How to monitor what 'smart money' is doing in crypto on US Election Day

Observing key crypto metrics on major platforms provides insight into what “smart money” is doing amid the U.S. election, according to Kaiko.Analysts predict big crypto price swings in either direction, depending on the outcome, as the presidential race draws to a close.

Election Day in the United States is here, and with crypto's 24/7 nature offering an advantage over traditional market trading hours, analysts at Kaiko outlined three key metrics to watch as the results come in.

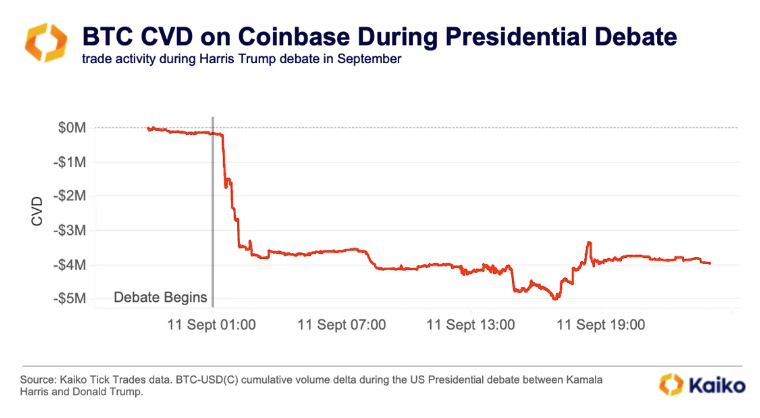

Firstly, observing tick trade data on major platforms can provide insight into what “smart money” is doing. Calculating cumulative volume delta (CVD) from tick trades measures net buying and selling activity on crypto trading platforms worldwide. It proved insightful during the presidential debate between Donald Trump and Kamala Harris, and will be again during the election itself, Kaiko analyst Adam Morgan McCarthy wrote . During that September debate, CVD turned negative, indicating a bearish reaction to Trump’s comparative performance, as Harris was viewed as less favorable to the industry than Trump’s overtly pro-crypto stance.

BTC CVD on Coinbase during the presidential debate. Image: Kaiko .

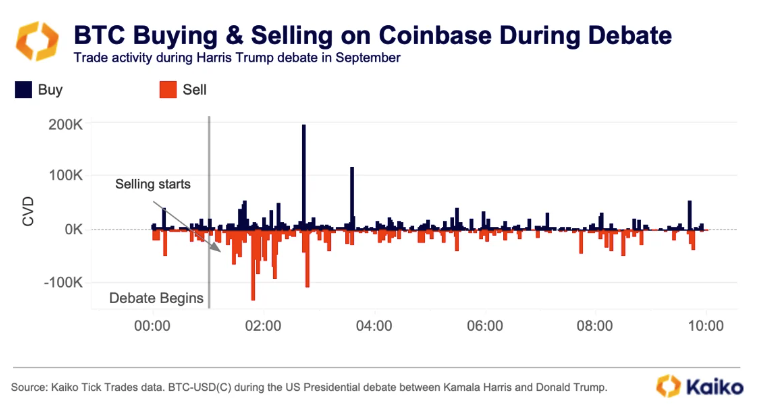

By separating tick trades into buys and sells, intense selling pressure was observable as the market reacted in real time to Trump’s performance, the analyst explained. This helped to time the market by showing when buying or selling pressure is easing and offering clues about participants' expectations.

BTC buys and sells on Coinbase during the presidential debate. Image: Kaiko .

A second metric to monitor is funding rates, according to Kaiko, with leveraged traders being sensitive to sudden changes that could lead to squeezes or cascading liquidations in either direction.

Elevated funding rates typically suggest heightened speculation in bitcoin perpetual contracts. In March, funding rates surged above 0.05% as bitcoin hit a record high above $73,000. However, last week, as bitcoin approached the same level, rates held steady around 0.01% on Binance and Bybit, the two largest platforms for perpetual contracts, suggesting reduced trader confidence ahead of the election, McCarthy said.

Binance adjusts funding rates every eight hours, initially at 12 p.m. ET and after voting closes on the East Coast at 8 p.m. The next adjustment follows at 4 a.m. ET on Wednesday, when perhaps the outcome will be clearer.

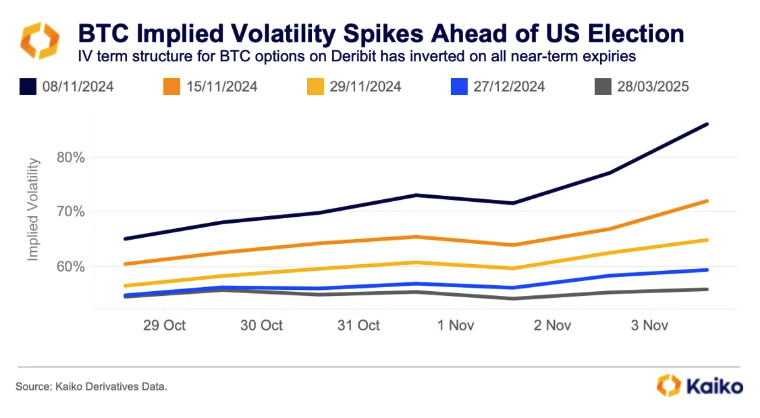

Finally, implied volatility is also key to watch in derivatives markets, showing how participants are pricing risk. IV is a forward-looking metric that predicts the anticipated volatility of an asset over a given time frame, consolidating various data points into a single figure and allowing traders to identify if options are relatively cheap or expensive.

