State of io.net Q4 2024

From messari by Troy Harris

Key Insights

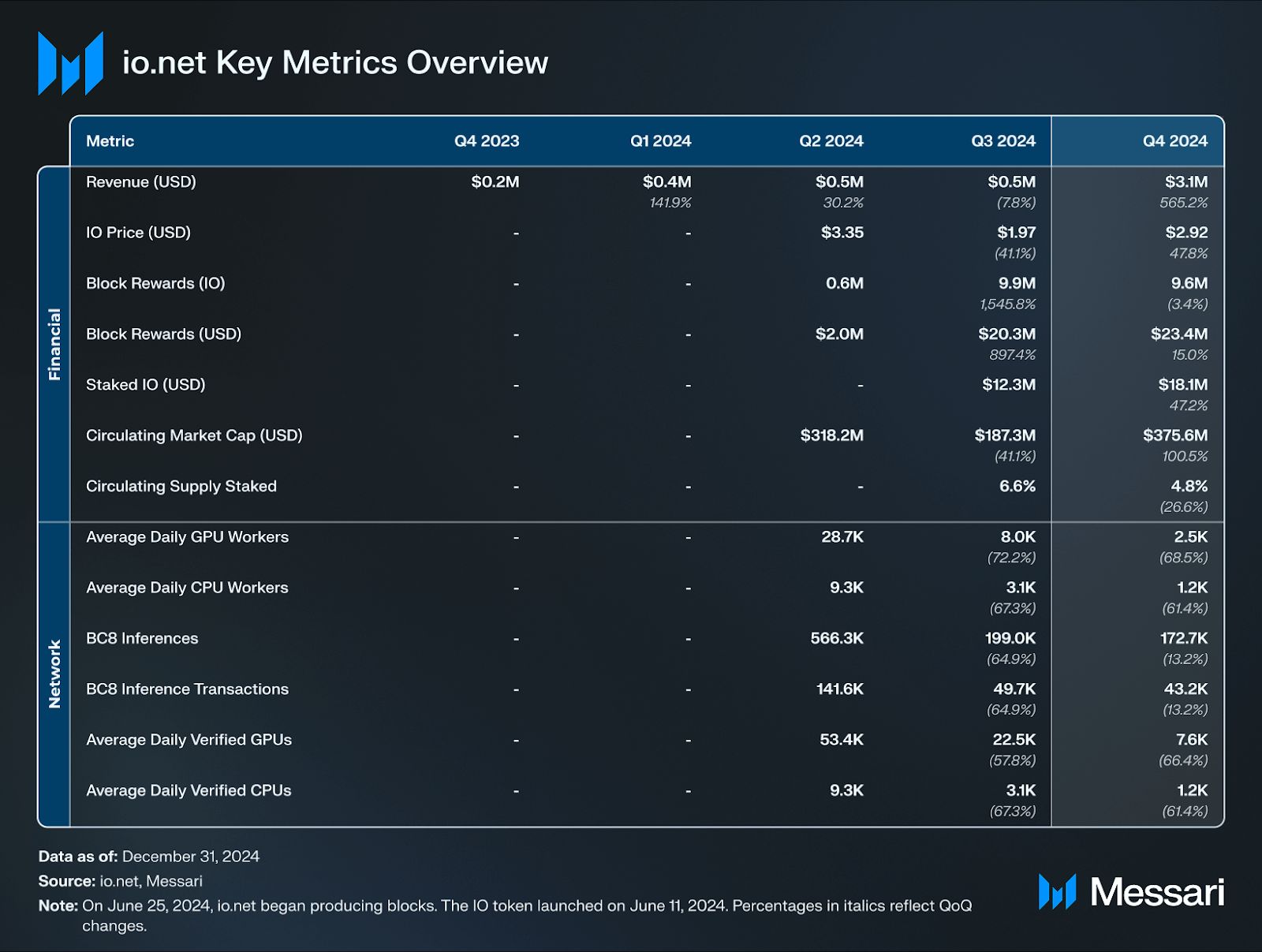

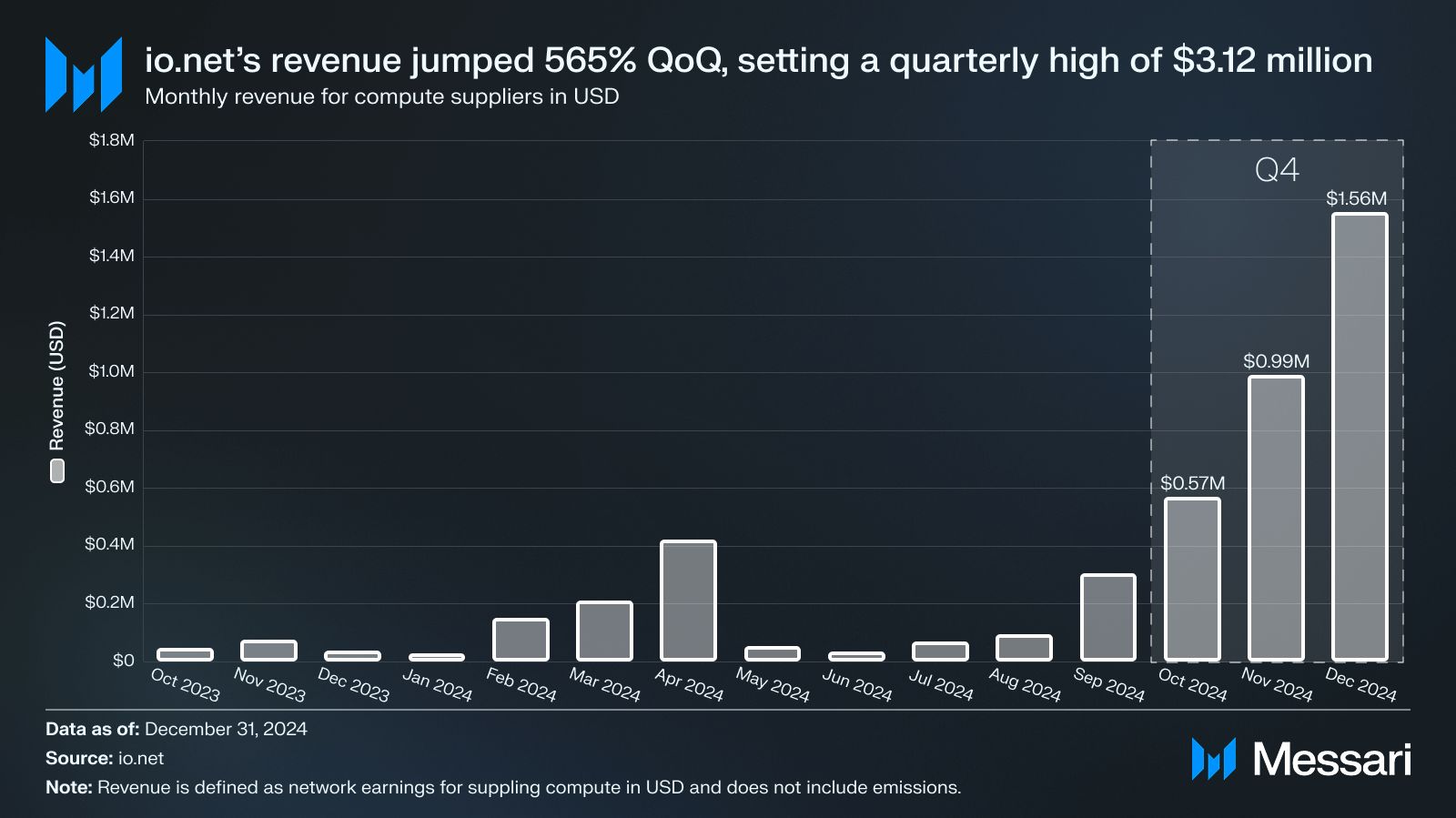

- Revenue for compute suppliers jumped 565% QoQ, with an all-time high of $3.1 million in Q4 and an annualized revenue rate of $12.5 million per year.

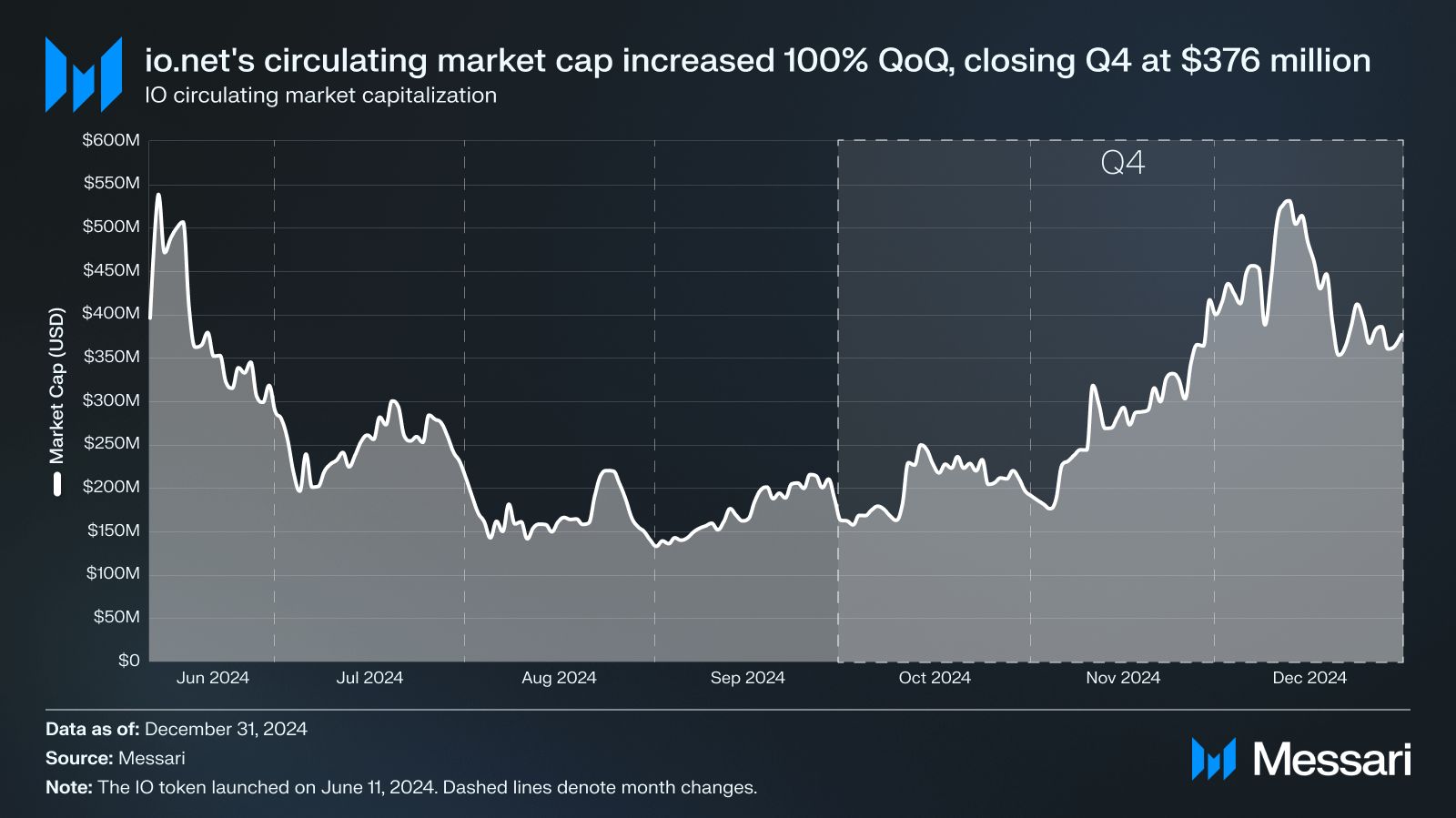

- IO’s market capitalization rose 100% QoQ, from $187.3 million in Q3 to $375.6 million in Q4.

