Bitcoin gains above $87,000 alongside XRP, SOL as Trump tariff concerns ease

Quick Take Bitcoin rose above $87,000, accompanied by gains in ether, XRP and Solana. One analyst said reports of the White House taking a more moderate approach in pushing tariffs provided some relief for investors.

Bitcoin and other major cryptocurrencies made gains on Monday as investors found some relief from the White House taking a more moderate stance on reciprocal tariffs and gained confidence from recent economic data.

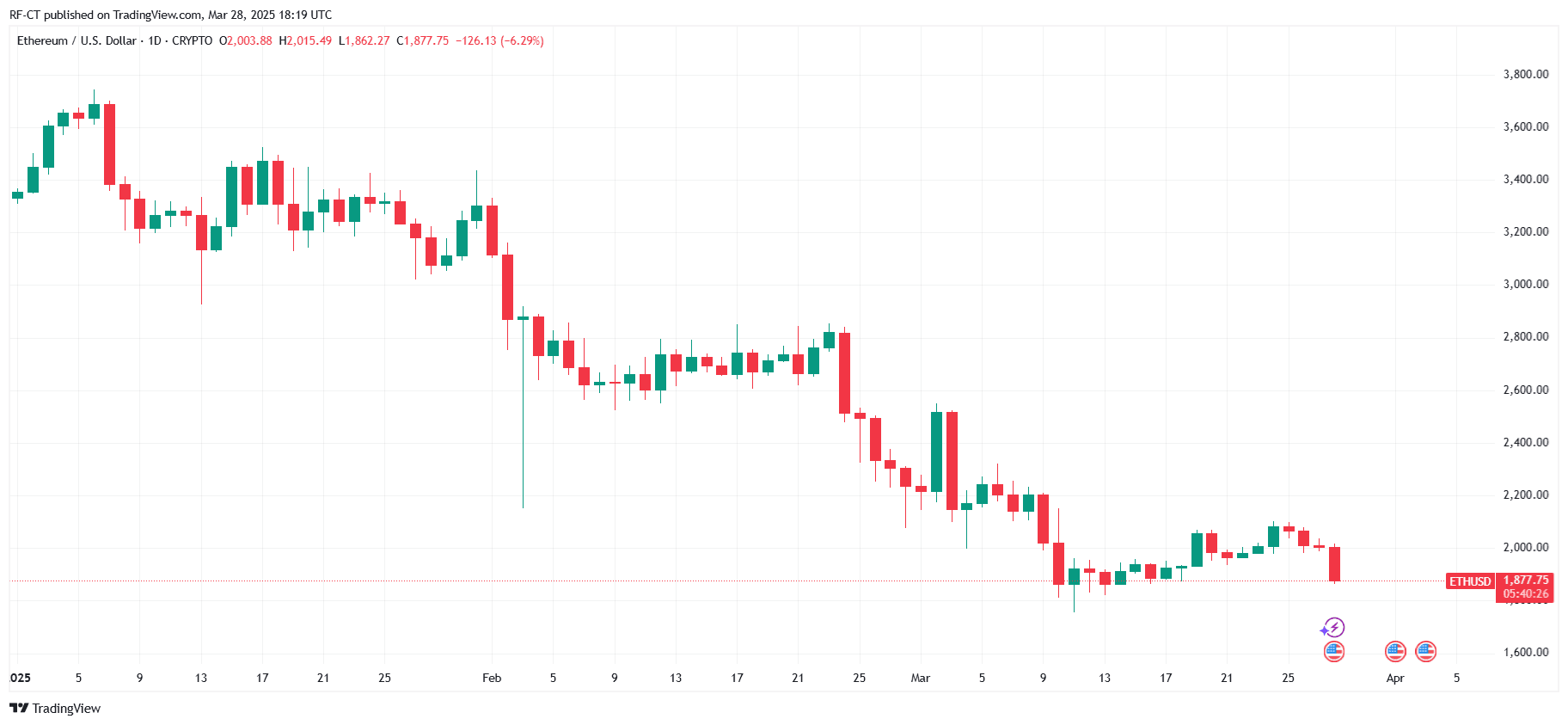

Bitcoin rose 3.29% to $87,033 in the past 24 hours leading up to 2:50 a.m. ET on Monday, reaching a level it has not seen since March 7, according to The Block's crypto price page . Ether also added 3.2%, surpassing the $2,000 line to trade at $2,066.

Among other major cryptocurrencies, XRP rose 3% to $2.46, and Solana gained 5.6% to $138. The GMCI 30 Index , measuring the performance of the top 30 cryptocurrencies, rose 3% in the past 24 hours.

