Top Crypto Gainers Today Nov 26 – Celo, 1inch Network, Aave, Akash Network

When was the last time you thought about why crypto surges happen? It’s easy to get caught up in the numbers and headlines, but behind every rally lies a story—one of innovation, market sentiment, or shifting utility. Today’s top crypto gainers—Celo, 1inch Network, Aave, and Akash Network—each hold a unique narrative driving their ascent. For investors, these stories reveal opportunities and insights into the market’s evolving dynamics, making them worth exploring.

Biggest Crypto Gainers Today – Top List

Our carefully selected top crypto gainers are leading today’s crypto rally, showcasing impressive price surges fueled by remarkable innovations in DeFi, cloud computing, and cross-chain technology. Celo gains attention with its Ethereum layer-2 upgrade, while 1inch Network stirs interest with Fusion+. Aave hits $10B in active loans, and Akash Network gains traction with Web3 developers, bolstered by its partnership with Witness Chain.

At the same time, the Crypto All-Stars presale has raised $6M and has 24 days left. It offers staking for top meme coins like Dogecoin and Shiba Inu. As these projects gain momentum, investors have plenty to watch and opportunities to seize.

1. Celo (CELO)

Leading today’s lineup of top crypto gainers is CELO, a unique token making waves with its recent progress. CELO has surged 8.02% in the past 24 hours, trading at $0.875422, as the Celo community prepares for a pivotal milestone: its migration to an Ethereum layer-2 solution. This transition, currently undergoing Baklava testnet upgrades with a mainnet launch expected in January, has fueled investor excitement as it signals enhanced scalability and interoperability for the network.

Celo’s ecosystem has also seen impressive traction. With over $1.25 billion in trading volume on Uniswap, a new all-time high, and the launch of initiatives like the $40M Minipay Ecosystem Fund, the blockchain is positioning itself as a hub for innovative, decentralized applications. These developments align with its financial inclusion and regenerative finance mission, supported by notable partnerships with Google Cloud, Deutsche Telekom, and others.

From a market perspective, CELO exhibits promising metrics. It has maintained a steady 50% green day streak and low volatility at 10% over the past month. Trading 33.5% above its 200-day SMA, CELO has shown remarkable resilience and steady growth. Moreover, it has outperformed nearly half of the top 100 crypto assets over the past year, adding to its appeal.

Liquidity remains strong, reflected in a market cap-to-volume ratio of 0.3645, which underscores sustained interest in the token. With a neutral RSI of 61.78, the token isn’t overbought, suggesting potential for continued momentum.

2. 1inch Network (1INCH)

Following CELO’s notable performance, another project in today’s market is the 1inch Network token. This DeFi powerhouse has surged 4.26% in the last 24 hours, drawing attention from investors. Its recent price movement might be influenced by the buzz surrounding Fusion+, a revolutionary cross-chain swap feature unveiled by the 1inch team. By simplifying and securing cross-chain trades, Fusion+ has positioned 1inch at the forefront of DeFi innovation, fueling optimism among traders.

Fusion+’s focus on MEV protection and atomic swap technology indicates the network’s commitment to security, a crucial factor for risk-conscious investors. The protocol’s beta success, processing millions of dollars in transactions, reflects market confidence in its potential to reshape cross-chain activity.

Liquidity remains a strong suit for 1inch, with a healthy volume-to-market cap ratio of 0.2702. Its neutral RSI of 54.99 suggests stability, though a sideways trading trend may persist. Despite this, the token’s recent 25.33% trading premium above its 200-day SMA indicates a longer-term upward trajectory. Such metrics often signal growing confidence in a project’s fundamentals, especially for investors seeking steady opportunities.

Over the past year, the token has climbed 16%, though it only outperformed 21% of the top 100 crypto assets. While modest, this growth aligns with the 1inch Network’s steady expansion, including new partnerships and its robust developer ecosystem. Investors eyeing its blend of innovation and security might find it a valuable addition to their portfolios.