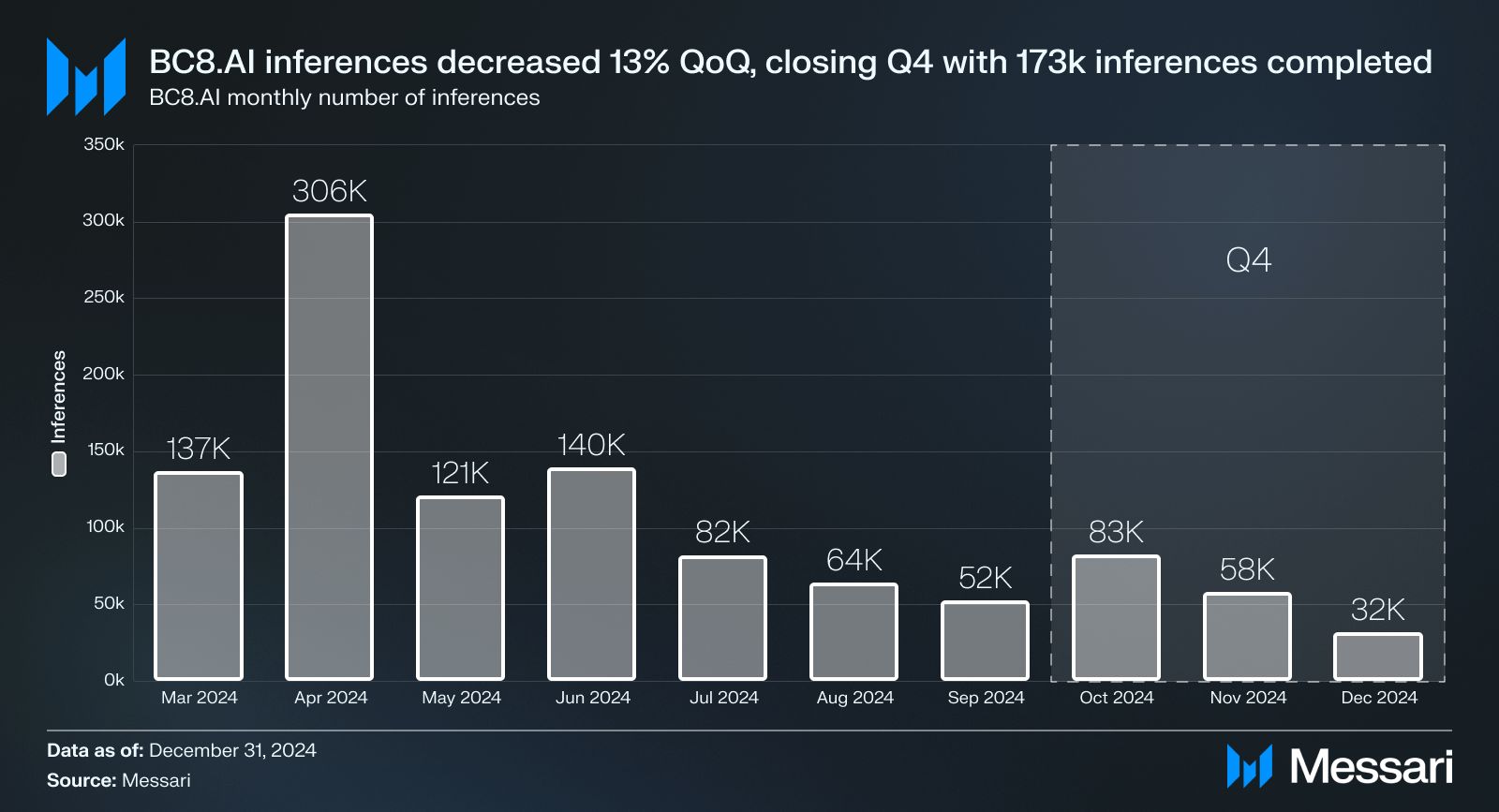

- Inferences via BC8.AI on io.net have decreased 13% QoQ, closing Q4 with 172.7k inferences and 43.2k inference transactions complete.

