Ethereum’s Next Move: Will It Rise Above $2,200?

In Brief Ethereum needs to surpass $2,200 to initiate a new upward trend. Whales are accumulating ETH while smaller investors are selling. Open positions in ETH have reached record levels, signaling bullish expectations.

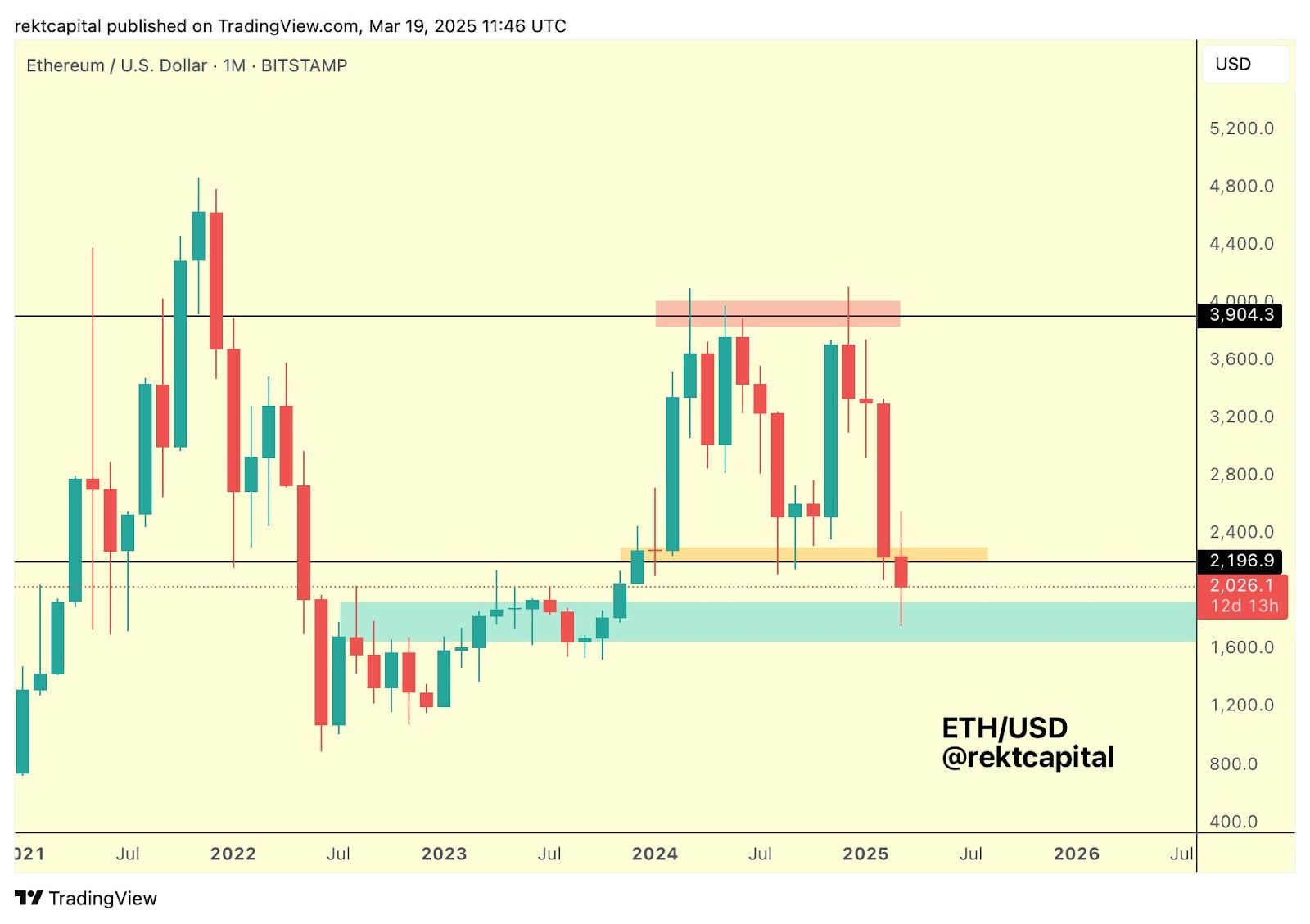

Experts suggest that Ethereum (ETH) $2,084 could initiate a new upward trend if it regains the $2,200 level. Analysts note that after falling 51% from its peak of $4,100 in December 2024, a strong recovery is unlikely without surpassing this macro threshold. According to popular analyst Rekt Capital, reclaiming the price range of $2,196 to $3,900 will be a determining factor for the market. Meanwhile, large investors seem to be increasing their ETH purchases during this period.

Whales Accumulate, Small Investors Sell

Nicolai Sondergaard, a research analyst at cryptocurrency analysis firm Nansen, explains that despite the drop in ETH prices, large investors are accumulating assets. He indicates that whales holding between 10,000 to 100,000 ETH have been consistently buying during March. While these whales choose to increase their holdings despite price declines, smaller investors are exerting selling pressure.

Rekt Capital – Altcoin Analysis of Ethereum ETH

Rekt Capital – Altcoin Analysis of Ethereum ETH

According to Glassnode data, the number of wallet addresses holding ETH worth $100,000 or more rose from 70,000 to 75,000 in March. However, when price levels were above $4,000 in December 2024, this number exceeded 146,000. This decline indicates a significant reduction in overall ETH holdings in the market. Analysts attribute this divergence to macroeconomic uncertainties and global trade wars, predicting that these factors will exert pressure on both Ethereum and the broader cryptocurrency market through early April.

Open Positions Reach Record Levels

Additionally, the number of open positions in ETH reached an all-time high in March, reflecting investor expectations for a quick rise above $2,200. Nevertheless, despite favorable developments like the SEC ‘s dismissal of the Ripple $2 case, the market has yet to gain significant upward momentum. Analysis by VanEck suggests that investors remain bullish for the long term, predicting a target price of $6,000 for ETH and $180,000 for Bitcoin $87,416 by 2025. However, due to short-term risks, investors are acting cautiously and closely monitoring macroeconomic developments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Memecoin Hype Diminishes Amid Market Saturation Concerns

Coresky Secures $15M for Meme Coin Incubation

SEC Ends Probe, Immutable (IMX) Jumps 15%

Ripple Drops Cross-Appeal in SEC Lawsuit