3. Crypto All-Stars (STARS)

Crypto All-Stars has quickly caught the attention of investors, raising over $6 million in its presale. With only 24 days left, the presale is winding down, making this the final chance to secure STARS at the fixed price of $0.0016189. The timing couldn’t be better, as the meme coin market is primed for another rally, and Crypto All-Stars stands out with its unique offering.

The project taps into the current meme coin craze by allowing users to stake 11 of the top meme coins, including Dogecoin, Shiba Inu, and Pepe, for passive income. As the market continues to embrace meme coins, Crypto All-Stars’ staking platform positions itself as a prime opportunity for investors looking to benefit from the meme coin supercycle.

In fact, renowned crypto analyst ClayBro highlighted the potential of Crypto All-Stars , noting its appeal in an environment where meme coins are gaining unprecedented attention. With Bitcoin nearing $100k, millions of new retail investors are expected to flood the market, which could propel STARS to new heights.

Despite recent market turbulence, Crypto All-Stars’ presale continues to surge. This demonstrates strong demand, even in a volatile environment, giving investors confidence in the project’s resilience and future growth.

With robust security, smart contract audits, and a solid use case, Crypto All-Stars is well-positioned for success. Investors have just 24 days to get in at this price, making now the time to act.

Visit Crypto All-Stars Presale

4. Aave (AAVE)

Building on the momentum of 1INCH, the spotlight shifts to a DeFi heavyweight making news: Aave. Its recent 4.18% price gain reflects a growing buzz around its ecosystem, fueled by an impressive milestone—$10 billion in active loans. This surge, a staggering 300% rise since the start of the year, aligns seamlessly with DeFi’s resurgent appeal, underscoring Aave’s integral role in this revival.

Intriguingly, Aave’s financials tell a compelling story. The protocol’s revenue soared by 82% in just 30 days, while total value locked (TVL) jumped to $15.96 billion, marking a 26.7% climb. These metrics highlight not just user confidence but also the protocol’s ability to adapt and thrive in a competitive DeFi market. Moreover, its strong liquidity, evident in a 0.3465 market cap-to-volume ratio, ensures stability for lenders and borrowers.

Perhaps what sets Aave apart is its long-term trajectory. The token exudes strength by trading 35.49% above its 200-day SMA and boasting an 87% price increase over the past year. Unlike many, it’s not overly volatile—current 30-day volatility sits at a manageable 11%. This balance makes it attractive to both cautious and adventurous investors.

Meanwhile, whispers of expansion onto Spiderchain, a Bitcoin layer-2 network, hint at even more extensive possibilities. Such a move could marry Bitcoin’s liquidity with Aave’s lending innovation, unlocking untapped potential. This makes Aave a unique blend of proven success and future promise for investors.

5. Akash Network (AKT)

As the crypto market surges today, one token that’s catching attention is Akash Network, now standing out as one of the top gainers. With a price increase of 3.76% in the last 24 hours, Akash is riding a tide of sustained interest in decentralized cloud solutions. The price of $3.97 highlights its resilience, especially considering the market’s volatility. Akash has maintained a strong position, boasting a 137% increase in price over the past year, outperforming 62% of the top 100 crypto assets in that period.

What truly differentiates Akash is its ability to provide affordable, decentralized cloud computing, which is gaining traction among Web3 developers. The platform’s peer-to-peer infrastructure offers services at a fraction of the cost of centralized giants like AWS and Microsoft Azure. Additionally, Akash’s recent partnership with the innovative Witness Chain protocol has positioned it as a leader in bridging the gap between blockchain and real-world data, further enhancing its value proposition.

In terms of volatility, AKT remains relatively stable, with a 30-day fluctuation of 22%, well below 30%. The token also trades 291.88% above its 200-day Simple Moving Average of $1.01, highlighting its impressive long-term performance. Additionally, 67% of the past 30 days have been positive, reinforcing its upward momentum.

Liquidity is solid for AKT, with a volume-to-market-cap ratio of 0.0689, ensuring healthy trading activity. The token’s RSI of 57.04 indicates a neutral position, making it a potential candidate for those looking to enter the market during relative stability.