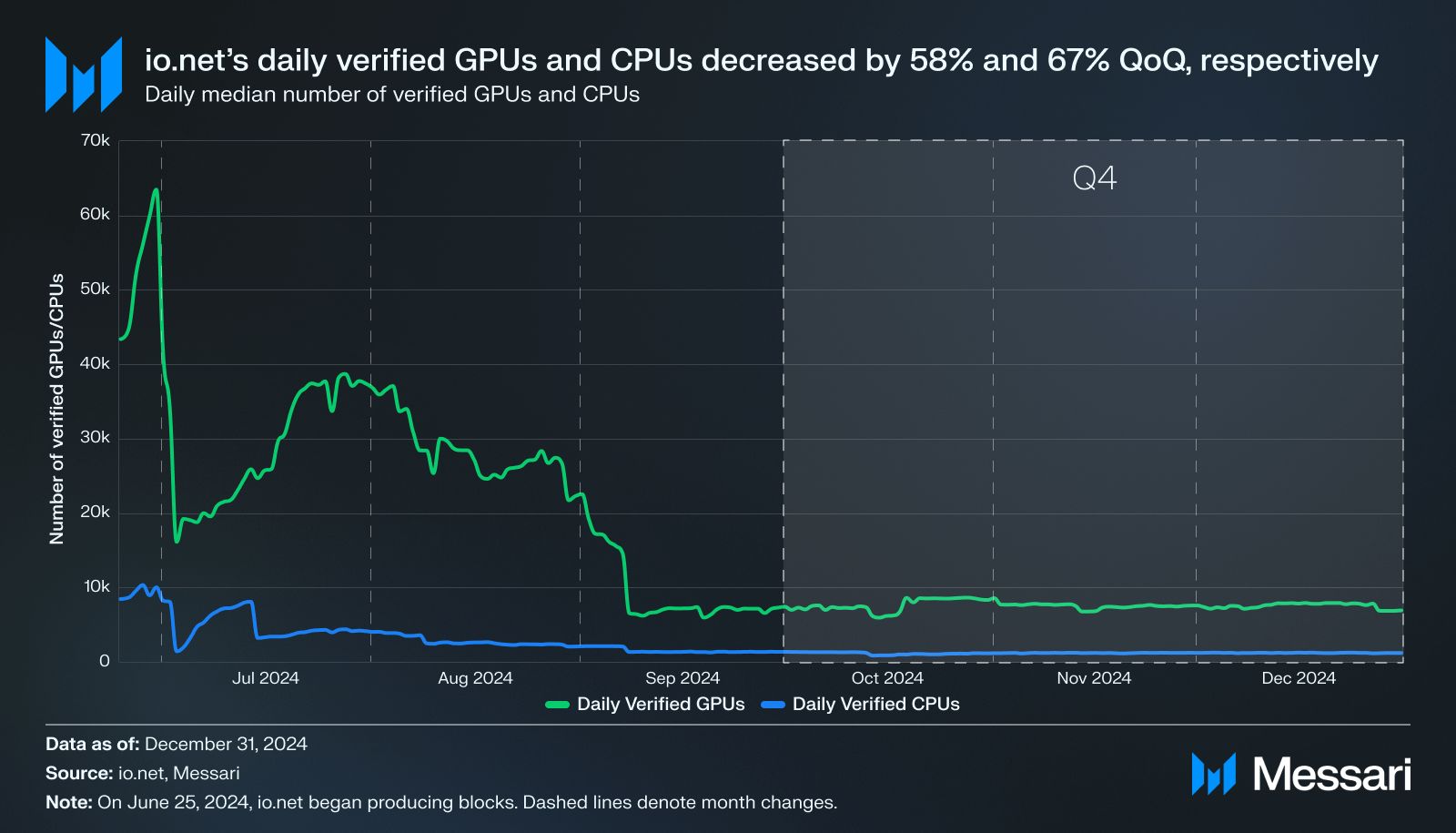

- The daily median number of verified GPUs and CPUs decreased 58% and 67% QoQ, respectively. Throughout Q4, io.net averaged 7600 verified GPUs and 1200 CPUs per day.

- 13 new partnerships were announced that will be leveraging io.net to power a variety of platforms ranging from AI agents to identity management solutions.

Primer

io.net ( IO ) is a decentralized network of graphics processing units ( GPU ) and central processing units ( CPU ) designed to provide accessible, scalable, and efficient access to compute resources. io.net ’s decentralized physical infrastructure network ( DePIN ) provides increased flexibility and control of compute resources to suppliers and buyers. The main focus of io.net is to provide GPU resources for machine learning ( ML ) and artificial intelligence ( AI ) applications at scale. Built natively on top of Ray , an open-source unified framework for scaling AI and Python applications, io.net supports a wide array of machine learning frameworks—including TensorFlow , PyTorch , and others—facilitating everything from distributed training and hyperparameter tuning to model serving.

Its system intelligently matches and groups resources based on connectivity, geolocation, and hardware specifications to minimize latency. It enforces a one-hour minimum rental period for GPU clusters while allowing rentals of an unlimited duration. io.net sources GPUs from underutilized avenues outside traditional cloud services, such as independent data centers, crypto miners, networks like Filecoin and Render , and consumer GPUs, which account for 90% of the total GPU supply but are often idle. io.net is SOC2 certified and maintains robust security without compromising latency, io.net uses a kernel-level VPN with secure mesh protocols. Its IO agent detects and blocks unauthorized containers, encrypts data within the Docker file system, and prioritizes suppliers with SOC2 compliance.

Key Metrics

Financial Analysis

In the context of io.net, revenue is the amount of money compute buyers pay to GPU and CPU providers. Compute buyers can rent compute for as long as they desire, but they must rent for at least one hour. Currently, io.net allows buyers to pay with IO, USDC, or card via a third party. In the future, there will be a 2% facilitation fee when paying in USDC; however, this fee is currently being waived, and the total cost to reserve compute goes to the suppliers. In Q4, io.net’s revenue increased by 565%, rising from $0.5 million to $3.1 million. This growth was driven by three consecutive months of all-time highs in monthly revenue, which also led to an all-time high in quarterly revenue.

The IO token was launched on June 11, 2024, via Binance’s Launchpool . IO launched with an initial circulating supply of 95 million IO and a total token supply of 500 million. The IO token has a 20-year emissions schedule that reduces on a monthly cadence and creates a fixed maximum supply of IO at 800 million. IO’s market capitalization rose 100% QoQ, from $187.3 million in Q3 to $375.6 million in Q4. Consequently, IO rose relative to its peers by moving from the 192 largest cryptocurrency by circulating market capitalization to 188 . The large move in the circulating market capitalization of IO can be attributed to the 48% increase in the price of the IO token QoQ and the 36% increase in the circulating supply of IO QoQ.

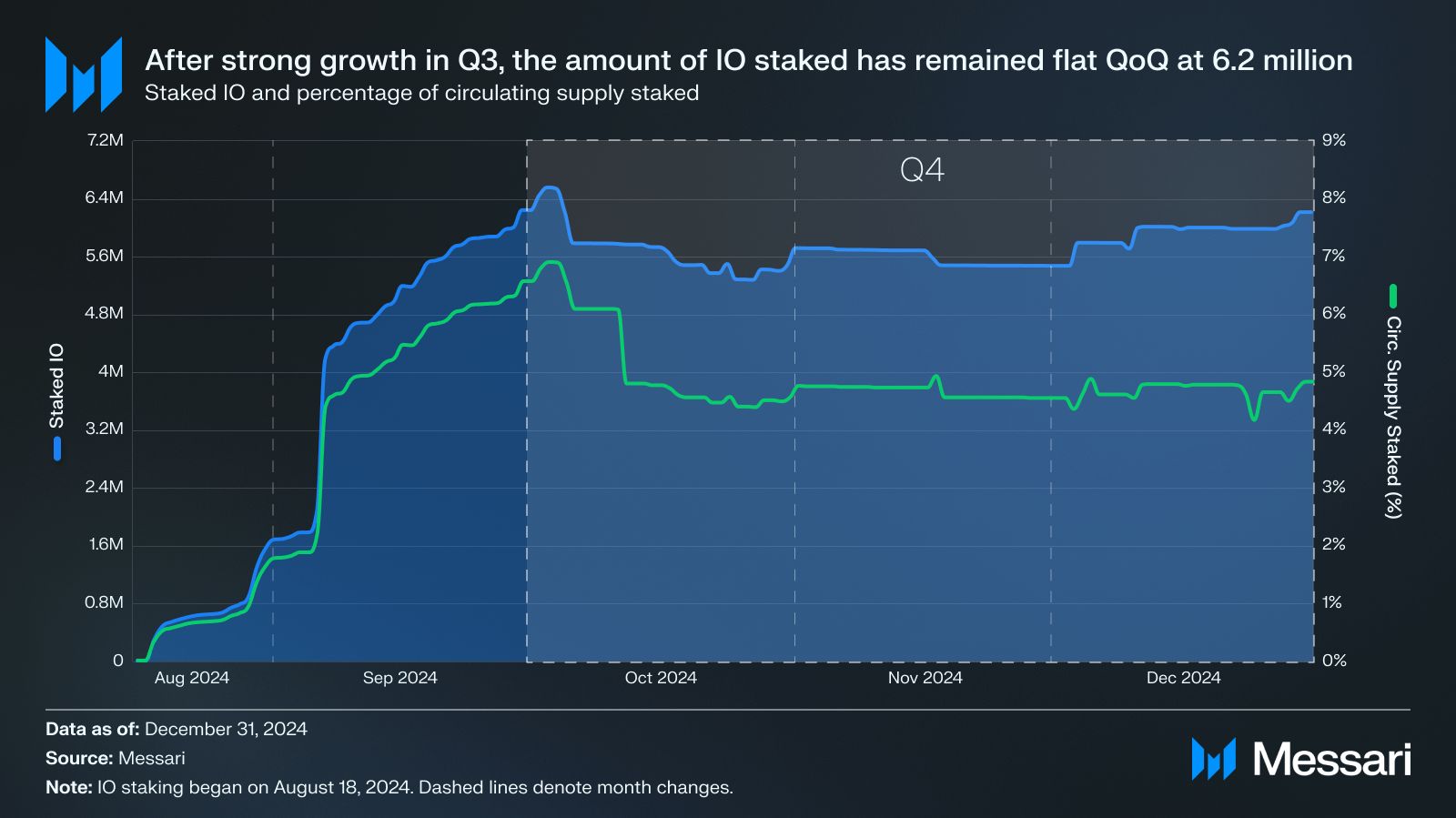

Staked IO remained relatively constant QoQ, only decreasing by 0.5%, with 6.2 million IO staked at the end of Q4. Staking began in the middle of Q3 and is a crucial aspect of network security and efficiency for io.net. By mandating that GPU and CPU suppliers stake IO tokens, the network cultivates long-term commitment, promotes proper behavior, and discourages malicious actions. The staking requirement is determined by each supplier's capacity and contribution, with a base stake of 200 IO per card that is adjusted by an earning multiplier; this multiplier guarantees that the per GPU stake is at least 200 IO. If a device has multiple GPUs, the total stake is calculated as the number of GPUs multiplied by the higher value between 1 and the earning multiplier, then multiplied by the base stake. For example, a device with eight GPUs at an earning multiplier of 10 necessitates a stake of 16,000 IO, whereas a device with four GPUs at an earning multiplier of 0.25 requires 800 IO.

Each device’s staked tokens are secured in a dedicated smart contract, and block rewards are assigned per device and distributed to the supplier’s Solana wallet through periodic claims. When a supplier chooses to unstake, a 14-day cooldown period is initiated, during which the tokens do not count toward block reward eligibility. After this period, the tokens must be withdrawn before they can be restaked on the same device.

Additionally, a slashing mechanism is in place to reduce staked tokens and accrued rewards if a supplier engages in malicious activities or if the device fails to perform adequately. Slashed tokens are subject to a one-month reconsideration process, during which the supplier may appeal the decision; if the appeal is unsuccessful or not pursued, the slashed tokens are burned.

Copilot Insights

Tell me more about slashing.

Go Deeper

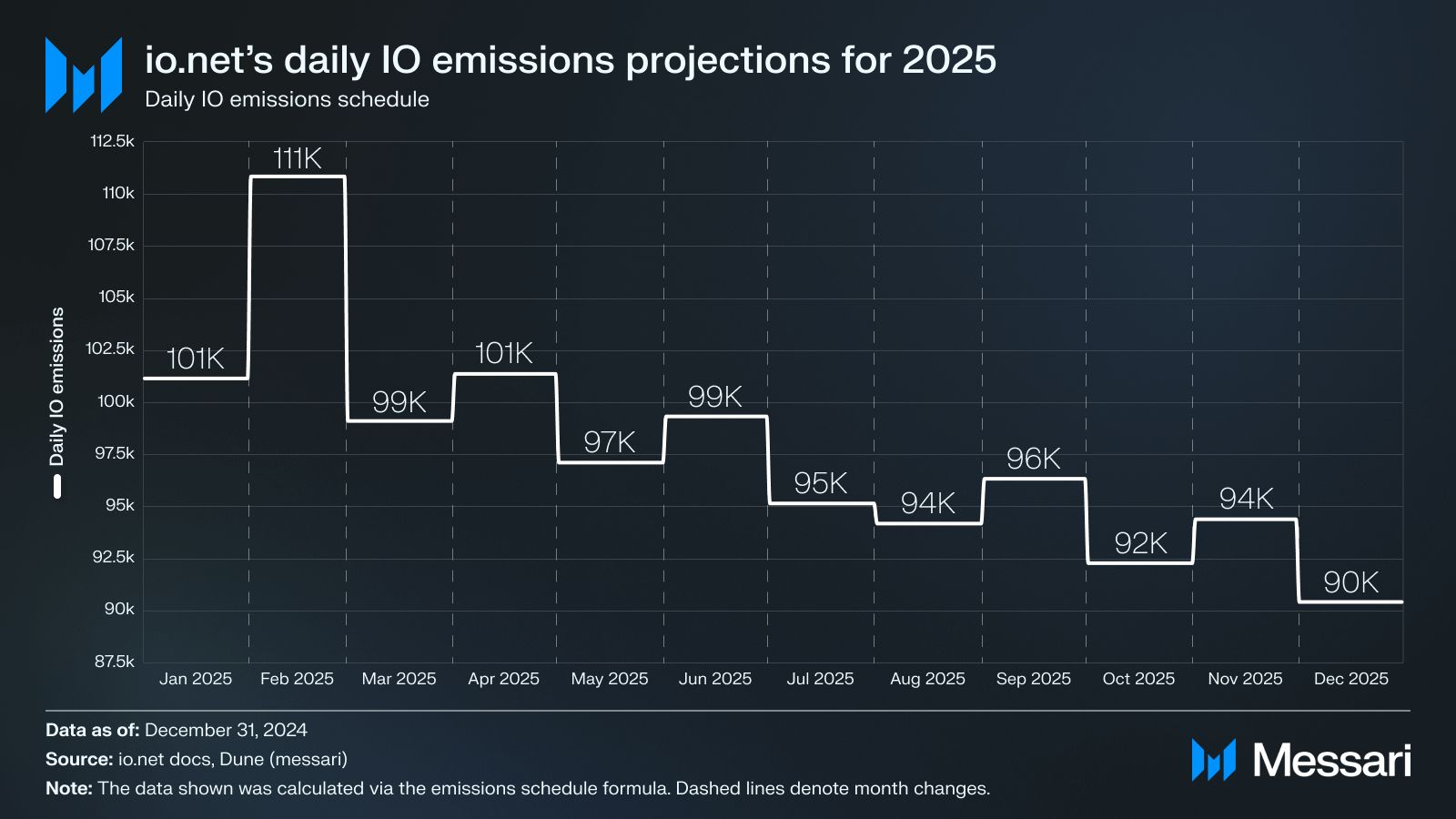

Looking forward, the emission schedule for IO rewards projects that 9.3 million IO will be distributed to GPU and CPU workers in Q1 2025, with an average of 103,000 IO being emitted per day. After initially beginning with an emissions schedule that adjusts per hour, io.net transitioned to an emissions schedule predicated on adjusting the inflation rate on a monthly cadence. The maximum supply for IO will be 800 million, and IO emissions will be distributed over the course of the next 20 years. The initial inflation rate was approximately 0.667% per month and decreases with each subsequent month.

Network

io.net requires devices with at least 12 GB of RAM, 500 GB of free disk space, and a high-speed internet connection (over 500 MB/s download, 250 Mbps upload, and under 30 ms ping). To ensure that suppliers' CPU/GPU resources are genuine and perform as expected, io.net implements an hourly Proof-of-Work (PoW) verification process. This process, which runs for about 15 minutes per hour, uses a cryptographic puzzle to verify the authenticity and performance of devices, deter fraud, and ensure fair resource allocation. The PoW system is structured around three components: a Binary Checker API that seeks a valid solution, a Challenges API that generates the puzzles, and a Results Submission API for verifying the solutions. Devices are visibly marked as verified, pending, or failed on the user interface, and any errors are logged for troubleshooting.

The daily median number of verified GPUs and CPUs decreased 58% and 67% QoQ, respectively. Throughout Q4, io.net averaged 7,600 verified GPUs and 1,200 CPUs per day.

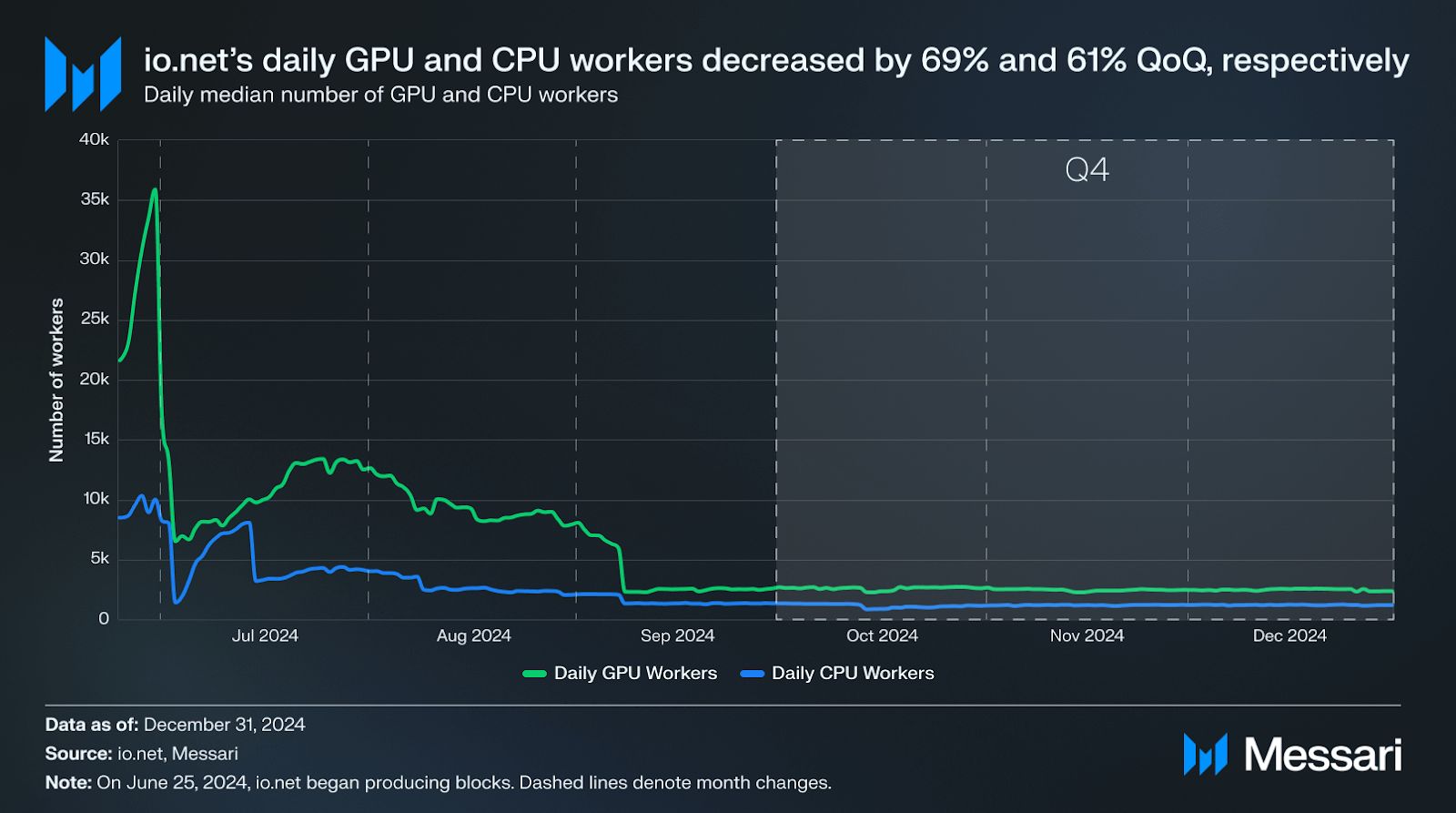

After strong opening numbers for the daily median number of GPU and CPU workers, the average number of GPU and CPU workers decreased by 69% and 61% QoQ, respectively. However, the number of GPU and CPU workers in Q4 remained relatively flat over the course of the quarter.

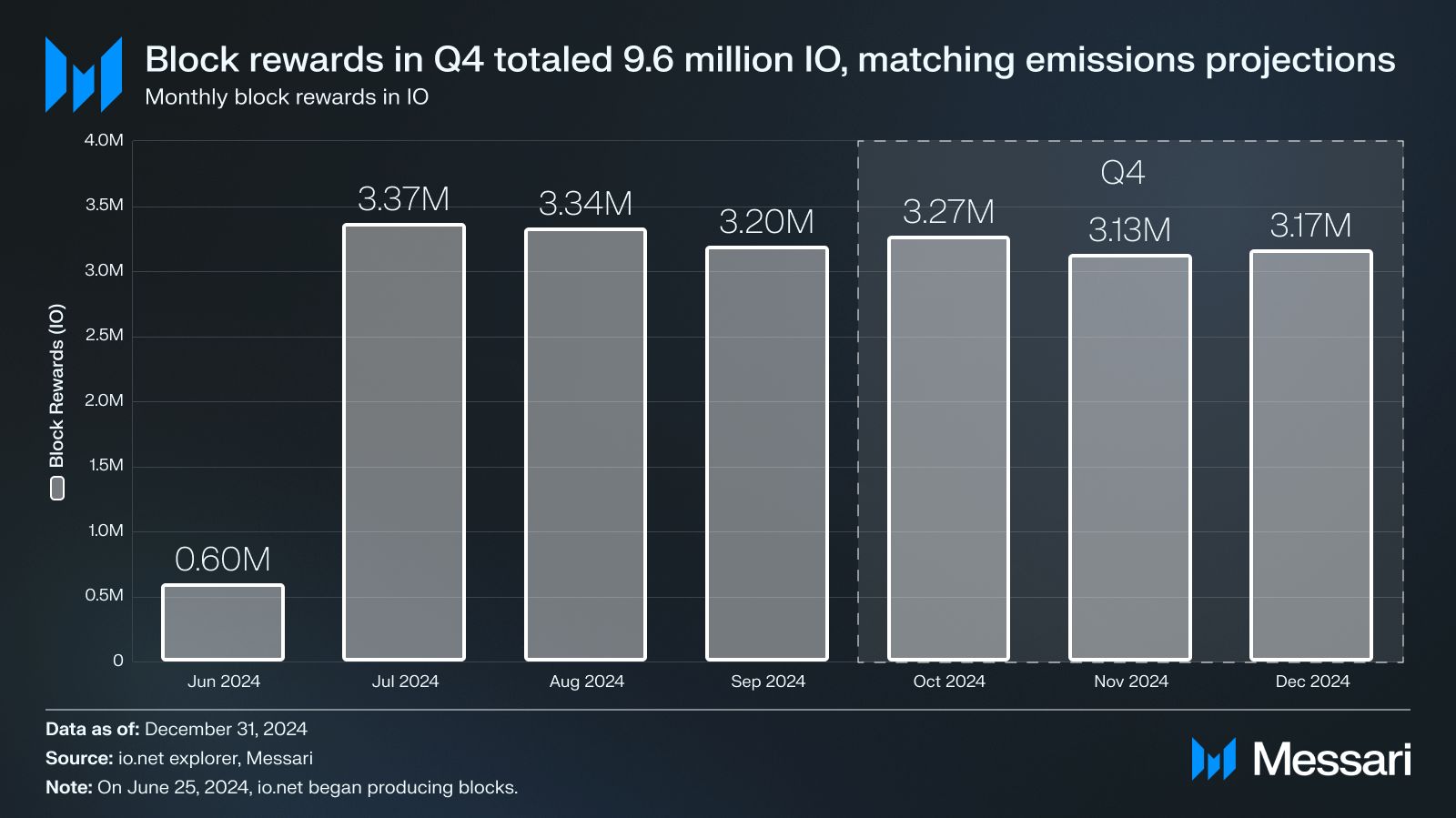

io.net began producing blocks and emitting the IO token as rewards for GPU and CPU suppliers on June 25, 2024. Since then, io.net has emitted 20.1 million IO tokens, with 9.6 million of them being emitted in Q4, matching IO emissions projections.

BC8.AI is an AI image generation platform that allows users to create images via prompts, similar to Midjourney . BC8.AI is powered by io.net, running its AI image generation model via io.net’s decentralized compute network. Inferences via BC8.AI on io.net have decreased 13% QoQ, closing Q4 with 172,700 inferences and 43,200 inference transactions complete.

Qualitative Analysis

Dell Technologies Partner Program

In December, io.net announced it had joined the Dell Technologies Partner Program as an Authorized Partner and Cloud Service Provider. The collaboration integrates io.net’s decentralized GPU compute network with Dell’s trusted hardware and infrastructure, giving io.net access to Dell’s resources, expertise, and go-to-market support. This collaboration allows enterprises to benefit from scalable, on-demand GPU clusters designed for complex AI, machine learning, and high-performance computing workloads. The collaboration aims to address challenges commonly associated with centralized compute networks by offering a decentralized solution that combines global GPU capacity with reliable enterprise-grade infrastructure. Additionally, the partnership supports strategic initiatives including demand generation, co-marketing, and tailored go-to-market strategies, positioning io.net to deliver cost-effective and efficient computing solutions for the next generation of AI innovation.

Zerebro Partnership

Additionally, io.net announced it had partnered with zerebro on December 17, 2024, an autonomous AI agent, to enhance its Ethereum validator operations by utilizing io.net’s globally distributed GPU clusters. Through this collaboration, zerebro will run its Ethereum consensus and execution clients on io.net’s decentralized infrastructure, ensuring scalable, reliable, and permissionless access to high-performance compute resources with geo-distributed redundancy. This setup addresses traditional bottlenecks in validator systems and supports flexible workload scaling.

Other Partnerships

- Nov 5, 2024, Phala Network, Engage Stack, and io.net demonstrated that enabling Trusted Execution Environments (TEEs) on NVIDIA Hopper GPUs for LLM inference adds minimal overhead within the GPU itself.

- Nov 19, 2024, Zero1 Labs is leveraging io.net's decentralized GPU network to train and scale AI agents for cross-chain applications through its Keymaker platform.

- Nov 26, 2024, OpenLedgerHQ partnered with io.net to combine blockchain-secured datasets with decentralized GPU compute, enabling AI developers to train and scale models on verifiable data pipelines.

- Dec 3, 2024, CreatorBid has partnered with io.net to provide decentralized GPU resources that power scalable AI models for content creation and digital engagement.

- Dec 5, 2024, Matchain has partnered with io.net to offer decentralized, scalable GPU resources for developers of identity and data management solutions.

- Dec 10, 2024, Mira Network has partnered with io.net to enhance AI reliability by providing scalable, decentralized GPU compute for output verification.

- Dec 16, 2024, Market Compass has partnered with io.net to utilize their decentralized computing network, which provides secure and scalable clusters equipped with A100 GPUs for model training, fine-tuning, and hosting AI agents.

- Other partners that are utilizing io.net's network include GAIB , YOM , NovaNet , ParallelAI , and MarlinProtocol .

Closing Summary

In Q4’24, io.net's token, IO, achieved substantial market capitalization growth. This growth was driven by an increased token price and circulating supply under the 20-year emissions schedule. Concurrently, the network upheld stringent hardware standards and executed an hourly Proof-of-Work process to authenticate and assess the performance of its decentralized compute resources. This ensured high-quality service despite a QoQ decrease in verified devices.

Furthermore, io.net’s revenue grew by 565%, with revenue increasing from $0.5 million to $3.1 million. Three consecutive months of unprecedented monthly revenue culminated in a record-breaking quarterly performance. Moreover, 13 new partnerships were announced that will utilize io.net to support a range of platforms, from AI agents to identity management solutions. Collectively, these financial, network, and partnership advancements highlight io.net's robust position as a scalable, accessible, and decentralized compute platform.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form . All responses are subject to our Privacy Policy and Terms of Service .

This report was commissioned by io.net, Inc. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Franklin Templeton says Solana’s DeFi rise presents a threat to Ethereum

Share link:In this post: A Franklin Templeton report suggested that Solana threatened Ethereum due to its growing influence. Solana’s DEX volumes surpassed the Ethereum ecosystem in January, highlighting a potential market shift. According to the report, the shift to activity to the layer two blockchain shows the Ethereum scaling approach was working.

Shiba Inu News: Agent Shiboshi Unleashes 1v1 Duels – SHIB Burns With Every Battle!

Bitcoin gets March 25 'blast-off date' as US dollar hits 4-month low

Ethereum most 'undervalued' in 17-months — Can ETH return to $4K?