Chainlink Lead Top DeFi Projects—Does THIS Mean $13 is the Bottom?

Chainlink leads the top 10 DeFi projects by development. LINK completes a retest of multiyear support at $13 and now bouncing back nicely. Crowd is bullish while Smart Money is bearish on LINK.

Chainlink (LINK) ranked first among DeFi protocols based on development rate because it carried out 547.5 activities.

The altcoin traded at $14.32 with a $9.33B market capitalization that placed it as number 28 per the supplied worldwide ranking chart.

As the leading blockchain oracle network, Chainlink occupies the top position of protocols that deliver real-time, safe data to decentralized applications.

This was because the DeFi protocol maintained its dominant DeFi standing while building trust in secure development frameworks and ensuring future growth potentials.

Top DeFi projects | Source: Santiment

Top DeFi projects | Source: Santiment

The DeFiChain (DFI) was in the second position, while DeepBook Protocol (DEEP) held the third spot.

Lido DAO (LDO) stood as the sixth competitor, with 142.4 activities demonstrating potential popularity through staking solutions.

The leadership role of Chainlink results from its key decentralized finance activities that combine accurate pricing services for smart contracts and cross-chain connectivity with automatic smart contract features that enhance DeFi platform performance within the growing DeFi ecosystem.

Chainlink Completes Multiyear Support

For the price action of the altcoin, re-accumulation was observed clearly on the LINK/USDT 2-day time frame. Accumulations precede price rallies.

LINK reached its highest price of $30 in the first of December 2024, only to decline abruptly to around $18 in the last 2 weeks of December 2024 before breaking through the $15 support level.

LINK held an extended support zone between $12 and $13 during the period from January through March 2025.

LINK’s price is projected to trade back to $26 by May after reaching $12 support through this March.

Thus it’s potentially validating a bullish trend reversal above the descending trendline.

LINK/USD 2-day chart | Source: Trading View

LINK/USD 2-day chart | Source: Trading View

The bulls could push LINK price to $20 from the current value of $14.71 during the next week if it overcomes $15 resistance along with strong market volume.

The price of LINK must maintain support at $13 to prevent further decreases to $12 or $11 which would start a downward price movement.

The support at $12 passed the reevaluation test before LINK’s price increased to $14.71, showing new potential growth while any loss below $13 could create additional downside movement.

Crowd vs Smart Money Sentiment

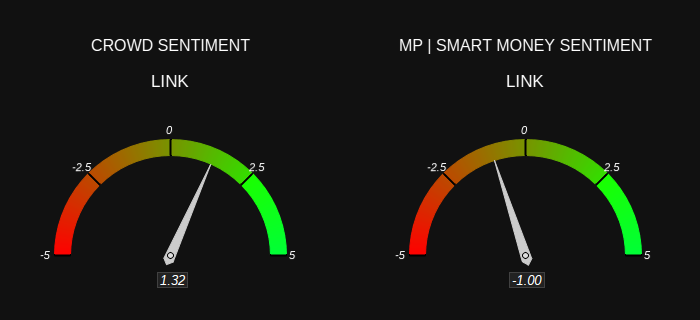

Furthermore, the sentiment gauges for Chainlink showed the overall sentiment of retail investors matched a score of 1.32 which sits on a range from -5 to 5 according to the Crowd Sentiment gauge.

These market sentiments tend towards moderate optimism, which explains either recent price developments or raised community awareness about LINK.

Regarding institutional trader sentiment, Smart Money sentiment maintained a negative value of 1.00.

Despite the bearish signals from experienced traders there is a possibility that market conditions or LINK fundamentals will limit future upward price movement.

The contrasting views from these two main participants in the market implied that Chainlink’s (LINK) present situation remains uncertain.

Institutional caution works to limit major growth despite retail sales driving brief price increases in the market.

LINK stands to benefit from sustained price growth if retail traders maintain their position and professional investors shift from bearish to bullish sentiment.

Long-term growth might be affected by ongoing institutional negative sentiment which needs constant observation of related metrics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terraform Labs Launches Crypto Loss Claims Portal for Investors

Bitcoin Core v29.0rc2 Update: Key Enhancements and Improvements

ビットコインはボラティリティの中で約29,200ドルまで回復

Cryptocurrency Market Analysis: Bitcoin Struggles at $90k, Predictions Vary for 2025