Top cryptocurrencies for Q2025 XNUMX

What are the top cryptocurrencies for Q2025 2025? Grayscale Research, a renowned digital asset manager, has recently published a report with optimistic predictions for the industry, indicating the top cryptocurrencies for QXNUMX XNUMX, suggesting that they are a good investment for investors and enthusiasts who are looking for tokens to expand their portfolios and make good profits.

Grayscale analysts elaborated a list of the “Top 20” cryptocurrency investment opportunities for 2025. “The Top 20 represents a diverse set of assets across Crypto Sectors that we believe have high potential in the coming quarter. Our approach incorporates a number of factors including network growth/adoption, future catalysts, fundamental sustainability, token valuation, token supply inflation, and potential tail risks.”

Source: Grayscale

Source: Grayscale

According to the firm, this quarter, experts drew attention to cryptocurrencies that touch on at least one of the following three central market themes: the U.S. election and its potential implications for industry regulation, particularly in areas such as decentralized finance (DeFi) and staking; continued advancements in decentralized AI technologies and the use of blockchains by AI agents; and growth in the Solana ecosystem.

Based on these themes, analysts added the following six assets to the top 20 list for Q2025 XNUMX:

Hyperliquid (HYPE): Hyperliquid is a Layer 1 blockchain designed to support on-chain financial applications. Its primary application is a decentralized exchange (DEX) for perpetual futures, featuring a fully on-chain order book.

Ethena (ENA): The Ethena protocol was developed as a new stablecoin, USDe, which is primarily backed by hedged positions in Bitcoin and Ether collateral. [5] Specifically, the protocol holds long positions in Bitcoin and Ether and short positions in perpetual futures contracts on the same assets. A staked version of the token is offered from the difference between the spot and futures prices.

Virtuals Protocol (VIRTUAL): Virtuals Protocol is a platform for building AI agents on Base, an Ethereum Layer 2 network. These AI agents are designed to perform tasks autonomously, mimicking human decision-making. The platform enables the creation and co-ownership of tokenized AI agents, which can interact with their environment and other users.

Jupiter (JUP): Jupiter is the leading DEX aggregator on Solana, boasting the highest TVL of any application on the network. As retail traders increasingly enter the crypto market through Solana and speculation intensifies around memecoins and Solana-based AI agent tokens, we believe Jupiter is well-positioned to capitalize on this growing market activity.

Jito (JTO): Jito is a liquidity-taking protocol on Solana. Jito has seen substantial growth in adoption over the past year and offers one of the best financial profiles across all cryptocurrencies, generating over $550 million in fee revenue in 2024.

Grass (GRASS): Grass is a decentralized data network that rewards users for sharing their unused internet bandwidth through a Chrome extension. This bandwidth is used to scrape online data, which is then sold to AI companies and developers for training machine learning models, effectively conducting web scraping for data while compensating users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

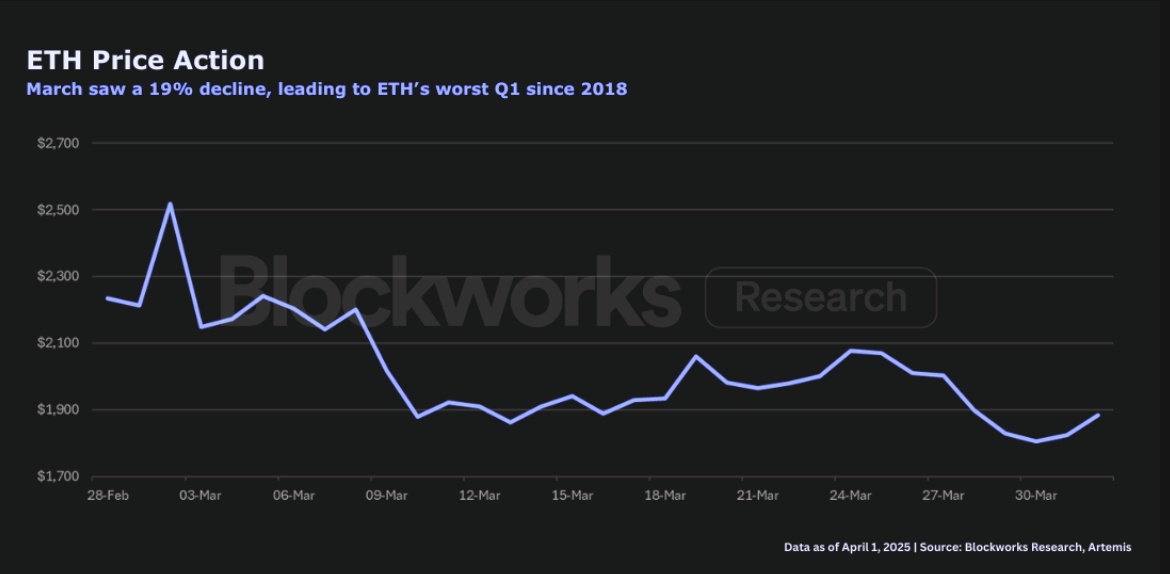

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far