Nucleus Marketplace Moves $77.5 Million in Bitcoin, Raising Questions About Its Impact on the Market

-

The recent Bitcoin transaction from the long-dormant Nucleus Marketplace has sent ripples through the crypto community, highlighting the complexities of dark web assets.

-

The dormant marketplace, which has seen no action for nine years, moved a staggering $77.5 million worth of Bitcoin, leaving an impressive $365 million untouched.

-

According to Arkham Intelligence, the sudden activity raises questions about the future of these funds, with speculation on how the new owner will navigate withdrawal challenges from highly scrutinized wallets.

This article delves into the unexpected Bitcoin movement from Nucleus Marketplace and its implications for the crypto market, shedding light on dark web assets.

The Resurrection of Nucleus Marketplace Assets

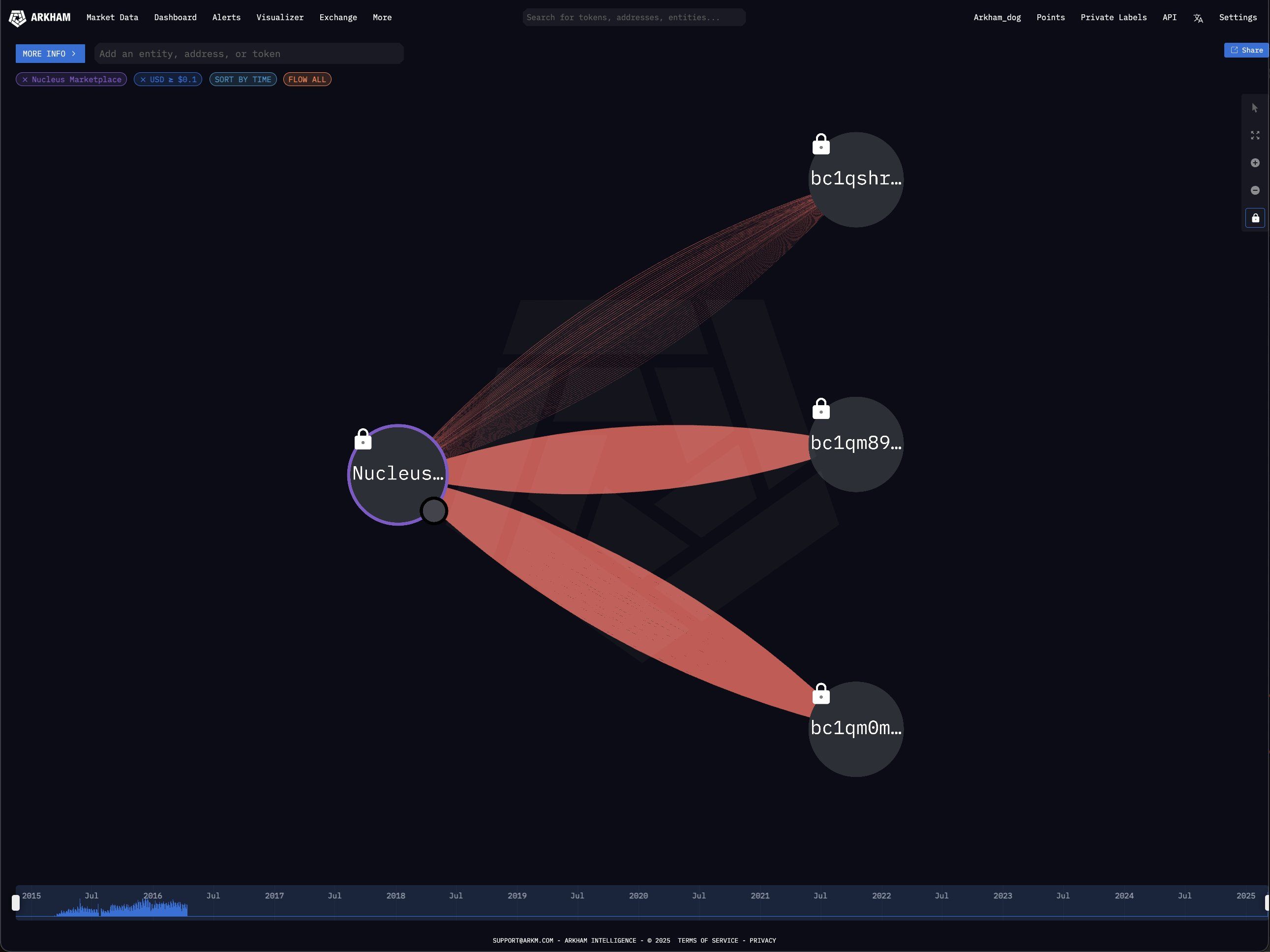

The unexpected movement from Nucleus Marketplace emphasizes the unpredictable nature of Bitcoin behavior. Arkham Intelligence, a prominent on-chain analysis firm, reported the transfer of over $77.5 million in Bitcoin from Nucleus, a dark web entity that has been inactive since 2016. This rare occurrence in the cryptocurrency realm commands attention due to its historical context.

The Historical Context and Current Market Impact

Nucleus Marketplace was known primarily for illicit trade, particularly drugs, before its abrupt dissolution in 2016. Initial speculations suggested that its operator had either been arrested or pulled an exit scam. However, the recent activity of transferring Bitcoin suggests a re-emergence of interest in these dormant assets. Arkham Intelligence stated, “The BTC held in their wallets has not been moved until today,” reflecting the significance of this transaction.

Bitcoin’s price trajectory has transformed dramatically since 2016, when it never crossed the $1,000 threshold. Currently valued much higher, the assets remaining—approximately $365 million—pose a fascinating case of potential gains and logistical challenges for those in control. Whoever is behind this transaction seems to be exercising caution, breaking the funds into three separate wallets to mitigate risk.

Although utilizing funds from a dark web marketplace is intriguing, it is crucial to grasp that transactions from ancient wallets are not entirely unusual. Many Bitcoin whales arise from early miners or previous owners of unlaundered assets. Nevertheless, the Nucleus case presents unique complications since it originated from a darknet context.

Challenges of Liquidating Dark Web Bitcoin

The practicality of converting these Bitcoin holdings into fiat currency is fraught with difficulties. Dark web transactions are closely monitored, and converting such a sizable amount without attracting attention can prove nearly impossible. The potential wallet owner faces the challenge of navigating a highly regulated financial landscape that scrutinizes large transactions.

Possible Strategies for Conversion

To navigate the conversion of Bitcoin to fiat without raising flags, several methods and strategies might be considered, although each comes with its own risks:

- Peer-to-Peer Exchanges: Using platforms that allow direct trades between users can sometimes protect anonymity, but they require finding trustworthy individuals.

- Over-the-Counter (OTC) Desks: Professional OTC brokers can assist in large transactions, often minimizing the impact on the market.

- Gradual Liquidation: Incrementally cashing out smaller amounts can help in avoiding detection, albeit at the risk of potential losses if market dips occur.

The methods the holder of Nucleus’ assets might employ remain speculative at this stage. Nonetheless, the burden of compliance and the high stakes involved indicate that any misstep could expose them to further scrutiny from regulatory bodies.

Conclusion

The recent movement from Nucleus Marketplace not only highlights the remnants of a once-active dark web market but also underlines the complex challenges of handling such significant amounts of Bitcoin in a regulatory climate that remains vigilant. As stakeholders in this space await further developments, the balance between anonymity and compliance will continue to shape the narrative surrounding darknet assets. Ultimately, regardless of the actions taken, the implications of this transaction will resonate within the cryptocurrency community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Celo Completes Transition to Ethereum Layer-2, Promises Sub-Cent Transaction Fees

Memecoin Hype Diminishes Amid Market Saturation Concerns

Coresky Secures $15M for Meme Coin Incubation

SEC Ends Probe, Immutable (IMX) Jumps 15%