Monitoring IV term structure helps traders anticipate potential market risks. An inverted term structure, where short-term IV is higher than long-term IV, often signals an impending risk event, like the U.S. election, the Kaiko analyst explained.

Recently, bitcoin’s rally to near-record highs caused a spike in short-term IV, catching traders off guard and prompting them to adjust their positions. This shift influenced the IV Smile — a pattern showing higher IV for options slightly above and below the current price. A rightward tilt in the smile indicates market anticipation of upward price volatility, while a leftward tilt suggests concerns about potential price drops. The recent shifts highlight how traders hedge against expected price swings, he said.

BTC implied volatility ahead of the U.S. election. Image: Kaiko .

Ultimately, markets are driven by supply and demand and shaped by the actions of participants, but the predictive accuracy of these trends remains uncertain, as traders are not infallible, McCarthy noted.

Prediction markets and average polls diverge amid outcome uncertainty

Trump currently leads Harris by 62% to 38% odds of winning the presidential race on the decentralized platform Polymarket, with its $3.25 billion in trading volume on the outcome making it by far the largest prediction market. The gap on the regulated Kalshi platform is 57% to 43% in Trump’s favor. However, national polling averages remain close, showing a 1% lead for Harris — within the margin of error — Bernstein analysts noted on Monday.

Kaiko previously argued that open interest levels on Polymarket suggest the platform lacks liquidity for U.S. election bets, and its predictive power was up for debate. Others have pointed to prediction markets having a mixed elections track record, whales potentially skewing the market or potential bias due to a dominance of men, crypto-natives and non-U.S. traders using the platform, analysts at crypto trading firm and market maker GSR noted this week.

However, following a brief convergence in odds between the two candidates over the weekend, Bernstein digital assets lead Gautam Chhugani said, “To anyone who was suggesting Polymarket data is manipulated with a Trump bias, we believe we had enough proof over the weekend to suggest that it behaves just like any public market, and it is easy for the traders to get spooked with incremental poll data.”

Additionally, supporters of prediction markets’ accuracy argue that the focus on popular vote polls, rather than the electoral college, and the use of backward-looking polls in election models are key factors. They also highlight that most betting markets share similar odds with Polymarket, suggesting minimal likelihood of manipulation. Further, academic studies show that prediction markets tend to be more accurate than surveys or expert opinions, with transparency, crowd wisdom and market dynamics driving the odds toward accuracy, GSR added.

Kaiko noted that the swing states of Pennsylvania, North Carolina, Georgia, Michigan, Wisconsin, Arizona, and Nevada were the ones to watch on election night, particularly Pennsylvania. If Harris loses its 19 electoral votes, the path to the White House becomes significantly more challenging, perhaps even impossible, according to some polls .

Trump currently leads in Arizona, Georgia, Nevada, North Carolina and Pennsylvania on Polymarket , while Harris leads in Wisconsin and Michigan.

Anticipated price impact on bitcoin

Amberdata Director of Derivatives Greg Magadini told The Block he expected a $6,000 to $8,000 price swing post-election, leading to a potential dip to the $60,000 level following a Harris victory or all-time highs above $75,000 if Trump wins.

BRN analyst Valentin Fournier agreed, predicting bitcoin’s price to fluctuate by around 10% post-election, with a positive impact anticipated under a Trump win and a potential dip if Harris prevails. “However, the medium to long-term outlook for bitcoin remains favorable, regardless of the election outcome,” Fournier noted.

On Monday, Bernstein analysts said they expected bitcoin to reach $80,000 to $90,000 following a Trump win in the run-up to inauguration day on Jan. 20 while warning a Harris victory could see bitcoin drop to $50,000 over the same period before any recovery.

Bitcoin is currently trading for $68,828, according to The Block’s Bitcoin Price Page . The foremost cryptocurrency is down around 4% over the past week but remains up 63% year-to-date.

Meanwhile, the GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, is down roughly 7% over the past seven days to 120.08 but has gained around 21% in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

1 in every 5 Americans hold Crypto: Ripple CLO

Ethereum MVRV Ratio Approaches Danger Zone – What’s Next for ETH?

XRP and ETH Show Promising Pump Signals, ETH Aims for $4,000 and XRP Aims for $17

Invest Smart: 4 High-Potential Altcoins for Massive Returns This Year