Read More

- Top Gaining Cryptos

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

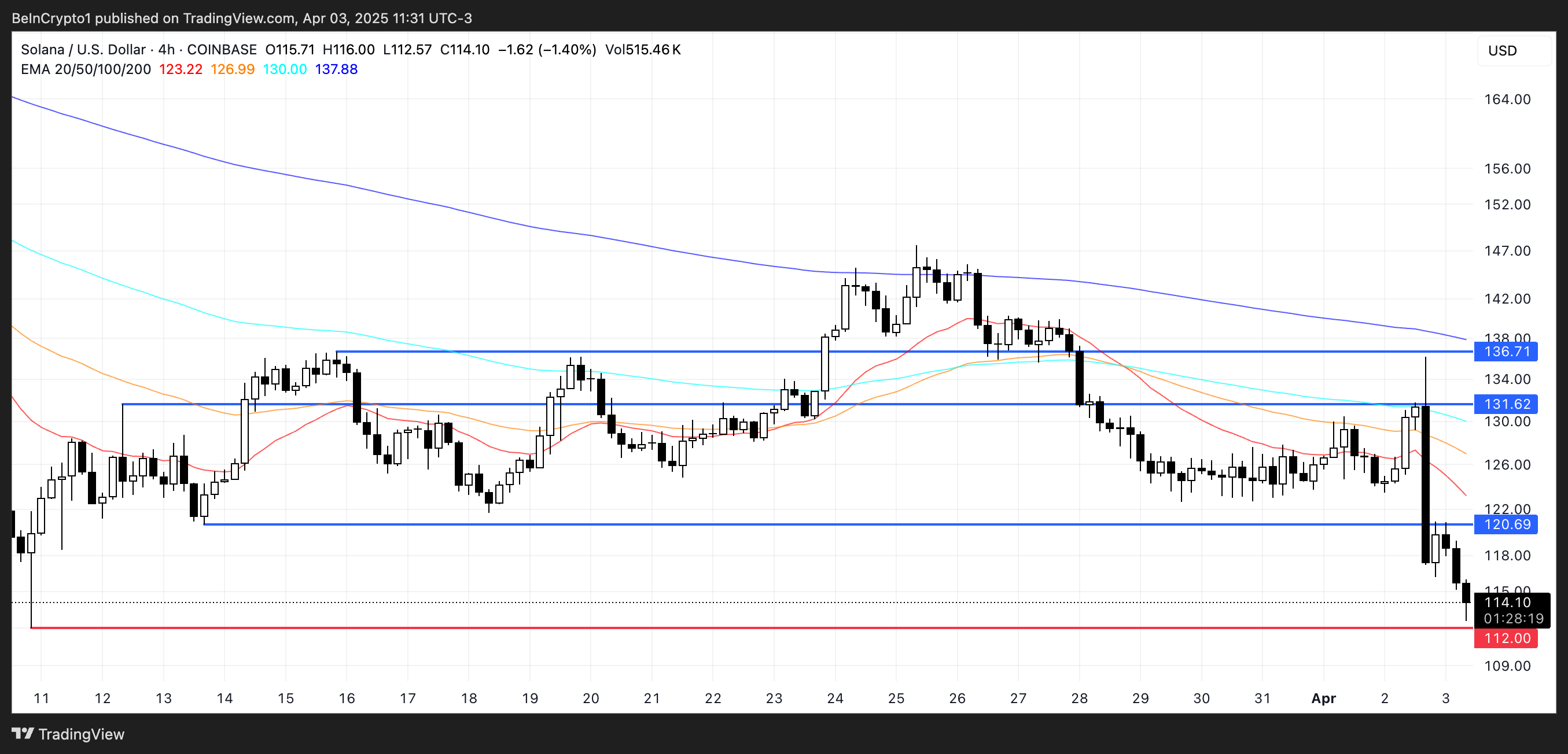

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin