Bitget Daily Digest (March 13) | U.S. February core CPI below expectations, on-chain "@neimugeX" arbitrage against Hyperliquid becomes a hot topic

远山洞见2025/03/13 08:54

By:远山洞见

Today's preview

1.U.S. initial jobless claims for the week ending March 8 will be announced today. Previous value: 221,000.

2.U.S. February PPI YoY will be released today, with the previous value at 3.50%.

3.U.S. February PPI MoM will be released today, with the previous value at 0.40%.

4.Aptos (APT) unlocks approximately 11.31 million tokens, representing 1.92% of the current circulating supply, valued at around $67.4 million.

5.Cheelee (CHEEL) unlocks approximately 20.81 million tokens, valued at around $162 million.

Key market highlights

1.U.S. February core CPI is below expectations. Inflation is cooling, but tariff uncertainties remain. The February core CPI MoM growth rate slowed from 0.4% to 0.2%, and YoY dropped from 3.3% to 3.1%, both of which are below market expectations. A decline in oil prices and airfare prices are the main drivers, indicating weak demand. Although inflationary pressures are easing, Trump is set to announce broader reciprocal tariffs on April 2, which creates uncertainty in the price trends of imported goods.

The market expects the Federal Reserve to remain on hold during the March meeting, with rate cuts potentially delayed until the third quarter.

2.Hyperliquid 50x leverage whale "@neimugeX" triggers collateral shortfall, causing a loss of $4 million for HLP. @neimugeX took a highly leveraged position with 50x leverage in Hyperliquid, holding 140,000 ETH (approximately $270 million). After multiple withdrawals while the position remained open, the liquidation price was pushed up to $1915, eventually triggering a liquidation of 160,000 ETH and a takeover by HLP, resulting in a $4 million loss for Hyperliquid. Following the incident, Hyperliquid reduces the maximum leverage for BTC and ETH to 40x and 25x, respectively.

3.

Base blockchain sees a significant increase in activity. Following Base's announcement that post-upgrade chain processing speeds will double those of Solana, and with Backed mapping stocks to the chain with $COIN, as well as Zora launching a memecoin, market speculation surrounding $

DRB has heated up. Additionally, $

PUBLIC, related to Jesse, and $

COOL, launched by BoredElonMusk, have further fueled Base's market sentiment, driving increased on-chain activity and market momentum.

Market overview

1.BTC experiences short-term volatility with a rebound; the market sees an overall increase, with the top 50 coins turning green across the board, excluding IP and $FTN. The top gainers are mainly small-cap coins and newly listed coins. $PI ranks second in trading volume, following $BTC and $ETH.

2.Tech stocks boost U.S. stock market. The Nasdaq gained over 1%, with Tesla up nearly 8%, Nvidia up over 6%, and Intel surging over 10% after naming a new CEO. Chinese stocks and the Chinese yuan retreated, while gold hit a two-week high.

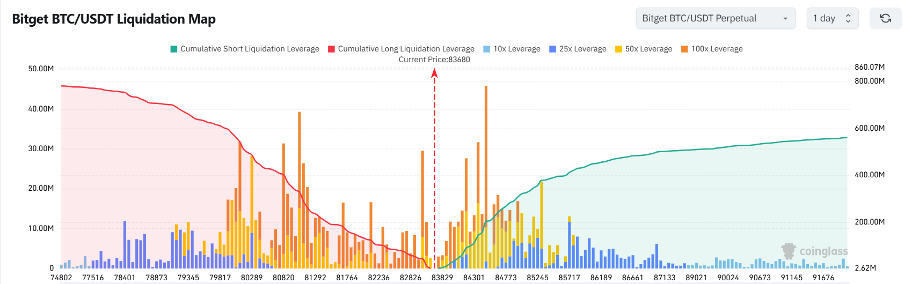

3.Currently standing at 83,680 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 82,680 USDT could trigger

over $76 million in cumulative long-position liquidations. Conversely, a rise to 84,680 USDT could lead to

more than $244 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

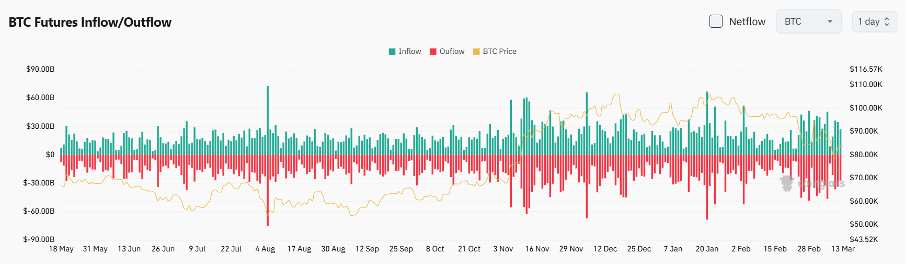

4.Over the past day, Bitcoin has seen $3.207 billion in spot inflows and $3.048 billion in outflows, resulting in

a net outflow of $159 million.

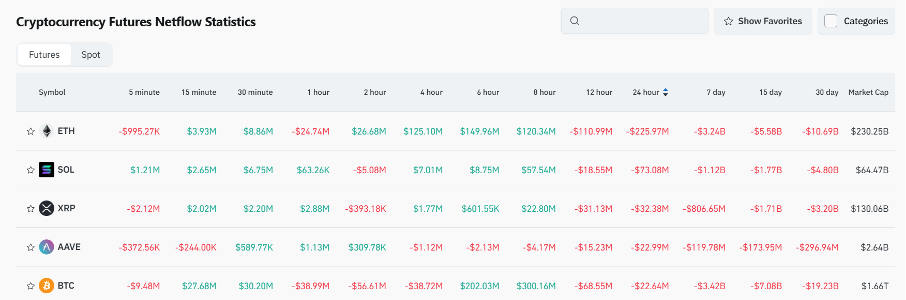

5.In the last 24 hours, $ETH, $SOL, $XRP, $AAVE, and $BTC led in

net outflows in futures trading, signaling potential trading opportunities.

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day inflow of $72.9 million, while the cumulative inflows amount to $35.477 billion, with total holdings at $92.732 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $6.653 million, with cumulative inflows of $2.633 billion and total holdings of $6.795 billion. Compared to the previous day, BTC inflows have turned positive, while ETH outflows have decreased.

Institutional insights

K33: The U.S. Treasury Secretary is expected to clarify the "Bitcoin reserve plan" by May 5.

Read the full article here:

https://www.theblock.co/post/345877/trump-strategic-bitcoin-reserve-watershed-moment-recession-fears-k33

Ark Invest: Ark remains bullish on Bitcoin's long-term outlook, stating that the current market sentiment is overly pessimistic.

Read the full article here: https://www.dlnews.com/articles/markets/bitcoin-price-to-pump-from-ai-and-robotics-says-ark-invest/

Glassnode: The supply gap for Ethereum in the $1900–$2200 range is small, and it is reasonable to expect a short-term rebound to the $2200 resistance level.

News updates

1.Massachusetts State Senator proposes blockchain and cryptocurrency special committee.

2.U.S. SEC confirms receipt of Fidelity's Ethereum ETF proposal.

3.Nebraska governor signs Bitcoin ATM regulation bill.

4.The Bank of Russia proposes a cryptocurrency investment pilot for high-net-worth investors.

Project updates

1.dYdX updates its roadmap to optimize deposit and withdrawal features in the short term.

2.FTX/Alameda unstakes 185,000 SOL, worth approximately $22.88 million.

3.MGX invests $2 billion in CEX and acquires a minority stake.

4.Data: 47% of Ethereum holders are in profit, with over 80% of OM, BGB, BTC, and other token holders also profiting.

