Tether doubles profit to $13bn and bests Wall Street giants

The crypto company has turned into a booming investment fund.

Tether may be known as the world’s top stablecoin issuer. Yet it is also emerging as a formidable investment fund.

In 2024, the company recorded $13 billion in profit stemming from its holdings of Bitcoin, gold, US Treasury bonds, and other financial instruments, according to an “attestation” released Friday by BDO, an Italian accounting firm.

The performance was more than double the $6.2 billion it notched in 2023.

Tether’s equity — the assets it manages minus its liabilities — surged 185%, to $20 billion.

The gaudy figures are bound to capture the attention of Wall Street chieftains.

Lutnick testifies

On Thursday, Blackstone, the private equity goliath led by billionaire Stephen Schwarzman, reported $5.4 billion in net income, less than half Tether’s haul.

Tether had already made a splash this week on Capitol Hill when Howard Lutnick, President Trump’s pick to be US Commerce secretary, testified in his confirmation hearing.

Senators quizzed Lutnick on his ties to Tether. Lutnick is the CEO of Cantor Fitzgerald, a New York financial services firm that is one of 24 primary dealers authorised to trade US Treasury bonds directly with the Federal Reserve.

In that capacity, Cantor has helped Tether buy and manage billions of dollars in Treasuries in the reserves that back up USDT, the dollar-pegged stablecoin. And Lutnick hasn’t been shy about singing Tether’s praise in media appearances.

Bad actors

The problem is that USDT has become popular with all manner of bad actors. Last January, the United Nations Office on Drugs and Crime said USDT plays a core role in laundering billions of dollars for organised crime syndicates in Southeast Asia.

While Tether CEO Paolo Ardoino has vowed to work with law enforcement agencies to curb the use of USDT in illicit finance, questions continue to dog the firm.

One solution would be getting one of the Big Four accounting firms — Deloitte, EY, KPMG, and PwC — to sign on as Tether’s auditor.

Ardoino told DL News last year that he would love to make this happen but they remain wary of crypto.

“None of the Big Four companies will audit us,” Ardoino told DL News.

In the meantime, the company will keep releasing its quarterly attestations.

Least risky

For 2024, Tether said it holds $113 billion US Treasuries as part of its programme to rest USDT on one of the least risky and most stable assets in fixed income.

The company also said it issued $23 billion in USDT in the fourth quarter, taking its total issuance for the year to $45 billion.

Circle’s USDC, the second most valuable stablecoin, has a market value of $53 billion.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

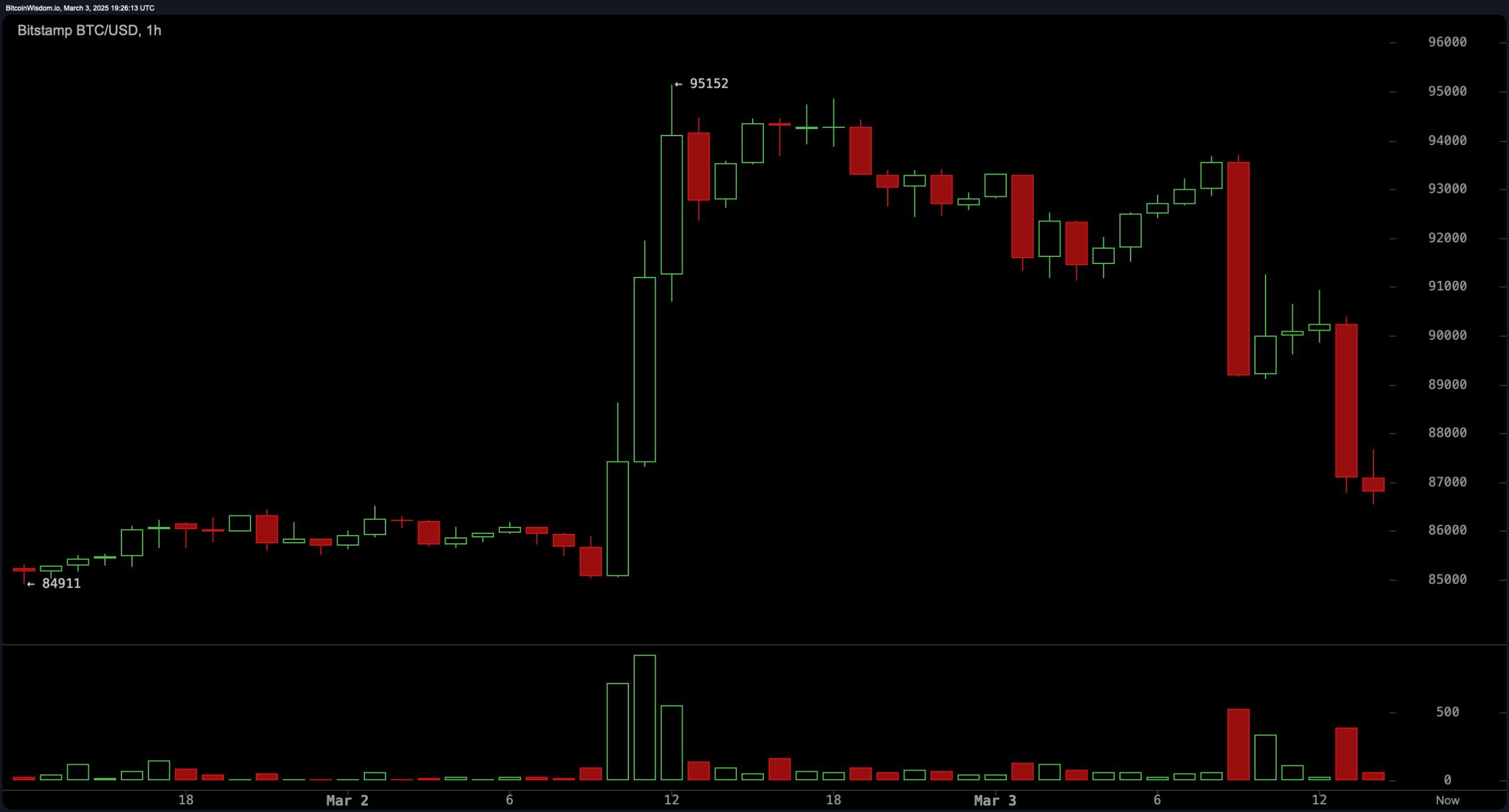

BTC in Freefall: Trump’s ‘External Agricultural Product’ War Wipes 7% Off Crypto Markets

Litecoin, SOL and XRP Price Drop Ahead of Trump “Big Announcement”

Trump’s latest post teased, “TOMORROW NIGHT WILL BE BIG. I WILL TELL IT LIKE IT IS!”

Breaking the Trendline: Bitcoin’s Route to $109K

Bitcoin Price Prediction: BTC Price to Surpass $100K BEFORE or AFTER the Crypto Summit?