Is the Sky Falling?

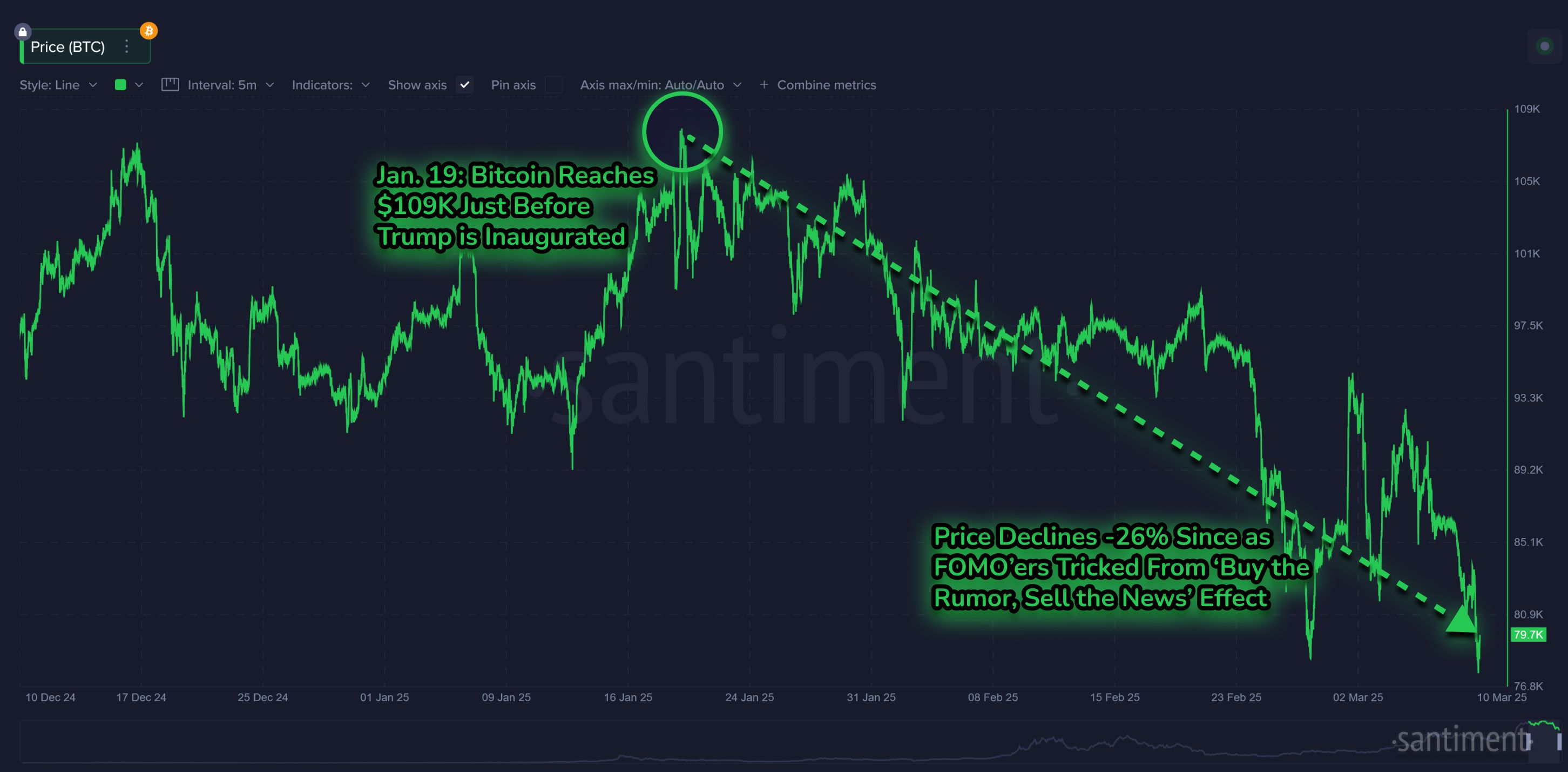

When we see these kinds of dips in crypto, it can be easy to lose hope. To lose the sense of optimism that likely brought you to invest, trade, or follow along with crypto markets in the first place. But history has shown us that what goes down always eventually comes up in this sector. Cryptocurrency is currently on a 7-week slump, ever since Bitcoin's all-time high of ~$109K was established the day before Trump's inauguration on January 19, 2025.

An argument can absolutely be made that the entire presence of Trump's crypto impact was primarily responsible for crypto's ascension across its previous $73K all-time high (from March, 2024) when he was elected the 47th US President on the evening of Novenber 5, 2024.

Bitcoin's on-chain evidence points to an immediate influx of network growth, whale accumulation, and optimism across the majority of crypto circles after the pro-crypto candidate won the US election. We can see how new wallet creation immediately erupted, hitting 2.51M BTC wallets created in the subsequent week after the news hit.

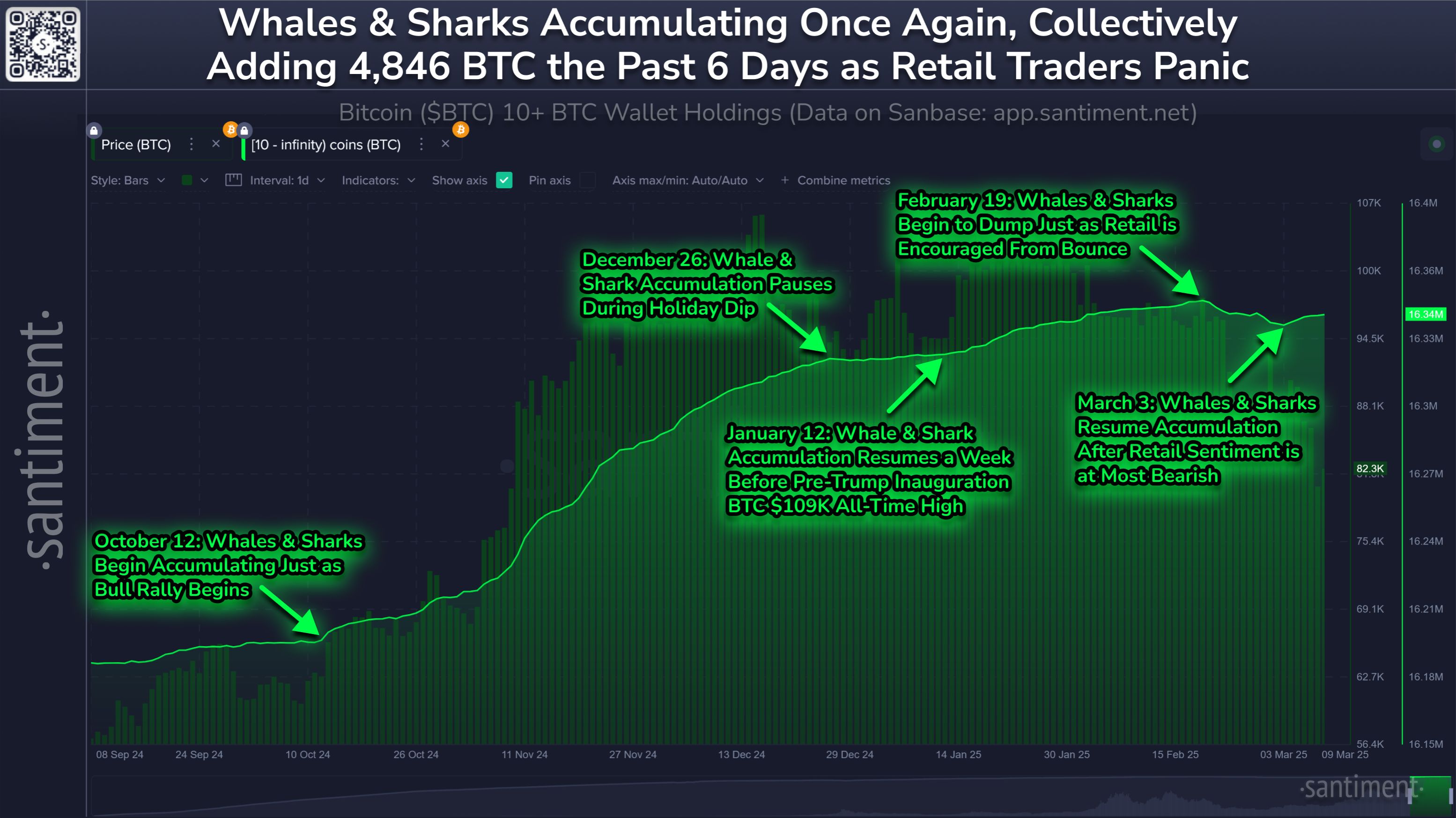

This was cause for a major party and breakout for crypto, as FOMO didn't slow down the rally at all like it usually would. This was due to the enormous level of accumulation being done in the background by whale and shark addresses, purchasing any coins they could from retail traders were willing to sell at the rapidly rising prices between early November, 2024 and mid January, 2025. Other than the holiday break, their buying was quite constant up until Trump's inauguration. From there, accumulation slowed down before finally coming to a halt in mid February.

And as we can see above, when key stakeholders finally began to take profit on February 19, 2025, prices immediately began to see much steeper drop-offs. It is especially interesting to see that prices have continued to plummet (falling back to a low of $78K today) even after these high capital BTC wallets began to buy back in one week ago on March 3, 2025.

