Rumble Makes its First Bitcoin Purchase As a Part of its $20 Million Treasury Plan

Rumble makes its first Bitcoin purchase as part of a $20 million plan, boosting stock and aligning with a growing trend among public companies.

Rumble, Canada’s largest video-sharing platform with over 50 million users, has announced its first Bitcoin purchase as part of its financial reserve strategy.

The company invested $20 million and indicated plans to expand its Bitcoin holdings in the future. This move reflects a growing trend among public companies adopting Bitcoin as a reserve asset.

Rumble Joins a Growing List of Public Companies Buying Bitcoin

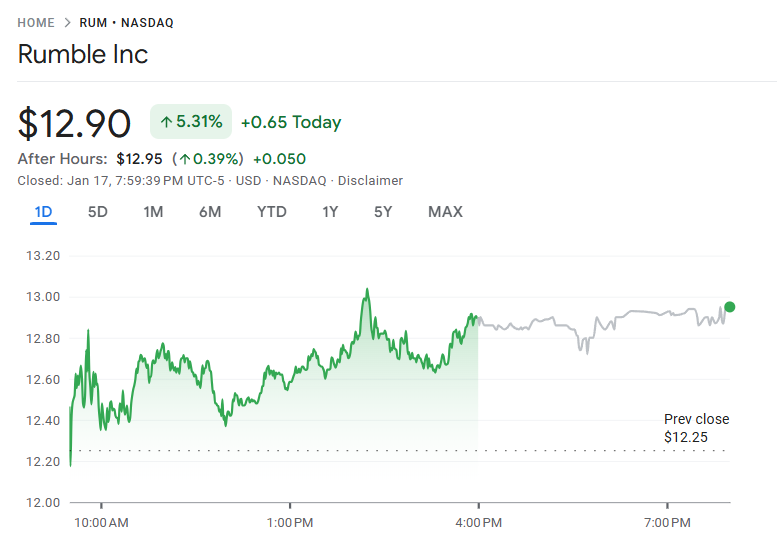

Following the announcement, Rumble’s stock surged by more than 5%. The publicly traded and valued at $3.6 billion company joins a list of other firms integrating Bitcoin into their financial strategies.

These include MicroStrategy, Semler Scientific, Marathon Digital, and Metaplanet, which have all implemented similar approaches.

Rumble Stock Price Daily Chart. Source:

Google Finance

Rumble Stock Price Daily Chart. Source:

Google Finance

Rumble initially outlined its Bitcoin strategy in November 2024. The platform’s CEO, Chris Pavlovski, reportedly discussed it with MicroStrategy’s Michael Saylor. This latest purchase marks the company’s first tangible step in that direction.

The move aligns with a broader market trend of publicly listed companies adopting Bitcoin as a reserve asset. These firms are increasingly being regarded as proxies for Bitcoin, attracting attention amid Bitcoin’s accelerating growth throughout the past year.

Rumble’s Bitcoin purchase comes shortly after a significant investment from Tether, the leading stablecoin issuer. In December, Tether committed $775 million to Rumble.

Tether has experienced substantial growth, with profits surpassing $10 billion in 2024. It also announced plans to relocate its headquarters to El Salvador because of its crypto-friendly policies.

Additionally, El Salvador’s president, Nayib Bukele, has invited Rumble to establish operations in the country, potentially aligning with its expanding Bitcoin strategy.

Meanwhile, other companies are ramping up their Bitcoin purchases. Marathon Digital (MARA) recently added $1.1 billion in Bitcoin to its reserves.

Top 10 Public Companies that Hold Bitcoin. Source:

Bitcoin Treasuries

Top 10 Public Companies that Hold Bitcoin. Source:

Bitcoin Treasuries

Overall, MicroStrategy, by far, remains the largest BTC holder among publicly listed firms. Its stock soared by over 700% last year, driven by its aggressive Bitcoin acquisitions. The firm was also added to the illusive Nasdaq-100 due to this remarkable growth.

Public companies like Rumble are now following suit, seeking to replicate similar success through strategic investments in Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Power Struggle: Buterin vs The Community Voice

Unmasking the Tug of Power: Vitalik Buterin's Lone Decision-Making Steering Ethereum Foundation Amidst Pending Leadership Reforms

Analytics Company Put Forwarded New Argument: “Whales May Be Preparing For Entry In This Altcoin”

According to cryptocurrency analytics firm CryptoQuant, whales may be preparing to enter a surprise altcoin.

Swiss Bank Managing $5.7 Trillion Launches Joint Gold Initiative with Surprise Altcoin

According to the latest information, Switzerland's largest bank has entered into a surprise gold joint venture with an altcoin. Here are the details.

Who holds Ethereum ETFs? Complete list of institutional holders in the 13F filings

The total inflow of ETH ETFs reached $2.73 billion, while Grayscale's outflows exerted downward pressure. SEC filings show that institutional investment levels in Ethereum ETFs vary.