Research Report | Tutorial Project Analysis & TUT Market Valuation

1. Project Introduction

TUT is a Meme token built on the BNB Chain and plays a key role in the blockchain education ecosystem. Initially, TUT started as a tutorial project created by developers within the BNB ecosystem to demonstrate how to launch a token on the BNB Chain testnet. As interest from the market and community grew, this OG token was officially deployed on the mainnet and gradually evolved into a project that merges Web3 education with Meme culture.

TUT was first issued on the four.meme platform, and after meeting the Bonding Curve conditions, its liquidity was migrated to PancakeSwap. Currently, TUT has a total supply of 1 billion tokens, all of which are in circulation. With strong community consensus and the expanding value of its ecosystem, TUT has evolved beyond a typical meme coin to become a key driver in blockchain education.

The TUT ecosystem is actively developing an AI-powered Web3 education platform. A core product, "Tutorial Agent", serves as an intelligent tutor, simplifying complex blockchain concepts and helping users acquire practical skills through interactive learning. Additionally, TUT plans to launch the Tutorial Terminal, further enhancing AI agents, API integration, and data interaction capabilities while expanding ecosystem initiatives such as the BNBAI Hackathon and partnership programs. Future plans include introducing advanced terminal features, AI-generated content, and active participation in global Web3 summits, positioning TUT as a gateway for blockchain education and adoption.

2. Project Highlights

1. BNB Ecosystem Growth Community Momentum Fueling TUT’s Popularity

TUT’s rise in popularity is driven by the continued expansion of the BNB ecosystem and the strong support of its community. Originally just an experimental token created for a blockchain tutorial, TUT quickly gained market traction as BNB Chain users embraced Meme culture and the education narrative. Community discussions, social media exposure, and KOL endorsements amplified the FOMO sentiment, transforming TUT from a basic meme coin into a BNB ecosystem project with real educational value, attracting a surge of short-term speculative capital and boosting market sentiment.

2. BNB Ecosystem Liquidity Test Strengthened Community Consensus

TUT’s rapid rise became a high-impact event within Meme culture. In a short time, TUT significantly increased DEX trading volume in the BNB ecosystem, accelerated on-chain capital circulation, and drove up BNB gas fee consumption. As confidence in the BSC narrative grew, TUT established itself as a key Meme asset in the BNB ecosystem, serving as a bridge between the community and Web3 education.

3. Education Narrative + AI Integration = Web3 Ecosystem Expansion

Beyond being a Meme token, TUT is an innovative project within the BNB ecosystem that integrates education and AI. Its flagship product, Tutorial Agent, leverages AI-assisted learning to lower barriers to Web3 knowledge, enabling users to grasp blockchain fundamentals more easily. Looking ahead, TUT aims to expand AI-generated educational content, foster strategic partnerships, and promote the adoption of its learning platform among Web3 enterprises and institutions. With the combined strengths of Web3 Education + Meme Narrative + AI, TUT has the potential to become a key sector in the long-term growth of the BNB ecosystem.

3. Market Valuation Expectations

As an education-driven Meme token within the BNB ecosystem, TUT initially gained attention due to its developer-created token tutorial on BNB Chain. With growing community support, it quickly captured market interest. As the BNB ecosystem narrative strengthens and interest in educational tokens rises, TUT has successfully listed on multiple trading platforms, reinforcing market consensus over time.

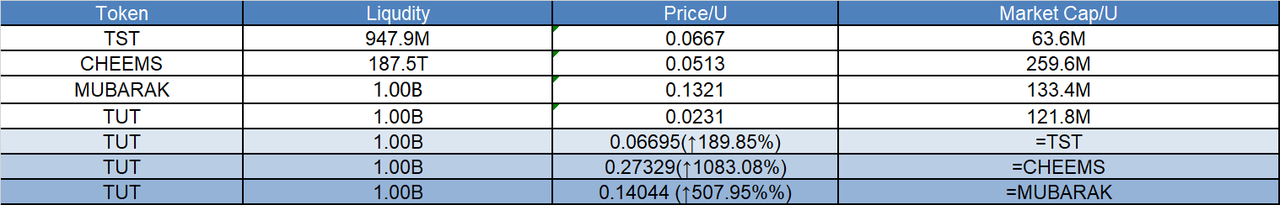

Comparing TUT with other BNB ecosystem Meme tokens like TST, Cheems, and Mubarak, its potential valuation can be benchmarked against their market performance. If TUT continues to enhance AI-driven educational tools and sustain market excitement, its long-term value could see further growth.

4. Tokenomics

- Total Supply: 1 billion TUT

- Circulating Supply: 1 billion TUT

- Current Market Cap: $22.6M

- On-Chain Liquidity Pool: $2.1M (~1,713.97 WBNB)

- Total Holders: 12,751

- Top 100 Addresses Holding Ratio: 62.71%

- Market Concentration: Relatively high, meaning large holders' actions could significantly impact price trends.

According to GMGN trading data, the Top 100 addresses purchased at an average price of $0.00651, while the current price is (+250.7%). The average sell price is $0.00958, reflecting a 138.1% profit from the buy-in price. This indicates that most large holders remain in profit, trading activity remains high, and FOMO sentiment continues driving price action, with no signs of mass panic selling yet.

5. Team Funding

Team Information:

TUT was not launched by a traditional team but rather emerged from a blockchain tutorial created by developers in the BNB ecosystem. Initially, it was purely an educational experiment, but as community interest surged, TUT evolved into a tradable token, drawing widespread market attention. Its growth is entirely community-driven, fueled by market FOMO sentiment and alignment with the BNB ecosystem's narrative.

Funding:

TUT did not conduct private sales, presales, or institutional fundraising. It was initially launched on the decentralized trading platform four.meme, and once it met the Bonding Curve conditions, it migrated to PancakeSwap. The initial liquidity was entirely market-driven, with no external capital involvement, making TUT a classic example of a community-driven Meme token.

6. Potential Risks

1. Dependence on Market Sentiment Web3 Education Narrative

TUT’s growth relies heavily on market sentiment, community engagement, and the Web3 education narrative. However, the Meme token sector is highly competitive, with numerous BNB Chain Meme projects vying for attention. Additionally, the Web3 education sector already has several established players, meaning TUT will need to sustain user growth, community engagement, and long-term relevance beyond short-term hype.

2. High Market Concentration Risk of Large-Holder Sell-Offs

On-chain data shows that the Top 100 addresses hold 62.71% of TUT’s supply, indicating high market concentration. While these large holders may be long-term investors, their buying and selling activities could heavily influence price movements. If whales decide to sell in large volumes, it could cause sharp price drops and even trigger market panic. Additionally, some whales may exploit low-liquidity periods to manipulate price action, increasing short-term trading risks.

7. Official Links

- Website: https://tutorialtoken.com/

- Twitter: https://x.com/tutorialtoken

- Telegram: https://t.me/TUTPortal

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Network (PI) Introduces Two-Factor Authentication – Here’s How to Secure Your Account

EOS Gains Momentum Following Key Breakout – Is RAY Gearing Up For A Similar Move?

Is Dogecoin (DOGE) Gearing Up for a Reversal? Surge in Active Addresses and Key Pattern Hint at a Rally

Is HYPE Ready to Soar? BNB Fractal Signals a Big Move Ahead for Hyperliquid