Ethereum Struggles Amid Leadership Disputes and DApp Market Shifts as Solana Gains Ground

-

Ether (ETH) is facing significant challenges as its price momentum falters amid ongoing leadership disputes at the Ethereum Foundation and rising competition from Solana’s expanding DApp market.

-

Recent analysis reveals that Ethereum’s on-chain activity has dropped sharply, raising concerns about its competitive position against other blockchains, particularly Solana.

-

According to DappRadar, on-chain activity on Ethereum has decreased by 38%, highlighting a steep decline in user engagement compared to other networks.

ETH struggles to maintain momentum as its price falters and on-chain activity declines alongside leadership turmoil at the Ethereum Foundation.

Ethereum’s On-Chain Activity Plummets, Lagging Behind Competitors

Ethereum has experienced a notable decline in on-chain activity, with 7-day volumes falling a staggering 38% to just $36.5 billion, according to data from DappRadar. This sharp decrease raises concerns about the network’s future viability as it trails behind its rivals.

In stark contrast, the BNB Chain observed a remarkable increase in activity, surging by 112%, while Solana’s active ecosystem grew by 36% during the same period. Notably, among Ethereum’s prominent decentralized applications (DApps), Balancer and Morpho witnessed a decline of 65%, followed by Uniswap with a 40% reduction in volumes.

Another alarming trend is Ethereum’s slip from the ranks of the top five blockchains by weekly fees. Between January 14 and January 21, Ethereum garnered a mere $46 million in fees, while Solana outperformed with $71 million, driven further by significant contributions from platforms like Raydium, Jito, and Meteora, totaling an impressive $309 million in that week, as reported by DefiLlama.

Transaction Fee Pressure and Layer-2 Scaling Solutions

Critics of Ethereum’s current strategy point to its mechanisms that favor layer-2 scaling solutions, particularly those utilizing blob space and low-cost state bridging methods. As transaction fees on Ethereum’s main layer hover around $5.50, many DApp developers find this cost prohibitive for ongoing projects.

Discussions within the community focus on a critical balance between keeping transaction costs low and ensuring adequate rewards for ETH staking. Proposed adjustments include potentially increasing fees or modifying the inflation rate, which has sparked further debate. Leading layer-2 solutions—Base, Arbitrum, Polygon, and Optimism—currently together account for a substantial $25.8 billion in weekly decentralized exchange (DEX) volumes.

Surge in Solana’s Activity Amid Ethereum’s Struggles

To illustrate the competitive landscape, Solana has emerged as the frontrunner in total on-chain transaction volume, having recorded an impressive $118.6 billion over a 7-day span, as sourced from DefiLlama. This growth is largely attributed to the recent introduction of the Official Trump (TRUMP) memecoin on January 18, which significantly boosted trading activity on platforms like Raydium, Orca, and Meteora, registering volume increases upwards of 200%.

Despite these challenges, Ethereum retains a leading position in total value locked (TVL), maintaining approximately $66 billion week-over-week. Moreover, its layer-2 solutions also saw growth, with total deposits across Base, Arbitrum, Polygon, and Optimism rising to $8.2 billion. Nonetheless, Solana’s TVL has shot up 29% over the past week, reaching a record high of $11.2 billion, creating uncertainty for existing Ethereum investors.

Internal Disputes at the Ethereum Foundation Raise Investor Concerns

Adding to the burden on Ether holders are internal disputes within the Ethereum Foundation (EF). In May 2024, EF enacted a conflict-of-interest policy following allegations regarding paid advisory roles some researchers took at EigenLayer. As of January 21, Ethereum co-founder Vitalik Buterin has claimed decisive authority over EF leadership amidst growing criticism, announcing that leadership responsibilities would remain his until structural reforms yield a “proper board.”

This announcement followed substantial backlash against EF’s executive director, Aya Miyaguchi, who has faced accusations of mismanagement during her tenure since 2018. The culmination of these controversies, alongside diminishing staking incentives for ETH, has significantly hindered Ethereum’s market momentum, while Solana leverages the ongoing memecoin trend, further challenging Ethereum’s historical dominance.

Conclusion

In summary, Ethereum is currently grappling with a multi-faceted set of challenges, including declining on-chain activity, internal leadership disputes, and intensified competition from Solana. Although it remains a dominant player in total value locked, the pressure from rising alternatives poses significant questions about its capacity to reclaim momentum in the competitive crypto landscape. Investors are urged to remain cautious as the market adapts and evolves in response to these trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

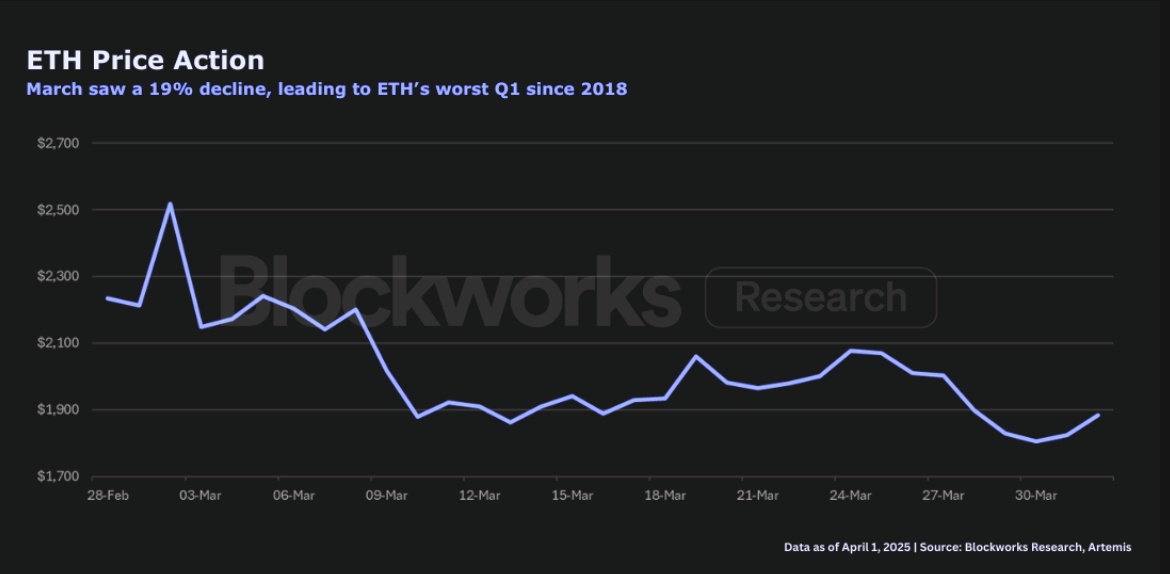

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far