5.Catizen: The 2025 CATI token consumption has reached 22 million, with the annual token consumption target raised to 150 million.

6.Sony and LINE announce a blockchain partnership.

7.Hyperliquid responds to 50x leverage whale liquidation incident: The platform claims no vulnerabilities and will adjust leverage limits for BTC and ETH.

8.CEX Alpha introduces new audit mechanism: 21 tokens, including ELIZA and WHALES, have been delisted.

9.Franklin files Solana spot ETF with CBOE.

10.NFPrompt completes its first NFP token burn: A total of 1,601,111 tokens have been permanently burned on-chain.

Highlights on X

Yuyue' insights of the hype dilemma and structural issues

Despite strong market performance, Hype faces structural problems, with numerous early holders and insufficient buying power in the mid-market. On-chain expansion is challenging, and the price discovery process is too fast, lacking long-term consolidation. It's value primarily relies on fee buybacks and the popularity of the CT narrative. If leveraged users decrease, Hype's positioning as the "On-chain Binance" could be at risk. Hyperliquid has yet to demonstrate a sufficient competitive advantage compared to exchanges like Bitget. Furthermore, the "dark forest" effect on-chain could limit capital flow and constrain platform growth. Whether it evolves into the "next ETH" still hinges on delivering long-term value.

@MetaHunter168: Crypto survival guide — How to level up efficiently

Futures trading volume remains high following the Trump Trade bull market inception, with significant activity in mainstream altcoins and new coins, underscoring sustained liquidity and ample market volatility. If the market seems bearish, you're probably not in the right market or timing. Futures are now the best strategy in the market. Instead of ditching outdated biases, it is better to think about how to focus on trading futures smarter. In essence, it follows the same logic as on-chain PVP—using small funds to leverage larger returns, just like rushing into memecoins. Control your position size, and a 100x leverage is just a reskinned game mechanism. The key is to take profits and exit without hesitation, build your own trading system, and keep market rhythm in your hands. Despite all the changes, the core of futures remains risk management and execution. Smart traders are not swayed by market emotions but instead make the market follow their rhythm.

0xTodd's Hyperliquid's arbitrage play explained

Hyperliquid's arbitrage play involves using large positions to influence market prices. The strategy involves pushing up the price of ETH by adding to the position, generating huge paper profits, but not closing positions. Instead, the trader withdraws principal and profits, leaving the remaining position to be liquidated, with $HLP buying up the liquidation. Traditional CEXs prevent such practices by restricting large position openings, freezing withdrawals of floating profits, and triggering early liquidations. However, the current risk control loopholes in Hyperliquid make this kind of strategy possible.

Chicken Genius's analysis of global M2 and Bitcoin price correlation

Through correlation analysis, Chicken Genius found that global M2 money supply and Bitcoin prices have a high correlation of 0.824, with a best lag period of 57 days. This implies that changes in the money supply reflect in BTC prices approximately two months later, offering key market insights. Based on current data, today might be the market bottom.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin must secure weekly close above $89K to confirm bottom has passed

