Memecoins are here to stay, says expert panel — but is utility the goal?

Quick Take A panel of experts at Emergence agreed that memecoins are here to stay but disagreed on whether or not memecoins should attempt to add utility or simply trade on “memetic value.” The experts also pondered which networks could challenge Pump.fun and Solana’s dominance in the memecoin space.

"Memes have existed since the beginning of man, scratched on cave walls," declared 6th Man Ventures founder Mike Dudas at The Block's Emergence conference in Prague during a panel discussion on the current state of memecoins.

Each of the panel's experts agreed that memecoins are unlikely to disappear from the crypto market any time soon while disagreeing on questions like whether memecoins should market their utility, the most likely ecosystems to challenge Pump.fun and Solana's dominance, and how to evaluate the likelihood of a memecoin's long-term success.

"Being able to add utility to memes and being able to generate revenue off the back of [memecoins]...that's going to be an additional factor you can't really write off, in terms of 'Hey, this thing is generating money now, and also it's funny,'" said Cumberland Labs Director of Research Chris Newhouse.

"I think utility is turbo-bearish," countered Genia Mikhalchenko, who leads business development at Douro Labs. "If you look at how people treat [memecoins] and if you look at the intended target audience, people aren't doing discounted cash-flow models on 'where is this going six months from now'?...They're just buying a picture of a hippo or a frog."

Mikhalchenko acknowledges that some outliers have successfully added utility, such as BONK , which he described as "party in the front, business in the back," using its protocols in the background to proliferate the memetic value of the token.

"When we talk to founders…I'll ask folks, 'When you launch a token, is it going to trade on fundamental value or memetic value?'" said Dudas. "The answer I like to here is 'There's going to be a lot of memetic value in the beginning…and then use that momentum over a period of many years to build out utility."

Not every meme makes a good memecoin, noted Nansen researcher Nicolai Søndergaard. "For something to be popular, especially long term…it has to be able to be altered…a meme is something which can be shared, can be altered, can be told whether visually or auditorally, and that's what really matters in the end."

Will Pump.fun and Solana be dethroned?

The discussion turned to which blockchain networks might dominate the memecoin space in the future. Chris Newhouse highlighted the potential for Base to disrupt Solana’s dominance in the memecoin market.

"I think that Base is going to be an interesting area of competition for Solana," he said. "In terms of memecoins and market cap, the Base network will be the one that will compete with Solana."

Newhouse described AI-driven token development tools on Base as a key factor catalyzing memecoin activity on the Layer 2.

"Base is where a lot of the next wealth effect is going to be, particularly the AI-driven stuff, which is a pretty hot narrative now," Newhouse said.

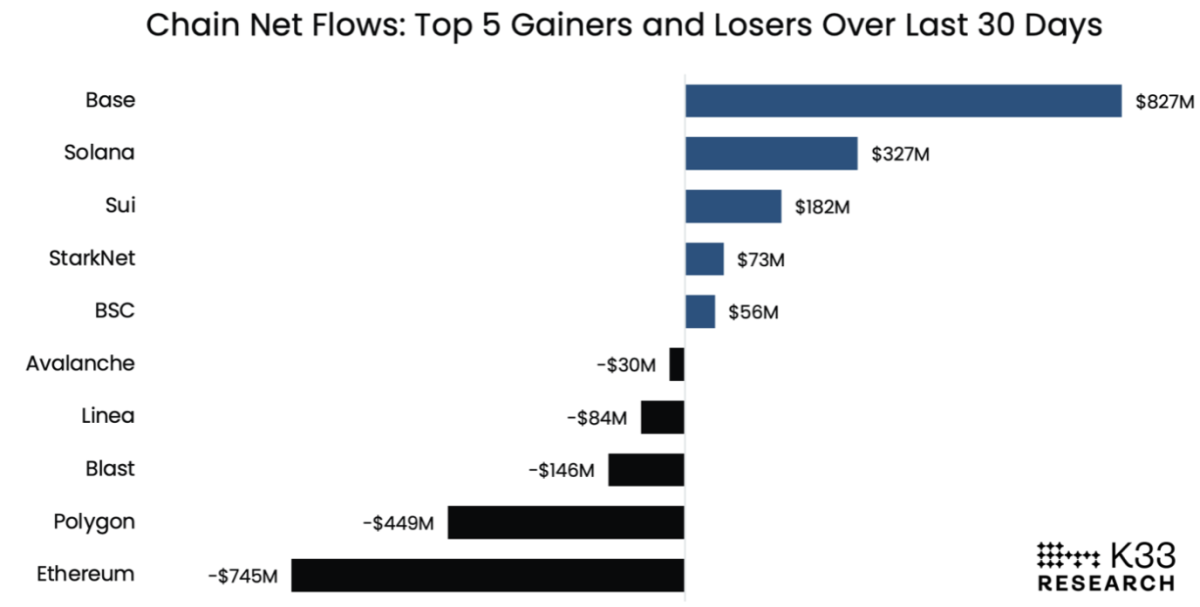

A recent report by K33 Research described AI-driven token generation tools such as Clanker and the Layer 2's seamless integration into Coinbase’s infrastructure as key factors facilitating the success of the Base network.

"Clanker, a popular AI-driven token deployment tool, is leading activity on Base, and generated significant revenue and user engagement, mirroring the success of Solana’s Pump.fun," K33 Research analysts said.

They added that Clanker, as a rival to the Solana-based Pump.fun platform, allows users to come up with memecoin token ideas, with the AI tool handling the entire creation process seamlessly.

"The concept has seen a remarkable surge in fees generated," the K33 report said.

Blockchain net flows in the month of November. Image: K33 Research

However, Mike Dudas emphasized that Base still faces hurdles.

"Base just doesn't have enough tokens yet, and you need to have a robust token ecosystem," he said. "However, I do think Base will eventually be a competing chain."

This view aligns with data from The Block, which shows Solana accounting for around 348,000 new tokens out of around 375,000 launched across all tracked chains in the month of November—over 92% of the total. Such numbers underscore Solana's dominant position as the preferred platform for token creators, including memecoins.

Base’s Total Value Locked (TVL) growth over the past month is noteworthy. According to DefiLlama data , Base’s TVL has surged to $3.89 billion, an increase of over 605 in the past month. Data from K33 Research indicates that while Base has attracted funds from other layer-2 networks like Polygon and Blast, Solana maintains net-positive inflows. Solana has seen significant capital inflows over the past month, posting an over 60% rise in TVL over the past 30 days to $9.32 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US equities slide as trade war escalates, Powell signals no rate cut

Tariff and interest rate concerns overshadowed a positive March jobs report

Sei Investments increases 39% stake in MicroStrategy

Fidelity Spot Solana ETF Gains Traction As SEC Acknowledges Filing

Paul Atkins Moves Closer to SEC Chair Role After Senate Committee Approval