Today's preview

1.The U.S. one-year inflation rate estimate for March will be released today, with the previous value at 4.30%.

2.The preliminary University of Michigan Consumer Sentiment Index for March will also be announced today, with the previous reading at 64.7.

3.Polyhedra Network (ZKJ) will unlock approximately 17.22 million tokens, representing 28.52% of the current circulating supply, valued at around $35.30 million.

Key market highlights

1.

Putin has expressed support for the U.S.-proposed 30-day ceasefire agreement for Ukraine but emphasized the need to address the root causes of the conflict. He outlined several issues that require clarification, suggesting that reaching a ceasefire consensus in the short term remains challenging. Meanwhile, Trump remains optimistic, stating that the U.S. is discussing the framework of a final agreement, while Ukrainian President Zelensky criticized Putin for attempting to buy time to strengthen his battlefield position.

2.Rumors about the Trump-themed

memecoin TRUMP "possibly having utility" have been debunked. A post by investor @tier10k on X caused a short-term price spike, but later, @tier10k explained that the account had been hacked before the false claim was posted. Additionally, The Wall Street Journal cited sources indicating that Trump's representatives had held talks to take a financial stake in a CEX, potentially involving Trump family holdings or transactions through World Liberty Financial (WLFI).

3.

The ETH/BTC exchange rate hits a new low, with overall market liquidity declining. Meanwhile, the Base ecosystem has gained renewed attention due to the AI narrative. Memecoins such as $DRB and $PUBLIC have driven on-chain activity. DebtReliefBot ($

DRB), backed by Bankr, Clanker, and Grok, has emerged as a key AI-assisted memecoin project. Additionally, $

BNKR has benefited from this trend, and $

PUBLIC has gone viral, attracting attention from notable figures like Jesse Pollak.

Market overview

1.BTC hovers around the 80,000 mark, with the market showing mixed movements. Small-cap coin $LAI and DeSci-themed $RIF lead the gainers. Among the top ten by trading volume, only $PI has shown an increase.

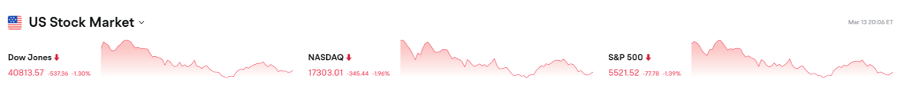

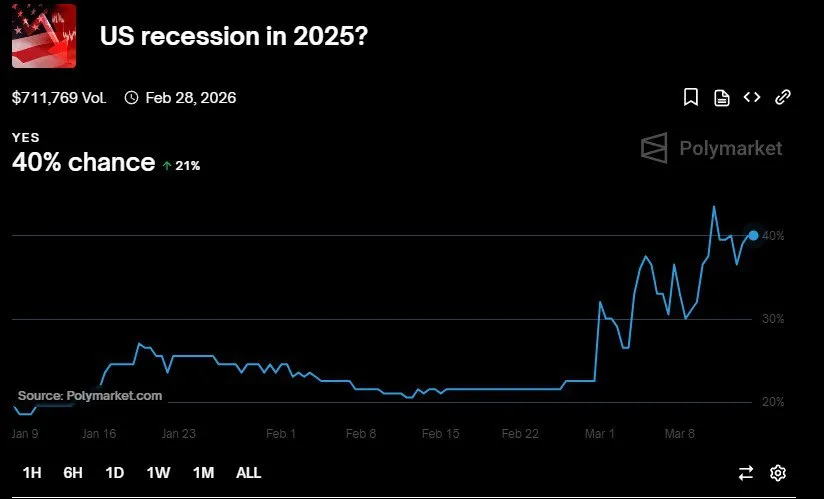

2.The SP 500 enters a correction zone, and the Nasdaq drops nearly 2%, while safe-haven demand pushes gold futures above $3000 for the first time.

