Who’s Behind the dYdX Native DYDX Token Price Jump of 30%?

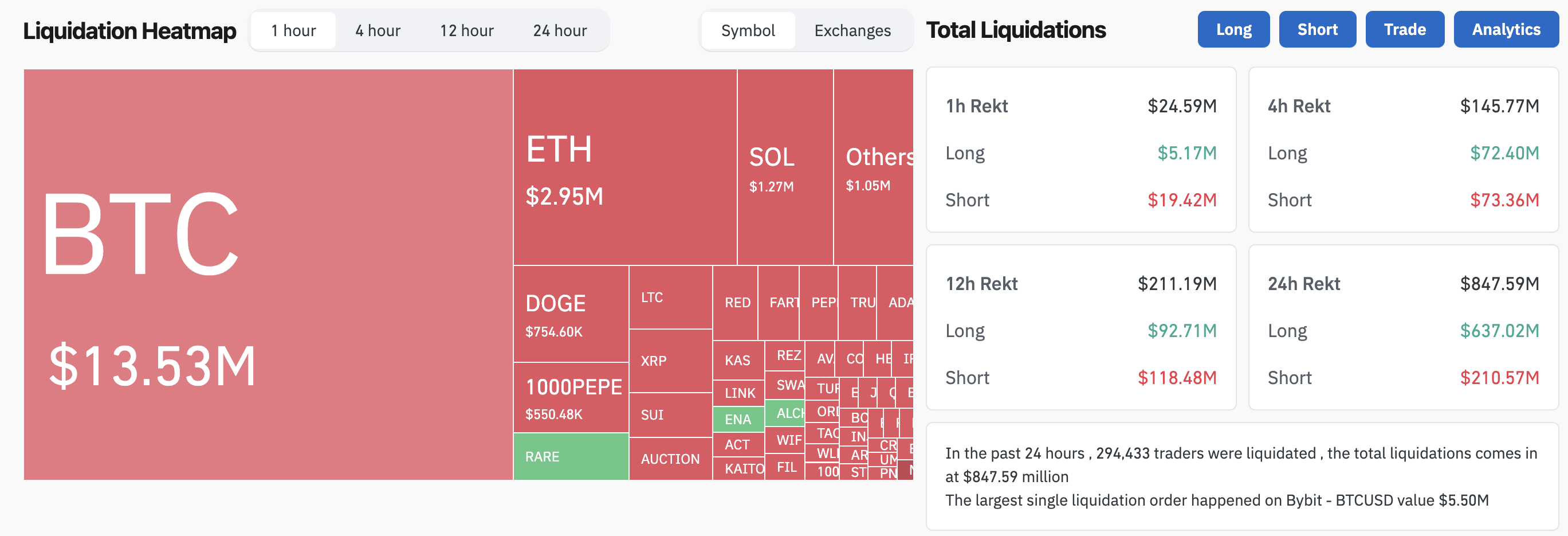

- dYdX native token DYDX surged 30%, crossing the $2 price mark.

- Surge in trading volume over 100% indicates further price rally.

One of the pioneering DeFi projects dYdX witnessed a price surge of 30% and is trading at around $2.3. The DYDX token has been on a steady growth since the beginning of November and has finally seen a sharp price hike today, after Craft Ventures venture capital firm invested in the project, among other crypto investments.

With the ongoing bull market sentiment across communities, and US President Trump’s favorable decisions to crypto, the market became quick and sensitive to any new announcements or investments from industry leaders and top officials.

DYDX Price in The Past Week (Source: CoinMarketCap )

DYDX Price in The Past Week (Source: CoinMarketCap )

The DYDX token is trading at $2.33 at the press time, with daily and weekly price rises of 30% and 45% respectively. Its market capitalization is a staggering $1.49 billion with a 26% rise and the trading volume increased by a substantial 140% in the last 24 hours.

What Triggered the DYDX Price Spike?

Earlier today, US President Trump made another big announcement regarding White House AI & Crypto Czar. Apparently, he appointed ex-PayPal COO David Sacks to guide policy administration for crypto and AI industries. Trump further stated Sacks will bring the regularity clarity, the crypto industry has been waiting for.

Craft Ventures, the venture capital firm of David O. Sacks, Trump's newly appointed White House cryptocurrency manager, has invested in cryptocurrency projects including: dYdX, Lightning Labs, River Financial, Kresus, Set Protocol, FOLD, Harbor, Handshake, Voltage, Galoy, Lumina,… https://t.co/9mtOeZza5e pic.twitter.com/7VWJCjlDpq

— Wu Blockchain (@WuBlockchain) December 6, 2024

David Sacks’ venture capital firm, Craft Ventures, invested in multiple crypto projects including dYdX, Lightning Labs, River Financial, Kresus, Lumina, among others. A couple of hours after Trump announced Sacks as AI & Crypto Czar, the news of Craft Ventures dYdX investment circulated across the crypto community.

The opportunity of serving at the top level in the US government, in the emerging technologies like AI & crypto made David popular in the industry. As a result, his venture capital firm investing in dYdX triggered a sharp price spike in its native DYDX token.

dYdX is a torch bearer in the DeFi industry, being the first-of-its-kind to offer decentralized margin trading, derivatives, flash loans, etc in the early stages of decentralized finance. Even though the project gained significant popularity and adoption, the native DYDX token followed a downtrend in line with the broader crypto market.

Now, with the return of the bull market and Craft Ventures’ investment in dYdX, combined with the positive crypto community, the DYDX token price is surging considerably. Adding to these factors, when technical indicators come in favor, the token price could reach its year-high in the current bull run.

Highlighted Crypto News Today:

Are Bears Gaining Control as Bitcoin Drops Below $100K?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Network Under Pressure: Will Pi Coin Hold or Plunge Below $1?

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty