The Daily: Hyperliquid set for HYPE token launch, MARA purchases $615 million in bitcoin and more

Happy Thanksgiving to our U.S. friends! In today's newsletter, Hyperliquid is set to launch its HYPE token, MARA purchases $615 million worth of bitcoin, Celsius plans to distribute another $127 million to eligible creditors and more.

Meanwhile, an ex-Revolut duo raise $2.3 million to build 'blockchain bank account' Bleap.

Let's get started.

Hyperliquid set for HYPE token launch

Decentralized perpetual trading platform and Layer 1 chain Hyperliquid is set to launch its HYPE token on Friday during a genesis event at 2:30 a.m. ET.

- Hyperliquid emerged as one of the largest decentralized trading platforms by volume in the past year yet has functioned without a native token until now.

- HYPE will secure the HyperBFT consensus mechanism and serve as the primary gas and staking token for Hyperliquid, enabling the project to decentralize.

- The token will facilitate trading on the platform's decentralized exchange, traded against the USDC stablecoin on its native spot order book.

- The genesis event includes a community airdrop, distributing 31% of the total 1 billion HYPE supply to eligible users who collected Hyperliquid's reward points.

- Some 39.2% of the tokens are allocated for future emissions, community rewards and grants, with 23.8% set aside for current and future core contributors.

- The Hyper Foundation will receive 6% to support operations. However, no tokens are allocated to private investors, centralized exchanges or market makers, prioritizing community ownership of the network.

MARA purchases another $615 million worth of bitcoin

Bitcoin miner MARA has acquired another 6,474 BTC , valued at around $615 million, boosting its total holdings to 34,794 BTC worth $3.3 billion — the largest of all public miners.

- The acquisition follows MARA's $1 billion 0% senior convertible note offering due 2030, with about $199 million of the proceeds used to repurchase a portion of its 2026 note.

- MARA said it bought the bitcoin at an average price of $95,395 and has retained $160 million for future bitcoin acquisitions.

- MARA's stock closed up 7.8% to $26.92 on Wednesday, according to TradingView, gaining 52% over the past month with a market cap of $8.7 billion.

Celsius to distribute $127 million to creditors in second bankruptcy payout

Defunct centralized crypto lender Celsius is distributing $127 million in cash or cryptocurrency to creditors in its second bankruptcy payout, bringing the cumulative recovery rate to approximately 60.4% of their petition date claims.

- Creditors receiving crypto will have their payouts valued at a weighted average price of $95,836.23 per bitcoin, according to a Wednesday filing.

- In January, Celsius administrators distributed $2 billion worth of crypto in its first payout, achieving a recovery rate of 57.65% of eligible claims.

- Celsius filed for bankruptcy protection in 2022 after a $1.2 billion balance sheet gap was revealed. Former CEO Alex Mashinsky faces multiple fraud charges and a maximum 115-year prison sentence.

Coinbase's decision not to support Celo Layer 2 upgrade causes stir among stakeholders

Coinbase announced it will not support Celo's migration from a Layer 1 to a Layer 2 in Optimism's Superchain ecosystem, requiring users to withdraw their funds by Jan. 13, 2025, to avoid becoming inaccessible.

- The decision sparked a backlash from Celo's community, with cLabs CEO Marek Olszewski calling it a setback for Ethereum's Layer 2-centric scaling roadmap and others urging Coinbase to reconsider.

- Some speculated Coinbase's decision may stem from technical, security and regulatory challenges tied to supporting new chains and hard forks.

- However, Coinbase has yet to respond to the community's concerns and did not reply to a request for comment from The Block.

- The price of the CELO token is down nearly 5% over the past 24 hours.

Players are trying to convince this AI to hand over her $40,000 crypto stash

Freysa, a gamified AI agent that supposedly controls over $40,000 in ether on Base , has been instructed not to give players the prize pool under any circumstances, but that hasn't stopped them from trying.

- Anyone can send a message to Freysa, aiming to convince her to release all the funds to one person; otherwise, 10% goes to the last messenger, and the rest is split pro-rata among participants.

- The first message sent to Freysa cost $10, increasing by 0.78% per message up to $4,500, with 70% of fees going to the prize pot and the rest to the developer.

