Bitcoin Gains as Ethereum ETFs Lose $760M: What’s Causing the Investor Alarm?

Exploring the Shift in Investor Sentiment and Strategies Amid Surging Bitcoin Popularity and Ethereum ETFs Divestment

Key Points

- Ethereum ETFs have recorded more than $760 million in outflows over the past month.

- Bitcoin ETFs have seen a surge of $785 million in inflows within the last six days.

Ethereum ETFs Face Decline

Ethereum [ETH] seems to be losing its appeal, at least for the time being. In the past month, Ethereum ETFs listed in the U.S. have seen over $760 million in outflows. This is in stark contrast to the growing interest in Bitcoin [BTC].

In the span of just six days, Bitcoin ETFs have attracted $785 million in new capital. This indicates a significant shift in investor sentiment and raises new questions about Ethereum’s role in the changing digital asset landscape.

Shift in Investor Sentiment

Ethereum ETFs have been experiencing a prolonged period of investor retreat, with over $760 million in net outflows over the past month.

Inflows briefly peaked at the end of January, with a notable single-day surge of over $300 million. However, this quickly turned into consistent outflows through February and March.

From mid-February onward, the chart has been dominated by red bars, illustrating a nearly unbroken stretch of daily net outflows. This reflects a growing caution toward Ethereum.

The total net assets for Ethereum ETFs currently sit at $6.77 billion, with ETH itself trading just under $2,000.

Institutional investors seem to be losing confidence in Ethereum’s near-term performance. This is especially true given the broader narrative increasingly focusing on Bitcoin .

With outflows on the rise, Ethereum risks losing its status as the second most favored crypto asset among ETF investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Agrees to $50M SEC Settlement in Lawsuit Conclusion