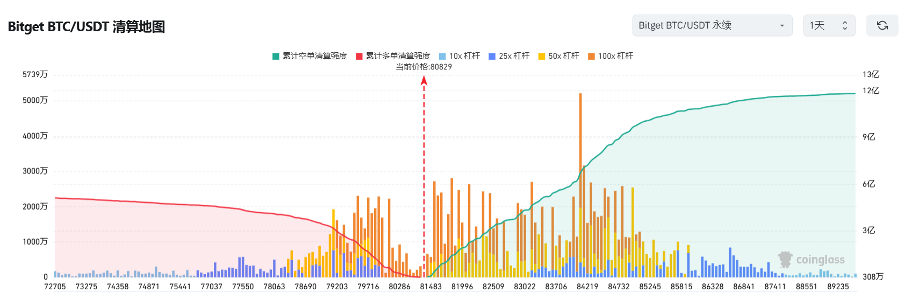

3.Currently standing at 80,829 USDT,

Bitcoin is in a potential liquidation zone. A 1000-point drop to around 79,829 USDT could trigger

over $100 million in cumulative long-position liquidations. Conversely, a rise to 81,829 USDT could lead to

more than $142 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

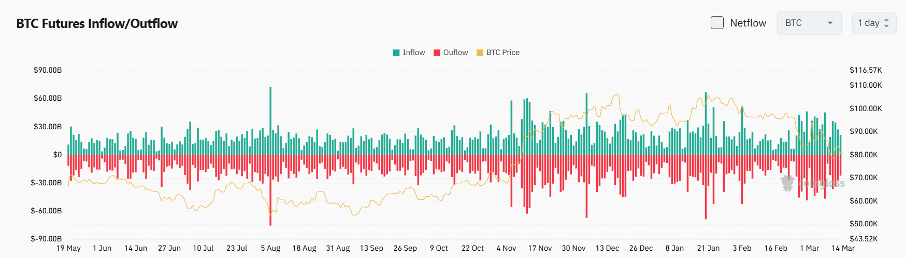

4.Over the past 24 hours, the BTC spot market recorded $21.3 billion in inflows and $22.0 billion in outflows, resulting in a

net outflow of $700 million.

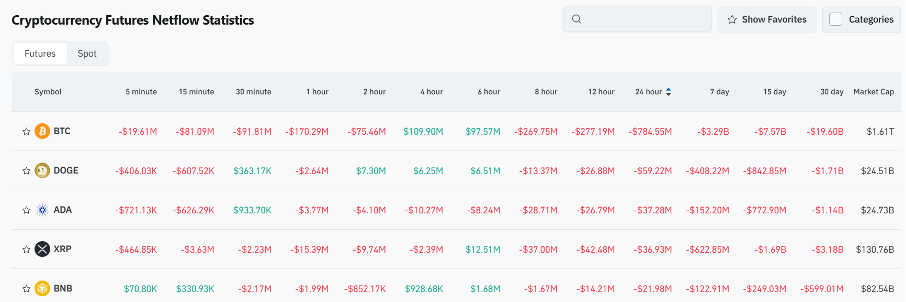

5.Over the last 24 hours, $BTC, $DOGE, $XRP, $ADA, and $BNB have led in futures trading

net outflows, signaling potential trading opportunities.

Institutional insights

1.

Santiment: USDT daily transfer addresses have reached a six-month high, indicating that traders are preparing to buy.

2.

