2024’s Most Bullish Altcoin Group Revealed – Only One Group Made a Loss for the Year

CoinGecko shared a new list with its followers, which includes the most trending and rising altcoin groups of the year.

Cryptocurrency tracking platform CoinGecko has announced its year-end analysis revealing the most profitable trends of 2024 based on annual average price returns.

As the crypto market capped off another volatile year, artificial intelligence (AI), memecoins, and real-world assets (RWA) emerged as the top-performing sectors, with GameFi and Layer 2 solutions lagging behind.

The AI trend has dominated 2024, delivering an average return of 2,940% year to date (YoY). This surge was primarily driven by the popularity of AI tool launchpad Virtuals Protocol (VIRTUAL), which became the year’s top earner.

AI saw a particularly strong year-end rally, nearly doubling its returns from 1,598% to 2,940% in December. This year-end momentum could see AI overtake memecoins as the most profitable trend of 2024.

Memecoins have followed AI closely, with an impressive 2.185% average annualized return. This trend gained traction in March, when returns skyrocketed from 96.6% to 1,713.1% in a single month. Despite high volatility, memecoins have maintained their leading trend position for much of the year. However, after reaching a record 3,211.4% return on December 9, the sector has seen a pullback as investor interest has begun to wane.

Real world assets (RWA) came in third with an average annual return of 820%. The trend experienced steady growth early in the year, peaking at 365.3% in April before entering a period of stagnation. RWA returns rose again in November, driven by the rising price of MANTRA (OM), and rose to their year-end positions.

Layer 2: Layer 2 tokens, the only trend to lose money, saw an average decline of 21%. Seven of the top 10 Layer 2 projects reported price declines with losses ranging from 6.3% to 75.3%. The trend of projects building their own Layer 2 networks contributed to the sector’s underperformance.

*This is not investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin Shows Bullish Signs as $0.2677 Target Comes into Focus

Bitcoin traders eye ‘huge’ US jobs data as BTC price risks $95K dip

BTC price strength faces further risks as prediction markets see a giant beat on US January jobs.

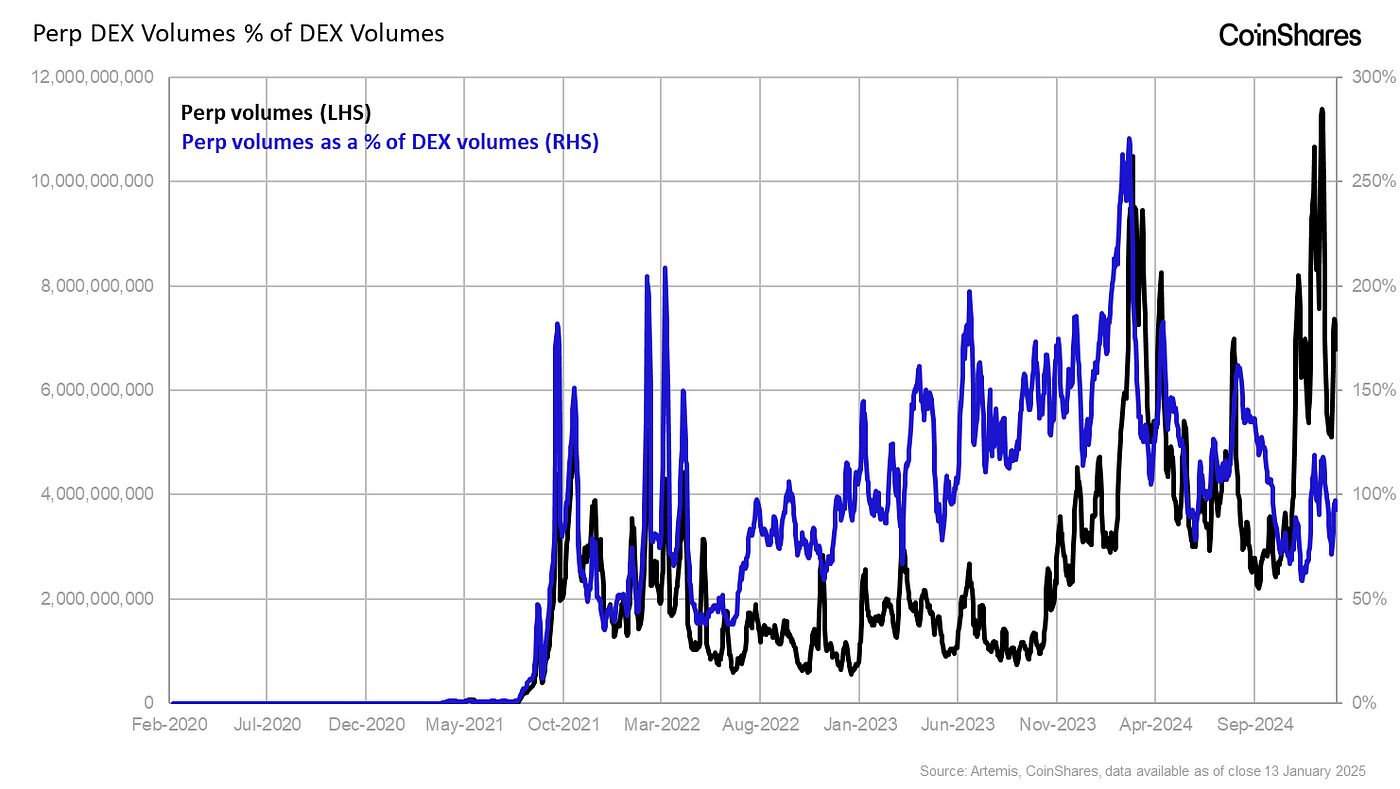

The Perpetual DEX Sector: A Great Leap Forward