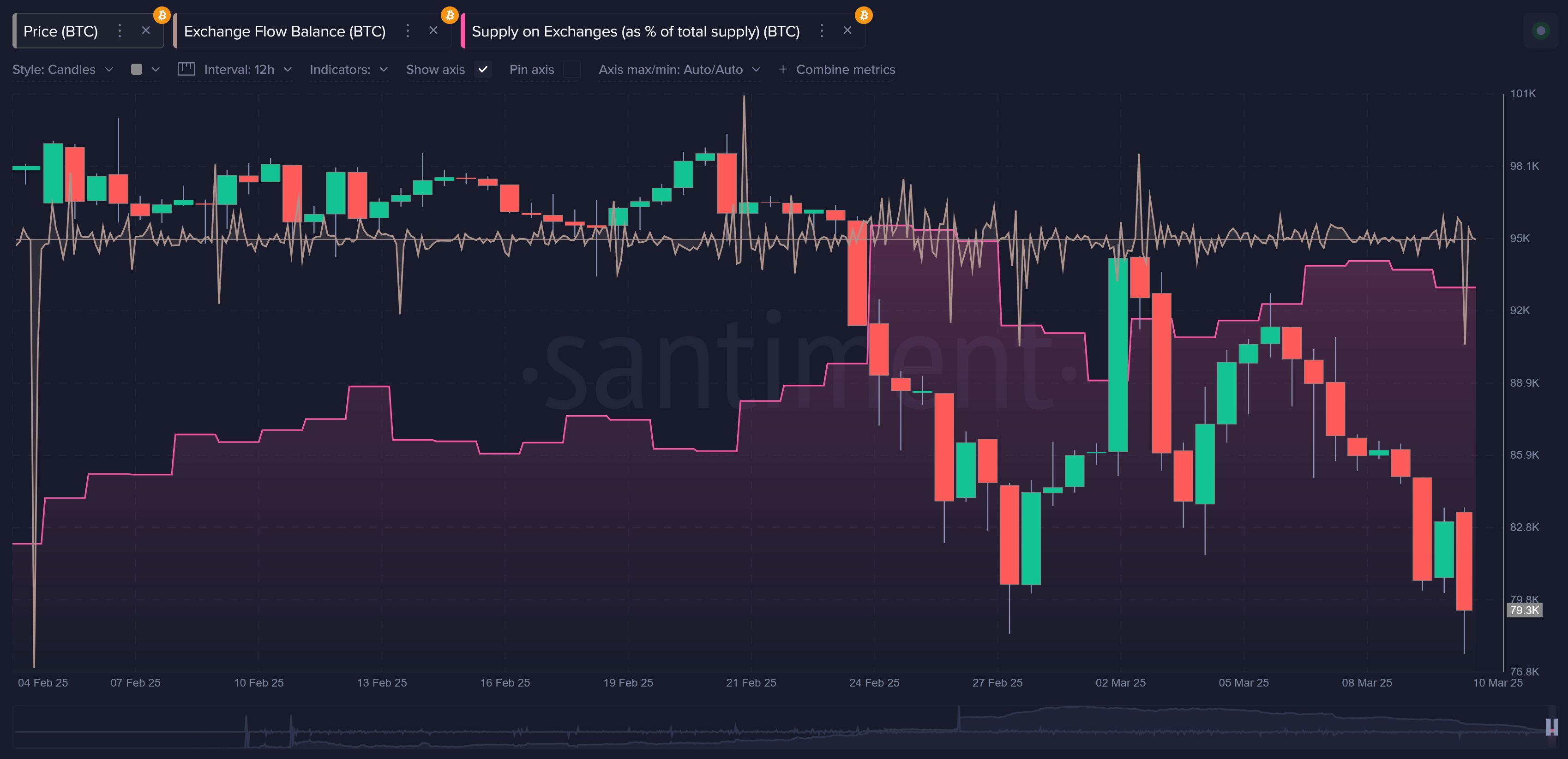

Another foreshadowing signal that we were in for some rocky times was the rising level of BTC moving to exchanges. From February 20 to March 8, there was a combined net move of 22,702 BTC (~0.11% of Bitcoin's entire supply) moving from non-exchange to exchange wallets. This is often a signal of volatility, because coins typically move to exchanges for one purpose: selling.

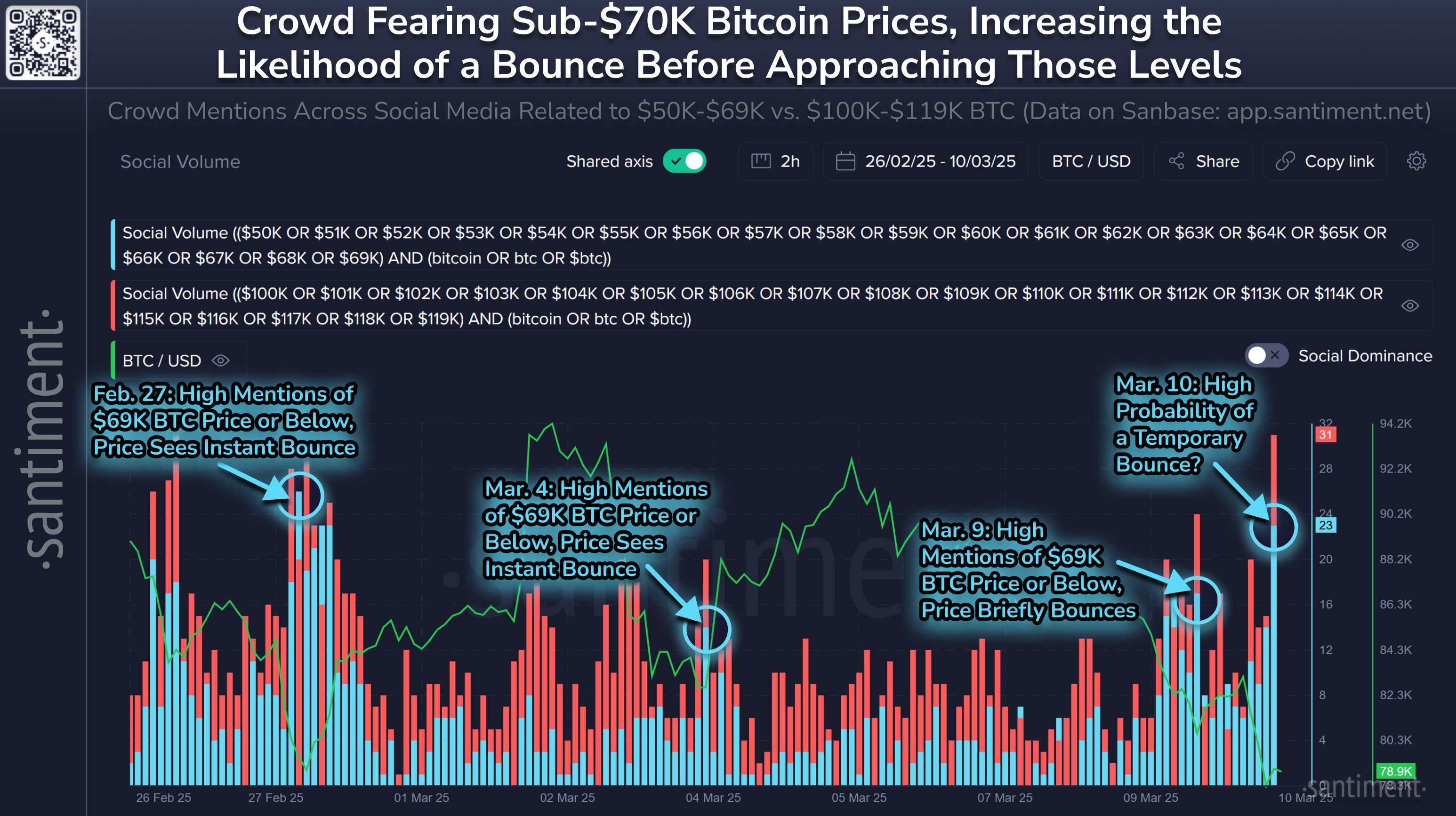

But of course, whale accumulation and exchange supply are much more long-term indicators and should not be used for swing trading (unless you plan on driving yourself crazy). What actually can help if you plan on trading on a more short-term basis would be the level of FOMO and FUD pouring in from the retail crowd on social media on a daily basis.

What we see above is the level of mentions of Bitcoin predictions (or at least, mentions) that are related to lower BTC prices than where markets currently sit ($50K-$69K) and higher prices ($100K-$119K). Since we know that markets move the opposite direction of retail's expectations, we actually are rooting for them to spam lower price predictions because it indicates that they are becoming bearish and are actively selling their coins to larger wallets as prices fall. On the other hand, we don't want to see them spamming euphorically high prices, because it indicates they are becoming over-confident and becoming bullish.

From a retail trader's perspective, this latest market retrace has been devastating. As our Bitcoin Network Growth chart showed above, there was an objectively large influx of new entries into crypto in late 2024, as they couldn't resist the temptation of missing out on surging prices. And this means that many of them are shell-shocked by the bloodbath that has happened over the past 7 weeks, especially since they were only used to seeing rising market caps for a prolonged period of time.

And remember that we've only covered Bitcoin. For most altcoins out there, particularly more speculative assets like meme coins, returns have been far worse than BTC's -18% performance in the past 30 days. Some other notables in this time frame include:

- Ethereum: -29%

- Solana: -40%

- Dogecoin: -38%

- Chainlink: -28%

- Toncoin: -32%

- Pepe: -39%

- Trump: -39%

And we can often lose sight of the fact that cryptocurrencies are a zero-sum game, just like any other investment market. Instead of just looking at these large negative price returns, we can objectively look at the average rate of gain/loss from short and long term traders. Currently, Bitcoin traders active in the past 30 days are down -11%, and those active in the past 365 days are down -5%.

