Israel Approves Investment Funds to Track Bitcoin Prices

Israel is making significant strides in the cryptocurrency space with a new move aimed at expanding Bitcoin investment options.

The Israel Securities Authority (ISA) has granted approval for six investment funds that will track Bitcoin’s price fluctuations. These funds are set to become available to the public on December 31.

Starting on that date, banks and investment firms will offer these funds to investors, allowing them to gain exposure to Bitcoin through various indices and strategies.

Leading Israeli investment firms, such as Migdal Capital Markets, Meitav, Ayalon, Phoenix Investment, More, and IBI, will manage these funds. The funds will come with management fees ranging from 0.25% to 1.5%.

READ MORE:

Bitcoin, Memecoins, and AI Coins Set for Major Growth in 2025 Amid Regulatory ShiftsSome of the funds will track U.S.-based Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust ETF (IBIT), while others will focus on actively managed strategies that aim to outperform Bitcoin’s price movements.

This new initiative allows Israeli investors to gain access to Bitcoin via the country’s fiat currency, making it more accessible for local investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

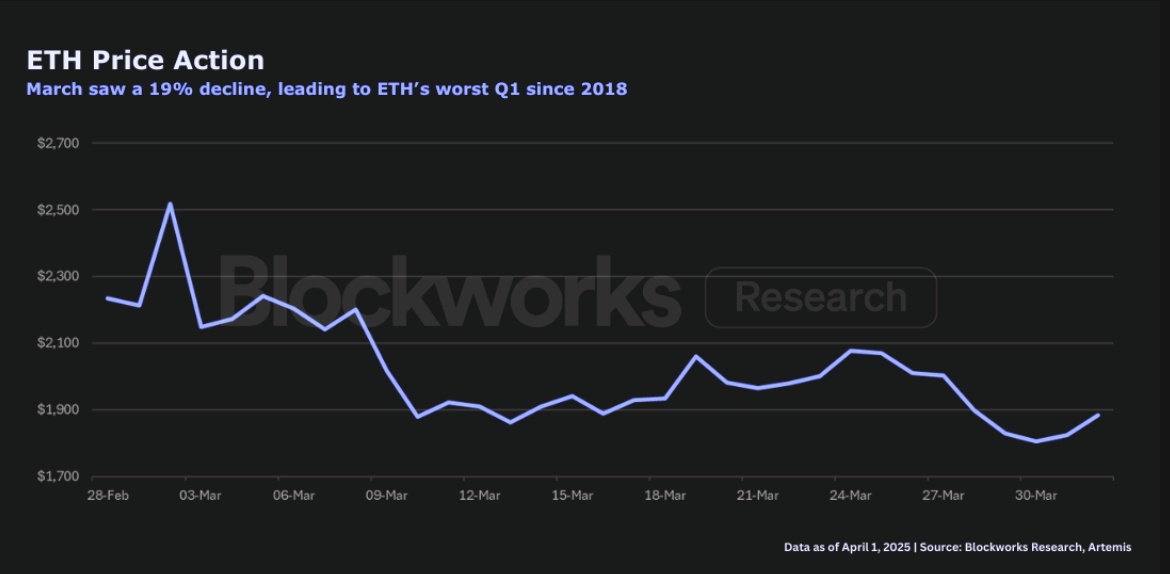

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far