Cointelegraph•2025/03/13 10:04

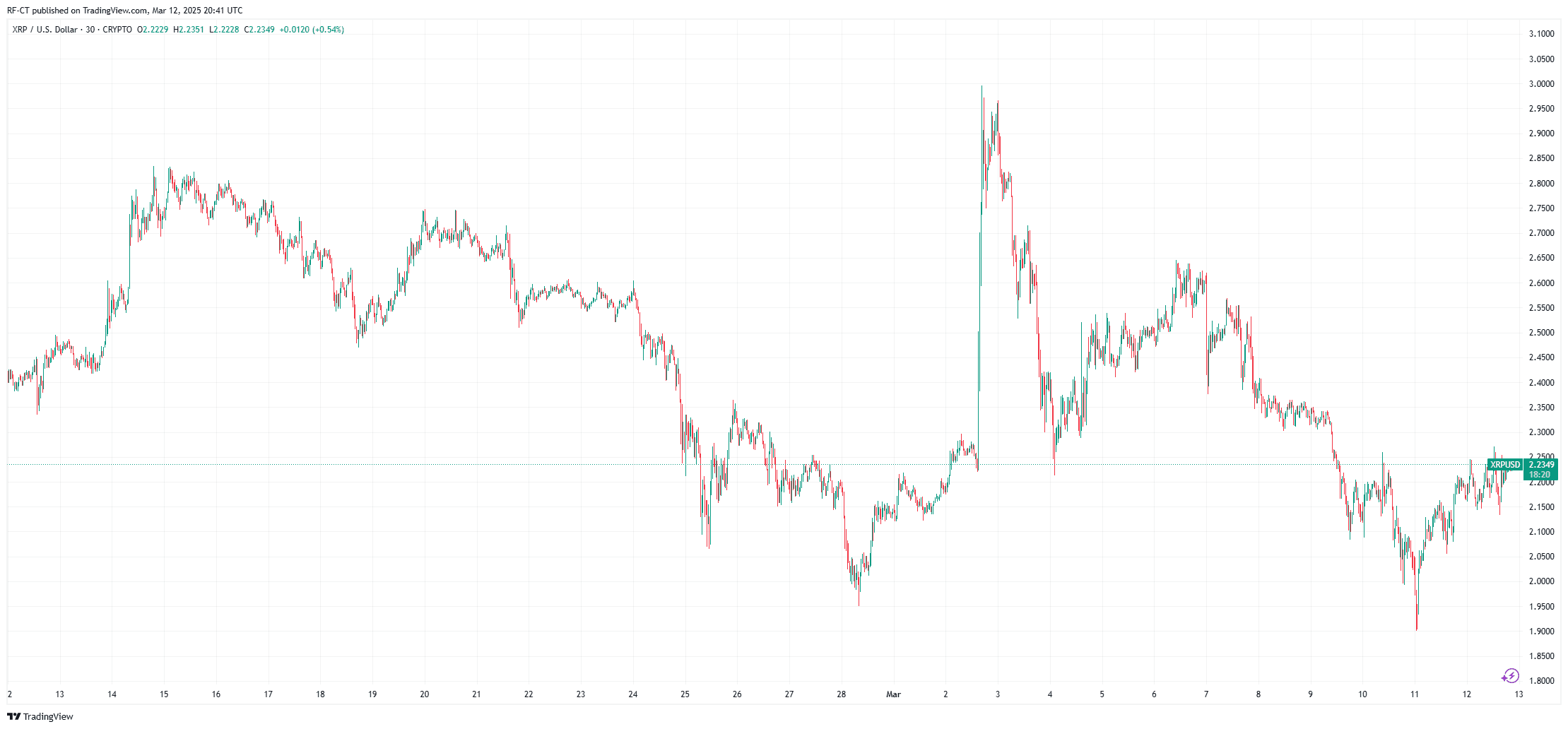

SEC vs. Ripple Case Nears Conclusion: Impact on XRP and Crypto Regulation

Cryptoticker•2025/03/13 09:22

Pi Network Jumps 28% — Will the Surge Last?

DailyCoin•2025/03/13 09:18

Research Report | Space Nation Project Overview & OIK Market Analysis

远山洞见•2025/03/13 09:10

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$82,936.34

-0.14%

Ethereum

ETH

$1,896.78

-0.98%

Tether USDt

USDT

$0.9996

+0.00%

XRP

XRP

$2.28

+3.40%

BNB

BNB

$579.15

+3.58%

Solana

SOL

$126.39

-0.22%

USDC

USDC

$0.9998

+0.00%

Cardano

ADA

$0.7261

-1.99%

Dogecoin

DOGE

$0.1696

+0.87%

TRON

TRX

$0.2254

+1.54%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now