When both the short and long term lines are well into the negative range, it's a signal that you can buy or add on to your position at a decreased risk compared to a normal time in crypto's history. Just keep in mind that we aren't in historically negative zones yet (such as both the short and long term returns surpassing -20% or lower).

So in short, the sky is not falling in crypto. We may see a bit more turbulence due to macroeconomic and global concerns, such as equity and crypto traders' concerns related to Trump's tariffs and an impending growing trade war beginning to emerge. But with key stakeholders beginning to accumulate once again, traders already in serious pain, and FUD becoming increasingly loud on social media, we are seeing positive signs beginning to emerge. Don't be surprised if there is a bit more pain in store first, though. It's always darkest before the dawn.

---

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysis: Bitcoin CME futures spread narrows to $490 as Trump effect fades

Calaxy, founded by NBA star Dinwiddie, launches Web3 creator fund

OpenAI releases new business tools for building AI agents

Share link:In this post: OpenAI releases Responses API, a new tool that helps businesses create AI Agents. Responses API will help developers build agentic apps and help businesses search through company files. OpenAI is also releasing an open-source Agents SDK that oversees agentic AI activities and performs various tasks.

SEC delays approval of XRP, SOL, LTC, ADA, and DOGE ETFs

Share link:In this post: The SEC has delayed approval decisions for XRP, SOL, LTC, ADA, and DOGE spot ETFs, pushing deadlines to May 2025. Official filings confirm the delays, with the SEC citing the need for more time to review the proposals. The SEC’s Crypto Task Force will hold a public roundtable on March 21 to discuss crypto regulations and security classifications.