Trump is already the crypto president. But what will come next?

Quick Take Trump reportedly said he would be the crypto president. But to be considered a good president, he needs to deliver on a number of key promises. Plus, there’s the question of whether Elon Musk will get more involved in the cryptocurrency space.

At a fundraiser in June, President-elect Donald Trump reportedly said he would be the crypto President.

Well, while he hasn’t been sworn in yet — give it an hour or so — he has arguably already earned the title. On Friday, Trump made an unprecedented move in launching his own speculative token, the value of which will be tied to him for the next four years. It was a bold and arguably reckless move, but it made one thing clear: he’s willing to embrace crypto and not just in rhetoric.

The big question is what Trump will do once he’s in power. Bloomberg reports that he’s preparing an executive order to deem crypto a national priority. This would help turn the U.S.'s approach toward crypto businesses and individuals.

Trump has already made one big move to show his support for the industry. He effectively booted out former SEC Chair Gary Gensler and nominated long-time crypto supporter Paul Atkins to lead the agency under his administration. This should be a sea-change from a very hostile agency to one that may engage more closely with crypto companies and try to help them understand and comply with the law rather than being evasive and difficult to work with.

Another immediate move in the cards is the potential pardoning of Ross Ulbricht, the creator of the Silk Road. While not directly related to crypto, many in the crypto community have strongly advocated for his release. Trump said he would pardon him on day one of his presidency, and this is a key promise that the community wants to see confirmed.

Clarity on the horizon

Another open question is what impact the crypto czar will have. In December, Trump said that Yammer founder and former Paypal COO David O. Sacks would be the “White House A.I. and Crypto Czar.” At the time, he said Sacks would work to develop a legal framework to provide the U.S. cryptocurrency sector with more clarity.

This is something the industry has been crying out for over the last few years. During the previous administration, it was clear that bitcoin wasn’t a security, but everything else was ambiguous, with Gensler unwilling to say whether or not ether was a security. In 2020, Ripple CEO Brad Garlinghouse complained that there wasn’t a "level playing field" for all digital assets in this regulatory climate. ”Bitcoin was the only one with the hall pass," he said.

Coinbase even had to go as far as suing the SEC for rules and guidance on crypto. If clear rules are put in place, big crypto businesses will know how to adhere to them and will ensure compliance in order to continue reaping the hefty profits available in the industry.

Establishing a bitcoin reserve

The biggest direct impact on crypto prices could come from Trump’s plan to establish a national bitcoin reserve. This is the idea that the government could start stockpiling bitcoin, in the same way governments do with other assets, such as gold. If done in size, this could have a big impact on the price of bitcoin — especially with other large buyers such as MicroStrategy continuing their purchases.

Senator Cynthia Lummis of Wyoming has proposed a draft bill, the BITCOIN Act, which would direct the U.S. Treasury to buy one million bitcoins over five years. If confirmed, this could also impact the price of bitcoin ahead of the actual purchases, as traders did when MicroStrategy started telegraphing its buys for its earlier purchases.

In the meantime, several U.S. states like Texas, Pennsylvania, and Florida have introduced bills aimed at creating state-backed bitcoin reserves. Despite these initiatives, there is opposition from figures like Steve Hanke and Bill Dudley, who argue against the economic benefits of a national bitcoin reserve.

Will Elon Musk get involved?

Tesla CEO Elon Musk has had a strange relationship with crypto over the years. He started out mentioning a few comments about it on a podcast in 2020, noting that he was skeptical of it. In 2021, he spoke about it more on what was then known as Twitter — before he bought it and renamed it. A month later, Tesla bought $1.5 billion of bitcoin.

Yet Musk always seemed to be a bigger fan of Dogecoin, shilling it on Saturday Night Live (and causing its price to crumble). He briefly added it as a payment method for buying Teslas and engaged more with its core developers. And now he is about to run a government efficiency department with the acronym DOGE.

With that in mind, it’s unclear whether he will increase his focus on crypto as he spends more time with Trump. He’s a close ally to Sachs and his familiarity with crypto and AI might mean he might be willing to help ensure regulatory clarity. On the token side of things, he certainly would have a shot at competing with Trump for market cap if he launched his own memecoin. While that seems unlikely to happen, so was the idea of a Trump coin.

