Bitwise suggests bitcoin fair value of over $200,000 as 'portfolio insurance' against global debt crises

Quick Take Bitcoin’s fair value could exceed $200,000 if it is used as “portfolio insurance” against sovereign default risks, according to Bitwise analysts. Major economies like the UK, France and the U.S. face growing sovereign debt risks, with the UK struggling with soaring interest costs and market concerns over its borrowing needs, while the US is about to hit its $36 trillion debt cap.

As global sovereign debt risks rise, with fiscal debt-to-GDP levels reaching record highs, analysts suggest bitcoin could become an appealing hedge against potential defaults. In a report on Tuesday, Bitwise analysts proposed a theoretical value for bitcoin of around $219,000 as "portfolio insurance" against sovereign defaults.

"Sovereign default risks have been on the rise globally as fiscal debt-to-GDP levels have reached new record highs, France’s and the U.K.’s fiscal situations are becoming particularly concerning for bond investors," Bitwise analysts said.

They added that the U.S. is set to hit its $36 trillion borrowing cap, reigniting worries about the government’s ability to fulfill its fiscal obligations. This could have broader economic ramifications, potentially increasing risk in the bond markets. Historically, such moments of uncertainty have had mixed effects on bitcoin’s price , with periods of heightened concern sometimes driving increased demand for the cryptocurrency.

The Bitwise analysts further suggest that bitcoin could serve as a hedge against the default of a basket of major sovereign bonds.

"In a theoretical model, bitcoin can serve as 'portfolio insurance' against the default of a basket of major sovereign bonds with a current 'fair value' of around $219,000 based on this model," Bitwise analysts said. They also noted that if sovereign bonds from G20 nations—valued at $69.1 trillion—were to face a weighted default probability of 6.2%, bitcoin’s theoretical "fair value" could rise above the $200,000 mark.

Bitcoin volatility still a concern

However, the Bitwise analysts outlined that the volatility of bitcoin, including its susceptibility to sharp price declines during times of uncertainty, poses a risk for investors looking for stability in times of crisis. However, bitcoin’s decentralized nature means it operates independently of any government or financial institution, making it an appealing option for those concerned about hyperinflation or currency devaluation risks. As the Bitwise analysts noted, bitcoin's "decentralised counterparty risk-free characteristics and its increasing scarcity" are part of its appeal as a hedge, but these qualities don't eliminate its volatility.

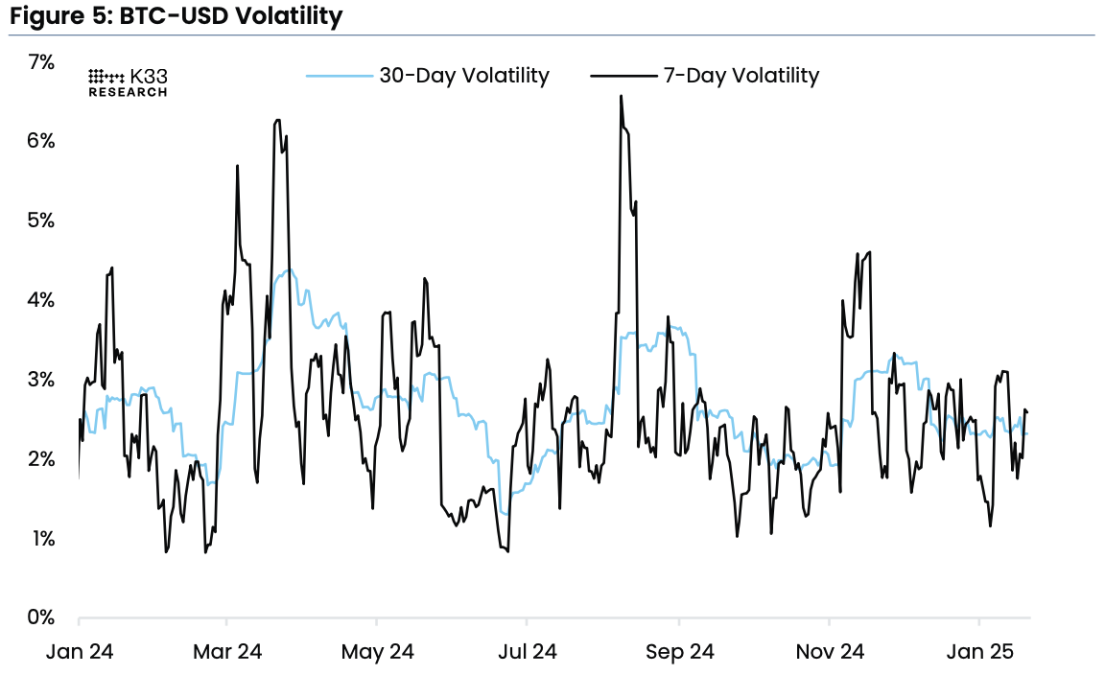

K33 Head of Research Vetle Lunde remarked that bitcoin's volatility remains significant, highlighting that despite strong momentum, bitcoin's seven-day volatility has risen to 2.5%.

"With that said, this week also hides significant volatility within our method of examining daily returns, as Jan. 20 saw a daily high-low variation of 10%," Lunde said. "In contrast, the day ended with a narrow 0.92% return, once again hiding the real volatility faced in the market amidst the inauguration day."

BTC-USD volatility increased amid Donald Trump's presidential inauguration. Image: K33 Research.

Major economies face heightened risks of sovereign debt crises due to several converging factors. Speaking to the Financial Times , Bridgewater Associates founder Ray Dalio warned of a potential "debt death spiral" for the U.K. as the nation grapples with increasing borrowing needs and rising interest costs. The recent sell-off in the gilt market and the weakening of the pound sterling indicate market concerns over the U.K.'s ability to meet its higher borrowing requirements. Annual interest payments have surpassed £100 billion, raising fears of a cycle where additional borrowing is necessary to service existing debt.

Similarly, in the U.S., the debt burden has reached significant levels, with the country approaching its $36 trillion borrowing cap. Fitch Head of Sovereign Ratings James Longsdon expressed concerns over the potential impacts of fiscal policies under Trump's administration on the U.S. credit rating. "We'll look to see what comes out and what the reaction to tariffs is," Longsdon told Reuters. Fitch downgraded the U.S. to AA+ in August 2023, citing apprehensions about aggressive tax policies and potential trade wars exacerbating the government's debt struggles.

Bitcoin's price decreased by over 3.4% over the past 24 hours, trading around $103,500 as of press time, according to The Block's Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US equities slide as trade war escalates, Powell signals no rate cut

Tariff and interest rate concerns overshadowed a positive March jobs report

Sei Investments increases 39% stake in MicroStrategy

Fidelity Spot Solana ETF Gains Traction As SEC Acknowledges Filing

Paul Atkins Moves Closer to SEC Chair Role After Senate Committee Approval