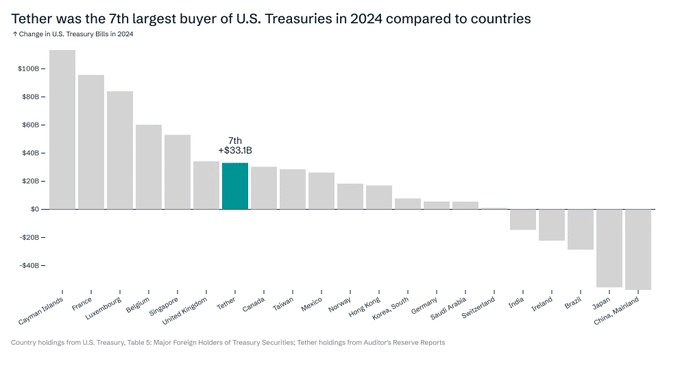

Tether Becomes 7th Largest Holder of U.S. Treasuries

Tether, the company behind the stablecoin USDT, is now the world’s seventh-largest holder of U.S. Treasury securities. That means it held more U.S. government debt than countries like Canada, Taiwan, Mexico, Norway, and Hong Kong.

According to Tether CEO Paolo Ardoino, the company has bought over $33.1 billion worth of U.S. Treasuries. “Tether was the 7th largest buyer of US Treasurys in 2024, compared to Countries,” Ardoino posted on X (formerly Twitter) earlier today.

Tether was the 7th largest buyer of U.S treasuries in 2024 | Source: x.com/paoloardoino

Tether was the 7th largest buyer of U.S treasuries in 2024 | Source: x.com/paoloardoino

Tether’s purchases put it ahead of many major economies, but it’s still far behind the top holders like the Cayman Islands, which has bought over $100 billion in Treasuries.

Ardoino also pointed out that jurisdictions like the Cayman Islands and Luxembourg include hedge fund investments in their numbers, while Tether’s holdings come from just one company. This makes Tether one of the biggest private buyers of U.S. government debt.

Tether uses U.S. Treasury securities as a way to back its stablecoin, USDT. These securities are short-term debt issued by the U.S. government, making them one of the safest investments available. By holding Treasuries, Tether ensures it has strong reserves to keep its stablecoin stable and reliable.

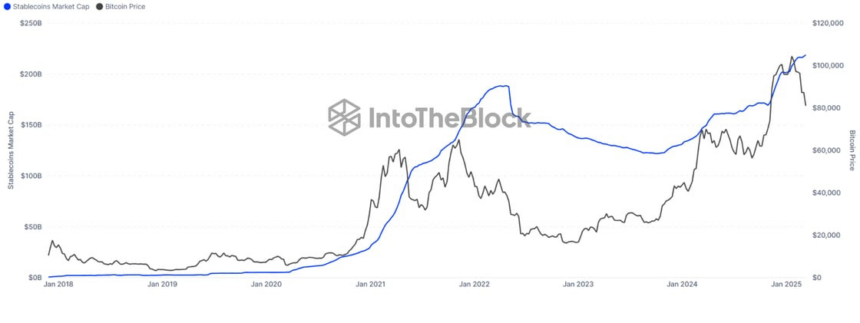

Meanwhile, stablecoins are seeing more demand from both investors and lawmakers. The total amount of stablecoins now exceeds $219 billion and is of growing interest as more and more people use them for trading payments and other financial activities. Analysts at IntoTheBlock believe the market is still growing and has not yet peaked.

Stablecoin supply hits $219 billion | Source: x.com/intotheblock

Stablecoin supply hits $219 billion | Source: x.com/intotheblock

At the same time, U.S. lawmakers are working on new rules for stablecoins. Kristin Smith, CEO of the Blockchain Association, said during the 2025 Digital Asset Summit in New York that a bill could be passed by August.

“I think we’re close to being able to get those done for August […] they’re doing a lot of work on that behind the scenes right now,” she said on March 19. Bo Hines, executive director of the President’s Council of Advisers on Digital Assets, also expects stablecoin regulations soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terraform Labs Launches Crypto Loss Claims Portal for Investors

Bitcoin Core v29.0rc2 Update: Key Enhancements and Improvements

ビットコインはボラティリティの中で約29,200ドルまで回復

Cryptocurrency Market Analysis: Bitcoin Struggles at $90k, Predictions Vary for 2025