"The crypto markets are surging as investors respond positively to Trump's more cooperative stance on tariffs, set to take effect on April 2, alongside the Fed's focus on long-term inflation trends," said Vincent Liu, chief investment officer at Kronos Research.

In the past weeks, bitcoin and the overall market have experienced increased volatility and steady decline since U.S. President Trump announced stringent tariff measures on both allies and foes. This has injected uncertainty into the market and tied crypto closer to equities.

However, the White House is seeking a more "targeted" approach rather than a broad one in rolling out Trump's reciprocal tariffs, potentially giving investors a break from tariff worries, Bloomberg reported , citing Trump's aides.

The latest rebound also signals stronger investor confidence after recent "hard" economic data showed that the U.S. market remains robust, analysts said.

Last week, U.S. unemployment claims slightly increased by 2,000 to 223,000, suggesting that the U.S. job market remains resilient, according to Reuters . Earlier this month, the consumer price index data showed that inflation eased down to 2.8% for February.

"In recent years, macro observers have generally been more precarious in their assessments than the actual reality, and we believe that the underlying economy remains stronger than feared," SignalPlus Head of Insights Augustine Fan said.

Despite positive "hard" economic indicators, Trump's tariffs may continue to cause volatility in the markets, in both stocks and crypto, BTC Markets Crypto Analyst Rachael Lucas told The Block.

"Markets generally don’t like uncertainty, and with the potential for unpredictable outcomes, we're likely to see some choppiness as traders adjust their positions," Lucas said.

After the reciprocal tariffs are placed next week, the market will likely see a "knee-jerk" reaction from traders as they digest new risks.

"The longer-term impact will depend on the scale and duration of the tariffs," Lucas said. "When it comes to crypto, tariffs could place additional short-term pressure on risk assets, particularly if the U.S. dollar strengthens because of trade tensions."

"However, if the market views the tariffs as part of a broader negotiation strategy and tensions ease, we could see a relief rally that lifts crypto prices," Lucas added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

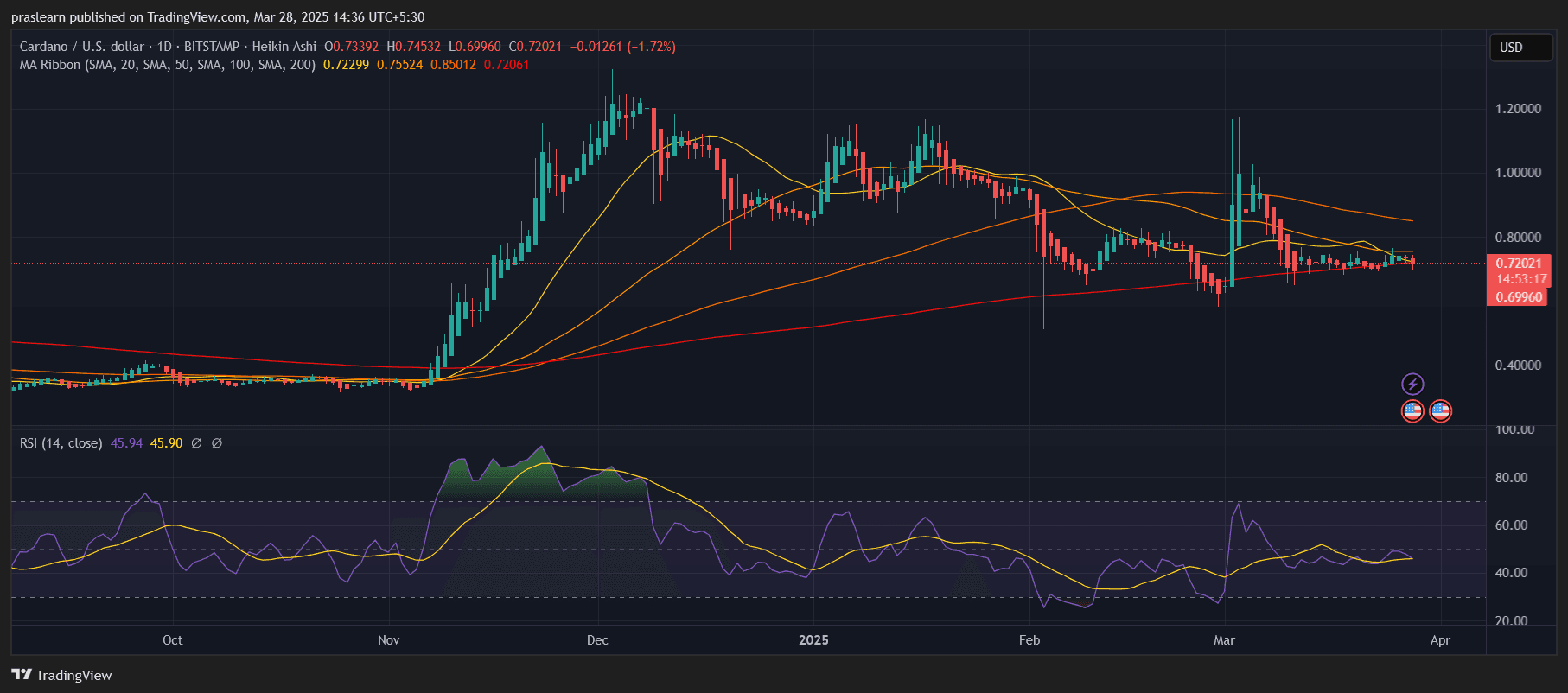

Cardano Aiming for $10? Big Move Coming?

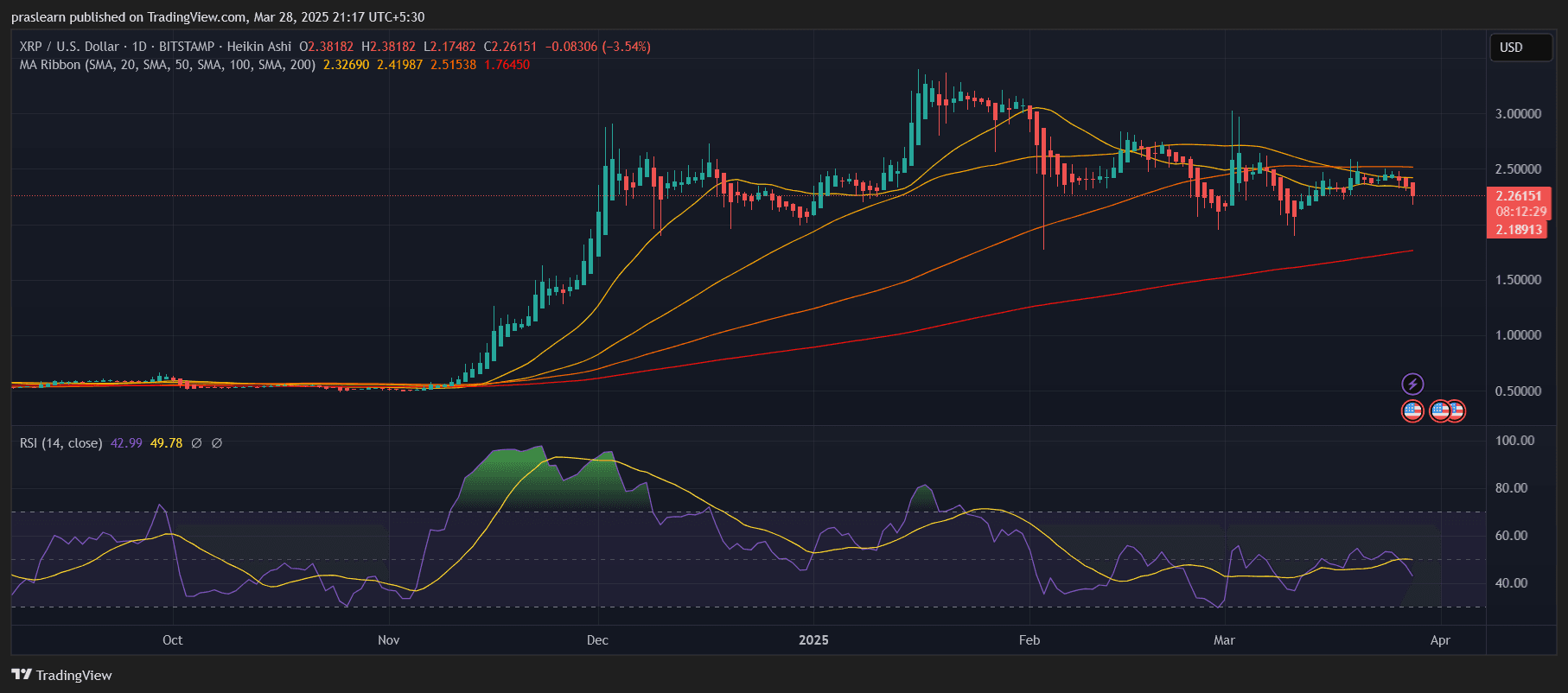

Will XRP Crash? Here’s What the Chart Is Warning Us About

Ethereum Price Prediction 2025: Will ETH Hit $10K Soon as Whales Accumulate?

Is XRP Following Kaspa’s (KAS) Bearish Trend? Price Action Suggests So