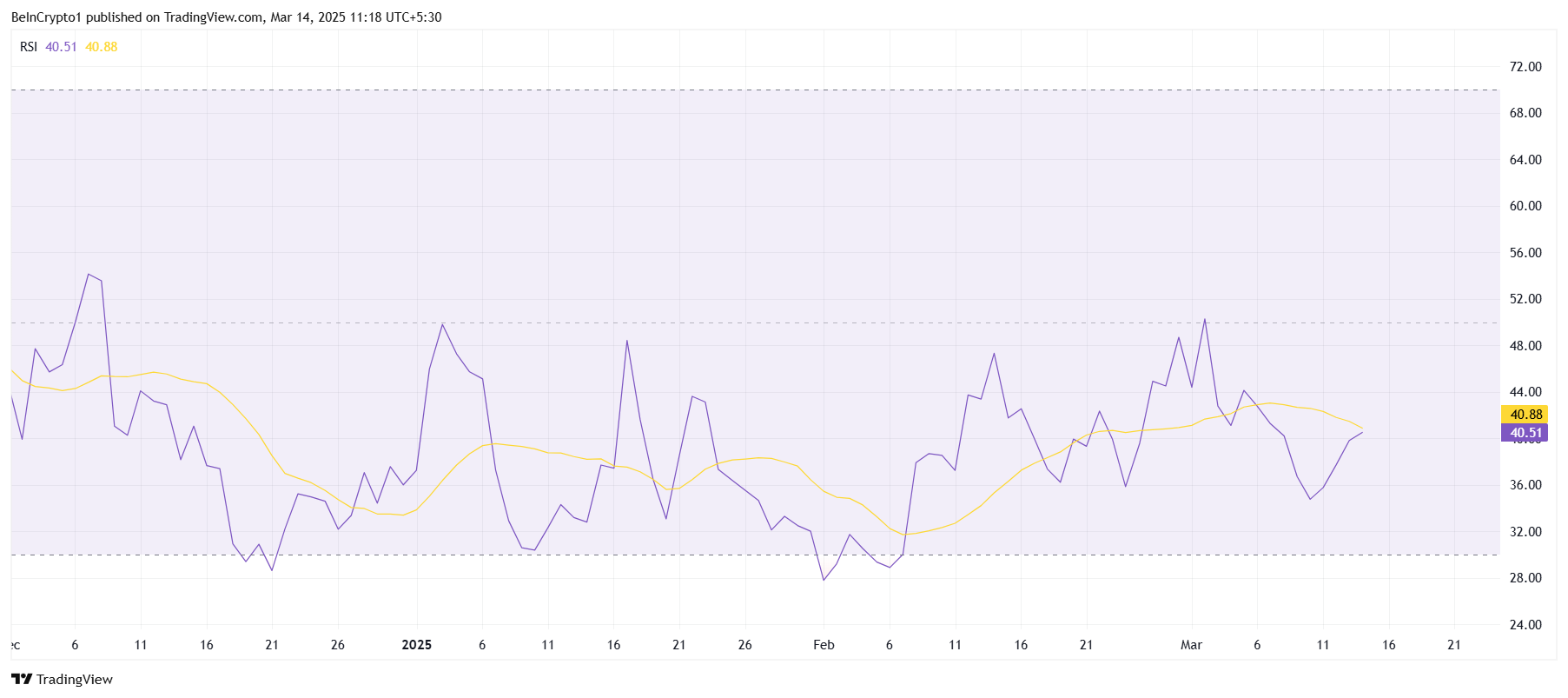

CryptoQuant: The crypto market has entered an oversold zone following a strong correction

3.

Santiment: Community sentiment toward Ethereum continues to decline, suggesting a greater chance of an unexpected breakout.

News updates

1.A U.S. Democrat lawmaker has urged the Treasury to halt Trump's Bitcoin reserve plans, citing potential conflicts of interest.

2.The U.S. Senate Banking Committee has passed a bill to regulate stablecoin issuers.

3.Türkiye is tightening crypto regulations with new rules for exchanges and investors.

4.South Korea plans to lift its de facto ban on institutional participation in crypto by Q3.

Project updates

1.Hyperliquid will implement a 20% margin ratio on margin transfers starting March 15.

2.Aave Labs has launched a new initiative called Horizon, potentially creating new revenue sources for Aave DAO.

3.Telegram has introduced trading and earnings features for its self-custodial crypto wallet.

4.Babylon has extended its airdrop registration deadline to 4:00 PM on March 19 (UTC+8).

5.The Catizen ecosystem has achieved a major milestone, surpassing 61 million users and a daily consumption of 1 million CATI tokens.

6.Developers of Clanker and Bankrbot have stopped the system from responding to Grok's commands for token issuance.

7.Trump's

cryptocurrency project WLFI has sold 99.2% of its newly added shares.

8.Gnosis has announced that the GIP-122 proposal has been voted through, and GnosisDAO will continue supporting the development of Gnosis VPN.

9.CBOE has filed an application for an XRP ETF from Franklin Templeton.

10.Jupiter has launched "Smart CT Likes," a community verification system enabling users to boost Solana ecosystem tokens by "liking" them.

Highlights on X

AB Kuai.Dong: Market rationalization is a necessary reset

The liquidity surge in 2020-2022 inflated market bubbles and altered perceptions of money, while policymakers sought to maintain post-pandemic economic momentum and avoid a hard landing. However, Trump's return accelerated the burst of these bubbles, forcing assets to quickly return to fair value. Although chaotic and painful, this correction is a necessary market reset. The violent shakeout of new coins in early 2025 reflects this de-bubbling process, as many crypto projects that should have been liquidated during the FTX collapse and Luna crash survived due to VC capital and temporary market support. Now, the market is correcting these past distortions. If no new turning points emerge, bubble liquidation will continue until assets reach rational pricing.