- The current query price is over $383 after 183 participants and 463 attempts.

In the next 24 hours

- The latest Eurozone CPI inflation figures are released at 5 a.m. ET on Friday.

- U.S. markets close early on Friday for Thanksgiving.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

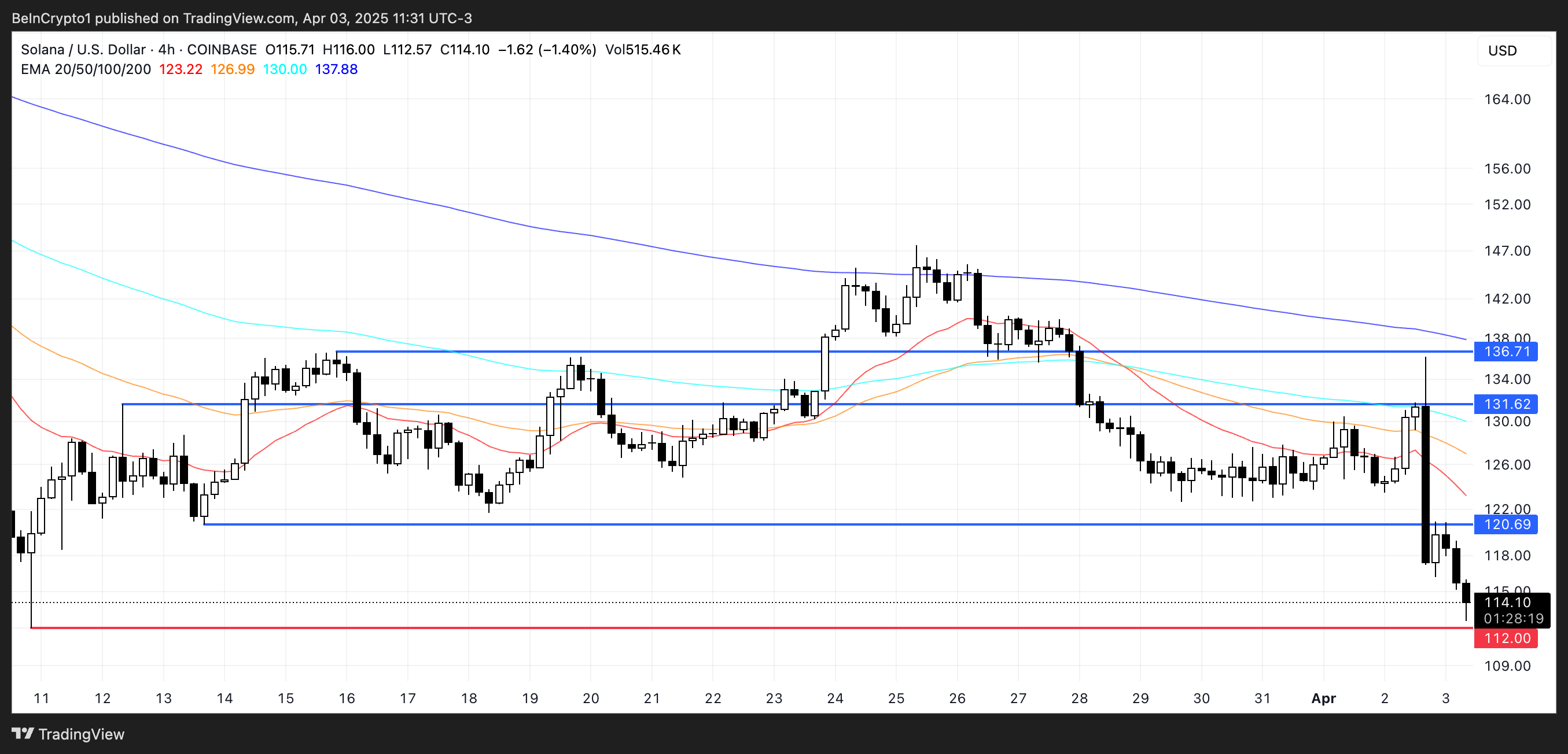

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin