Solana Price Prediction: SOL Pumps 7% As Daily Transaction Fees Hit Record-Breaking $33M And This Layer-2 Scaling Solution Surges Past $13.3M

The Solana price pumped 7% in the last 24 hours to trade at $254.24 as of 3.35 a.m. EST on trading volume that dropped 44% to $8.83 billion.

The SOL price surge in the last day is only the latest attempt to breach several strong resistances. SOL is up 35% compared to last week, but over the last weekend, its price skyrocketed much higher, reaching the value of $293.39, only to then correct to $234 on Monday.

Since then, its price made two new attempts to return to the resistance at $275, including one on Monday, when it managed to pull it off, and another one in the last 24 hours. SOL is currently battling a resistance at $250.

Solana also recently saw a new all-time high in terms of daily transaction fees, which hit a record-breaking $33 million. This likely comes as a consequence of increased activity in the project’s ecosystem surrounding new meme coins, specifically TRUMP and MELANIA, both of which launched on Solana’s network.

Solana Price Prediction

The Solana price has seen countless smaller fluctuations in the last 24 hours, which is quite clearly visible on its chart. The coin saw a major widening of its Bollinger Bands yesterday afternoon, after its price surged to $260 in an attempt to breach the resistance and return closer to $300.

However, the price got rejected, marking the end of its growth and sending it back to the lower band. The price managed to bounce back relatively soon after that, however, and while it did return to the upper band and the following fluctuations kept SOL between the upper band and the middle line between the two bands, Solana’s Bollinger Bands remained narrow.

This suggests that the traders remained uncertain regarding the price and its movement, as many likely expected a correction to start at any time, given the surge seen on the previous day.

Something similar can be seen from the project’s Relative Strength Index (RSI). After delving deep into the overbought zone and nearly climbing to 80 yesterday at the time of the price surge, the SOL RSI has dropped to the neutral zone at 50.

From there, it saw several fluctuations between 50 and 63, but traders never pushed it to the overbought zone again, suggesting that they were not optimistic about the token’s short-term performance, and they expected the price to correct.

Right now, SOL is seemingly seeing the start of that correction, and the RSI has dropped below 50, albeit only slightly for the time being. However, while this might be the start of a correction, it is worth noting that the situation could turn around at any time, and SOL could yet bounce back. However a new rally would likely be tied to Bitcoin, which is currently slowly slipping back toward $100k.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

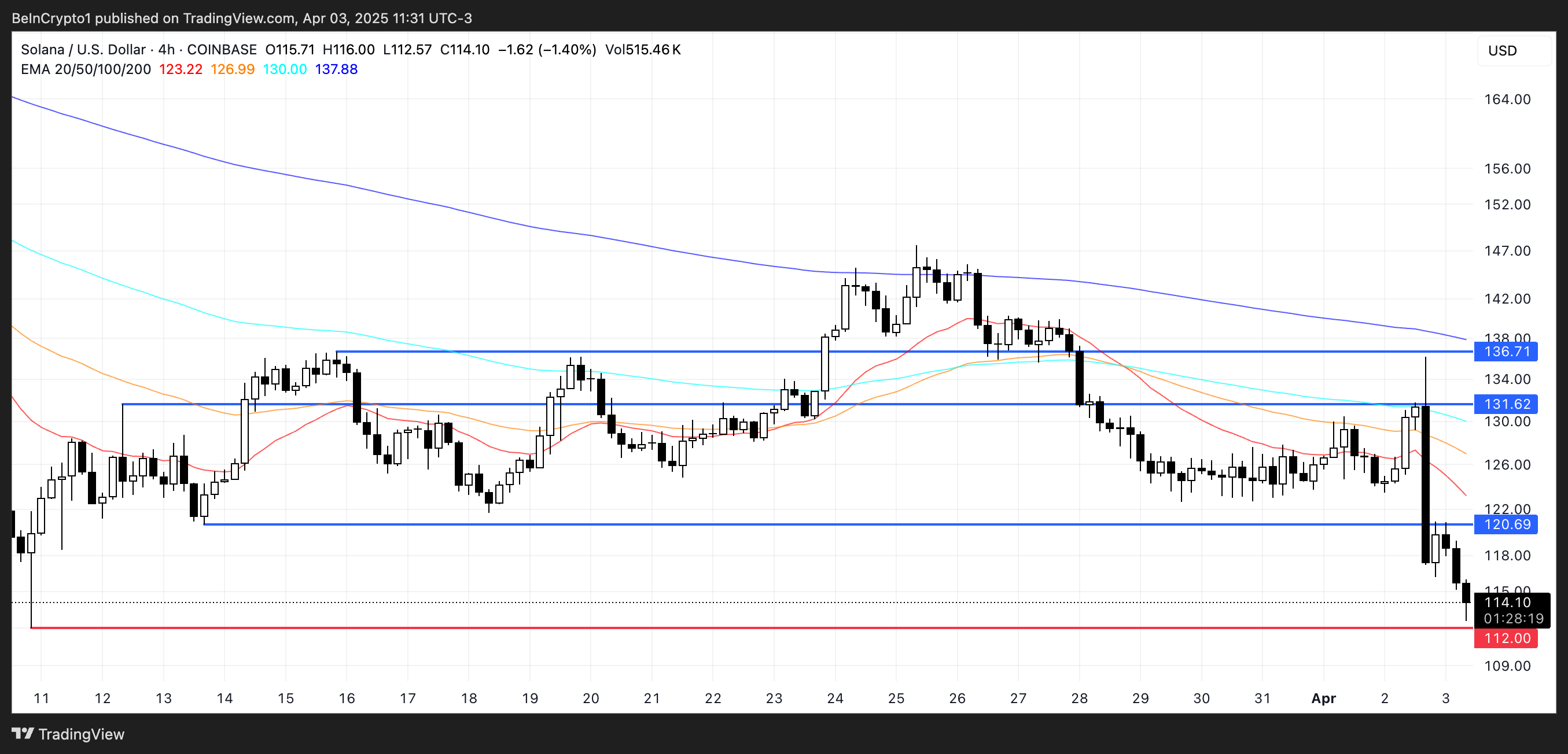

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

XRP’s Retail Interest Surges Amidst Caution Over Potential Volatility Compared to Bitcoin