitcoin’s price movements displayed a similar setup. Around the Democratic election, BTC formed another rounded bottom before a breakout. Consequently, Bitcoin reached new all-time highs, displaying resilience during corrective phases.

Additionally, BTC stabilized at a high support zone, aligning with previous cycle peaks. These historical patterns underscore Bitcoin’s unique cyclic trends, showing repeated price consolidation and subsequent rallies.

Current Market Movements and Potential 2024 Election Impact

Currently, Bitcoin is consolidating near its all-time high of $70,207.54 , reflecting a 10.88% increase in October 2024. This price zone suggests market indecision ahead of the upcoming 2024 election.

Read CRYPTONEWSLAND on google news

The Relative Strength Index (RSI) also signals a potential cooling in buying momentum. Although the RSI remains above midline levels, which indicates Bitcoin is not in oversold territory, the reduced buying pressure hints at market caution.

Moreover, recurring pre-election consolidation and post-election rallies highlight Bitcoin’s sensitivity to broader political and economic shifts. Each cycle’s pattern has shown consistent post-election breakouts that pushed Bitcoin to new highs. The potential impact of the 2024 election might mirror these previous cycles, setting the stage for Bitcoin’s next price movement .

Whale Activity and Political Cycles Fuel Optimism

The recent whale purchases show growing confidence in Bitcoin’s long-term potential. Despite temporary price fluctuations, the continued whale accumulation demonstrates strong support from institutional investors.

Furthermore, the recurring price patterns linked to election cycles indicate Bitcoin’s potential for another bullish phase. As the 2024 election approaches, Bitcoin’s market behavior will likely capture heightened attention from investors, eager to see if history repeats itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty