- PEPE faces volatility as its X account compromise raises investor concerns.

- Key support at $0.000066, while resistance near $0.000071 limits upside moves.

- Derivatives data shows rising volume and open interest despite price decline.

Pepe (PEPE) token is seeing big price moves because there’s worry its social media platform X account has been hacked. Heads up to Investors:: don’t be interacting with that account for now.

Meanwhile, PEPE’s price is sliding, following the general market mood . The token’s latest price action is all over the place. So now, traders are keeping a close eye on support and resistance levels to see where things might go next.

Related: Whale Alert: Market Observer Highlights Ongoing PEPE Accumulation

PEPE Price Keeps Falling

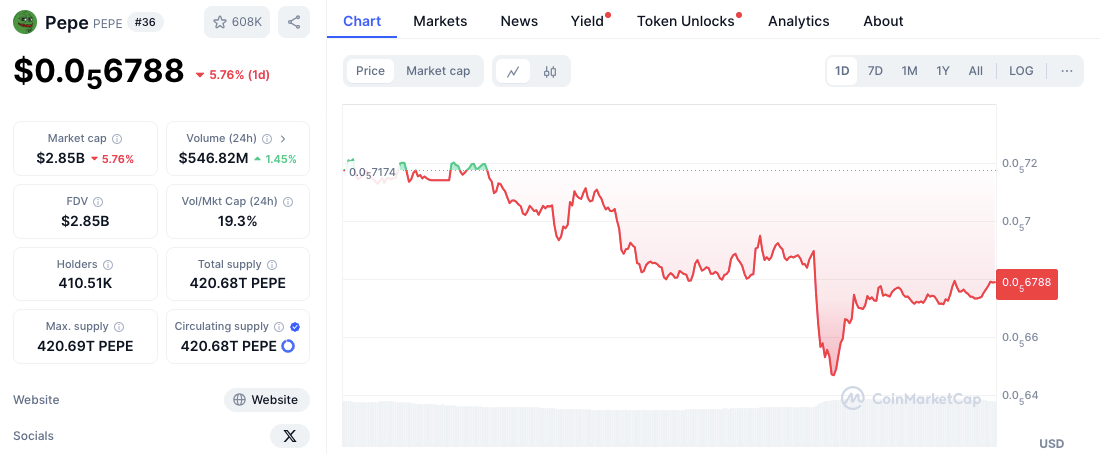

PEPE is currently trading at $0.00006755 , marking a 5.86% decline in the past 24 hours. The token’s market capitalization stands at $2.84 billion, while its 24-hour trading volume has increased by 1.46% to $546.64 million.

Related: Meme Coin Crash: $WIF, $PEPE, $ANIME, & More Down 50% — Buy the Dip or Bail Out?

The price has been heading downwards, making lower highs and lower lows. It bounced back a little after a fast drop, maybe trying to find its footing.

Key Support at $0.000066 and $0.0000645

Market watchers are focused on support and resistance zones that could decide where PEPE goes next.

Support right away is around $0.000066. Buyers showed up there before. Below that, stronger support is at $0.0000645. It bounced up from there before, so it’s a key level to watch for buying.

Source: CoinMarketCap

Source: CoinMarketCap

But, resistance right away is near $0.000071. It hit a high there, which saw selling. Above that, tougher resistance is at $0.000074. The price got turned back pretty strongly there before. If it can break above these levels, bulls might get back in charge.

RSI Getting Close to Oversold

PEPE/USD daily price chart, Source: TradingView

PEPE/USD daily price chart, Source: TradingView

The RSI is currently at 33.39, getting close to oversold. If it drops below 30, it could mean a reversal, or at least the price settling down for a bit.

MACD (Moving Average Convergence Divergence): The MACD line and signal line are still negative. This confirms bearish momentum is still going. The histogram also looks weak, meaning selling pressure is still around.

According to Coinglass data, the PEPE derivatives market is busier. Trading volume jumped 14.08% to $403.72 million. Open interest also rose 2.95% to $201.03 million, meaning more traders are active in contracts.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.