@bitfool1: Ethereum's midlife crisis — From dominance to a crossroads

Ethereum is experiencing a deep "midlife crisis", marked by declining fee revenue, stagnation in application innovation, weakened operational activity, struggles in Layer 2 strategy, failure of deflationary mechanics, and rigid governance. Once a leader in DeFi innovation, Ethereum now struggles to replicate the success of emerging chains and is also trapped by a lack of liquidity and users in its Layer 2 development. However, this is not due to its own failures but due to shifts in market conditions and competition. ETH's commitment to high decentralization has sacrificed TPS (transactions per second) but maintained faith and market stability. However, the public blockchain business model is inherently competitive, and its moat is shallower than expected. If ETH misses key trends, its ecosystem activity could drop by 95% in bear markets. Ethereum isn’t failing — it has simply lost its edge. How it redefines its role will determine whether it can continue leading the market.

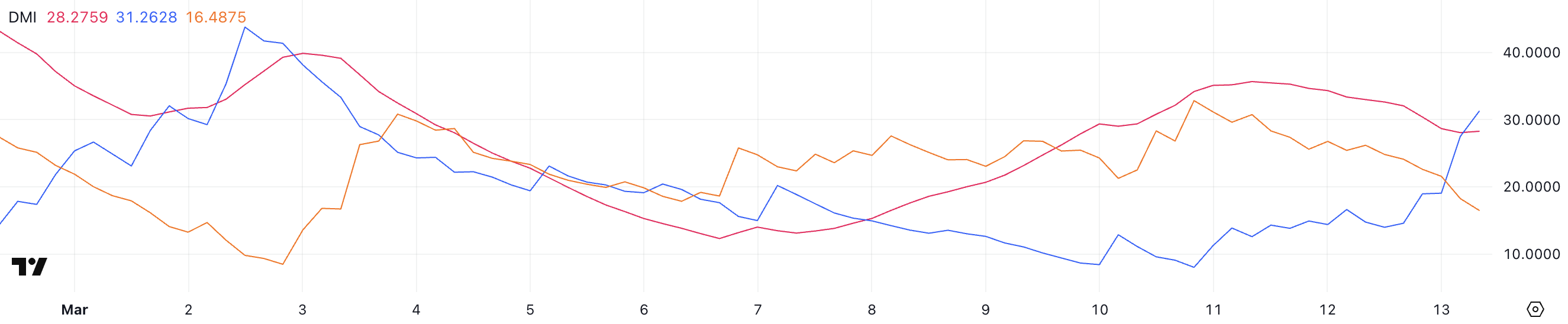

Murphy: The best time to capture a BTC pullback — Using reverse structure

There's a wide range of bottom predictions for the current BTC correction, but instead of chasing the lowest point, traders should wait for a complete "reverse structure" to increase certainty when entering the market. During

BTC price corrections, short-term holders' coins gradually fall to the hands of long-term holders, forming a cost ranking of: Red (1d-1w) < Yellow (1w-1m) < Blue (1m-3m) < Purple (3m-6m). As market sentiment stabilizes and new capital enters, short-term costs decrease while long-term costs rise, eventually forming a fully reversed "purple-blue-yellow-red" structure—a signal of market bottom consensus. Currently, BTC's cost structure is taking shape, but it has not fully contracted, as the purple line remains at the bottom, indicating that the correction phase is not yet complete. True right-side traders should wait patiently for the structure to form fully and use additional data indicators to find the best balance between profit expectations, high certainty, and entry triggers before making a decisive move.

DaPangDun: Why I'm bullish on SONIC — A new hope in DeFi narrative

SONIC is a grassroots-driven blockchain with minimal VC involvement, offering greater potential for organic growth and outsized returns.

With deep participation from DeFi genius Andre Cronje (AC), its potential is hard to ignore. Although SONIC's TVL is rising, market bias stemming from FTM and AC's past controversies has led to undervaluation — creating an excellent entry opportunity. The ecosystem is thriving, with a high-quality user experience and innovations such as credit lending and "Flying Tulip" mechanisms, which could reshape DEXs, perpetual futures, and lending markets. While DeFi is not a new narrative, integrating Web2 dynamics still allows for sustained long-term growth. SONIC represents the new frontier of this sector, offering a combination of undervaluation, high activity, and product innovation — making it a prime opportunity to watch.