Whether Trump ends up perceived as a good crypto president will probably always be up for debate. But if he frees Ulbricht, establishes a bitcoin reserve, and provides regulatory clarity, then he will certainly have a good shot at it — as long as his memecoin doesn’t blow up in his face.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

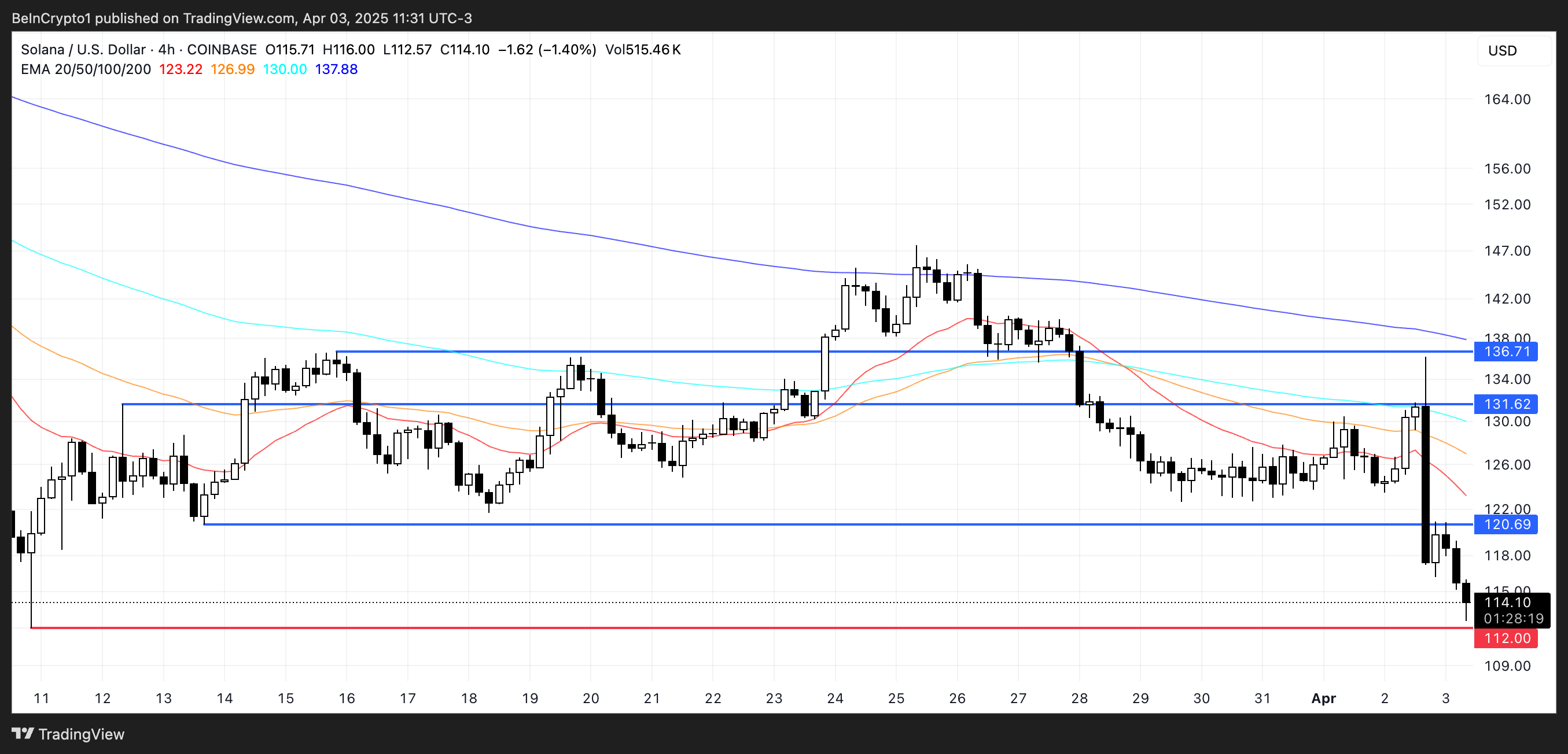

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin