- South Korea to lift its ban on institutional crypto trading from 2025

- Phased rollout to allow non-profits, universities, and listed companies to trade crypto

- South Korea looking to support blockchain businesses with clearer regulations

South Korea is set to lift its ban on institutional crypto trading . Through 2025, a number of institutions, such as non-profits, universities, law enforcement agencies, and listed companies, will gain permission to trade crypto assets like Bitcoin and Ethereum.

This move follows years of strict rules aimed at controlling speculation and managing money laundering risks in the crypto market

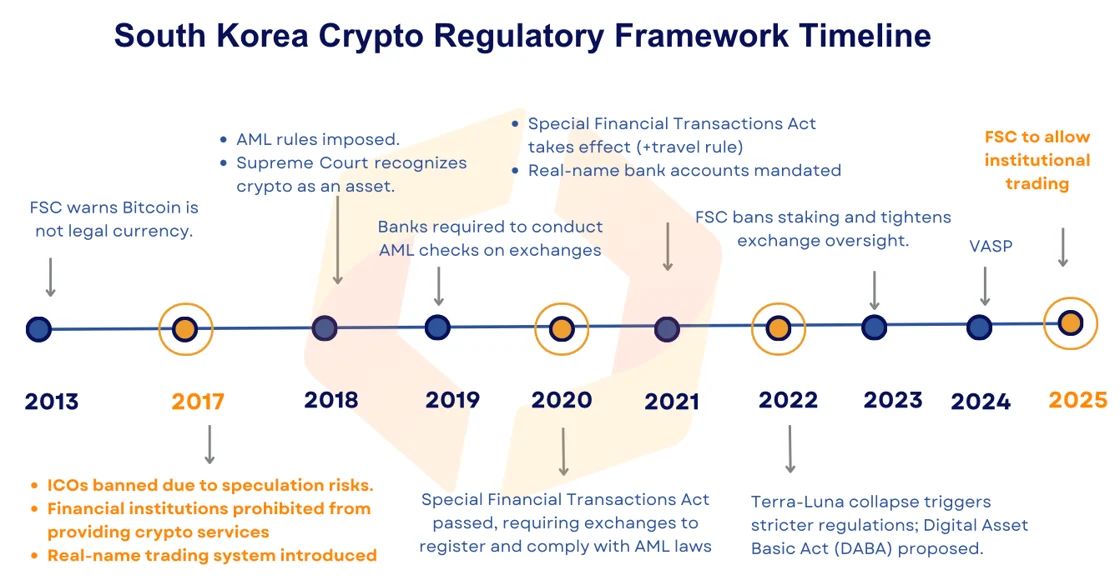

South Korea’s government has long had strict regulations on crypto trading. In 2017, the Financial Services Commission (FSC) banned Initial Coin Offerings (ICOs) due to concerns over speculative investments.

This was followed by a ban on financial institutions offering crypto services and the start of a real-name trading system to ensure transaction accountability. By 2018, Anti-Money Laundering (AML) regulations were put in place, setting the stage for more detailed oversight of crypto activities.

Source: Kaiko

Source: Kaiko

AML Checks and the Digital Asset Basic Act

In 2019, banks had to perform AML checks on crypto exchanges. The year after, the Special Financial Transactions Act was passed, requiring that exchanges comply with AML standards and use a real-name bank account system.

Related: South Korea Accelerates Crypto Regulations as U.S. Policies Shift

In 2021, staking was banned, and the FSC increased its monitoring of exchanges. The collapse of the Terra-Luna project in 2022 further tightened regulation, leading to the development of the Digital Asset Basic Act (DABA) in 2023.

Two-Phase Plan to Ease Crypto Ban

On February 13, 2025, the South Korean Financial Services Commission announced it would allow certain institutional entities to trade crypto as part of a two-phase rollout. These entities will be allowed to use virtual asset exchanges for transactions involving approved crypto assets like Bitcoin and Ethereum.

The second phase, expected to start in the latter half of 2025, will include roughly 3,500 listed companies. These companies and professional investors registered under South Korea’s Capital Market Act will have the ability to buy and sell digital assets.

Global Trend Drives South Korea’s Crypto Policy Shift

The decision to lift the institutional crypto trading ban is happening as other countries move towards integrating corporations into the digital asset market.

Related: South Korea Crypto Regulation: New Bill Targets Money Laundering

The South Korean government mentioned this global trend in its press release, pointing out that demand for blockchain-related businesses is growing both locally and internationally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.