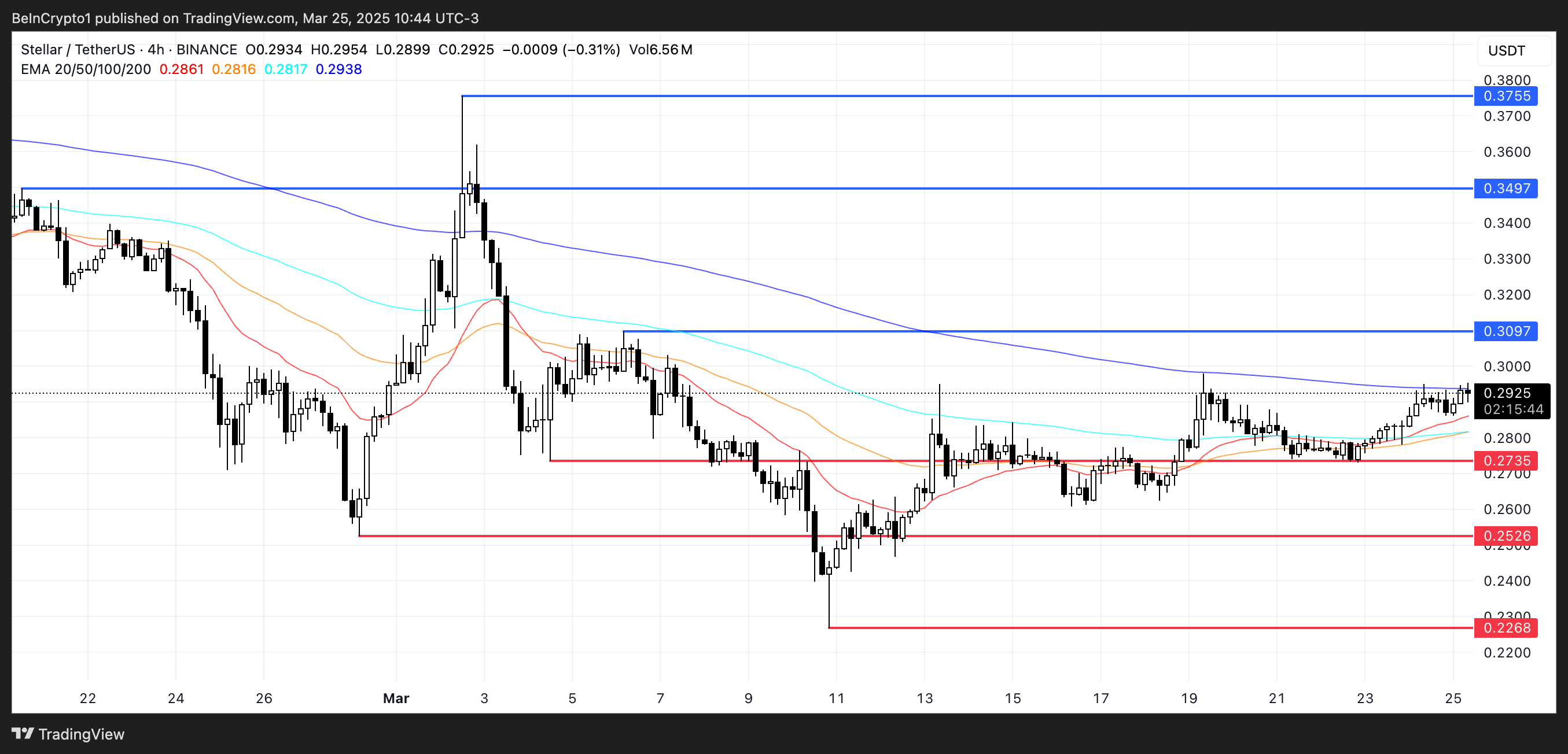

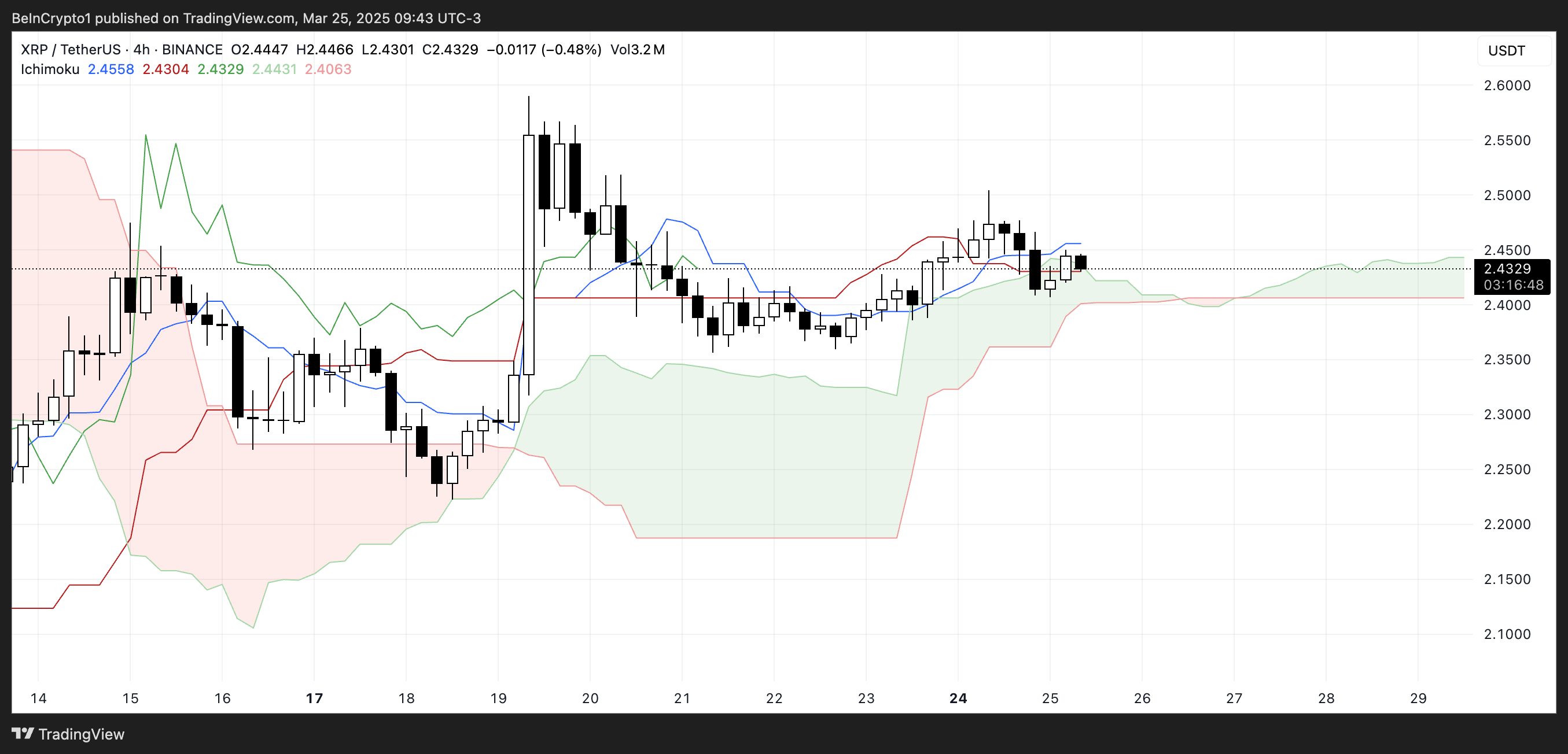

XRP Remains in Consolidation: Analyzing Market Indecision and Potential Price Movements

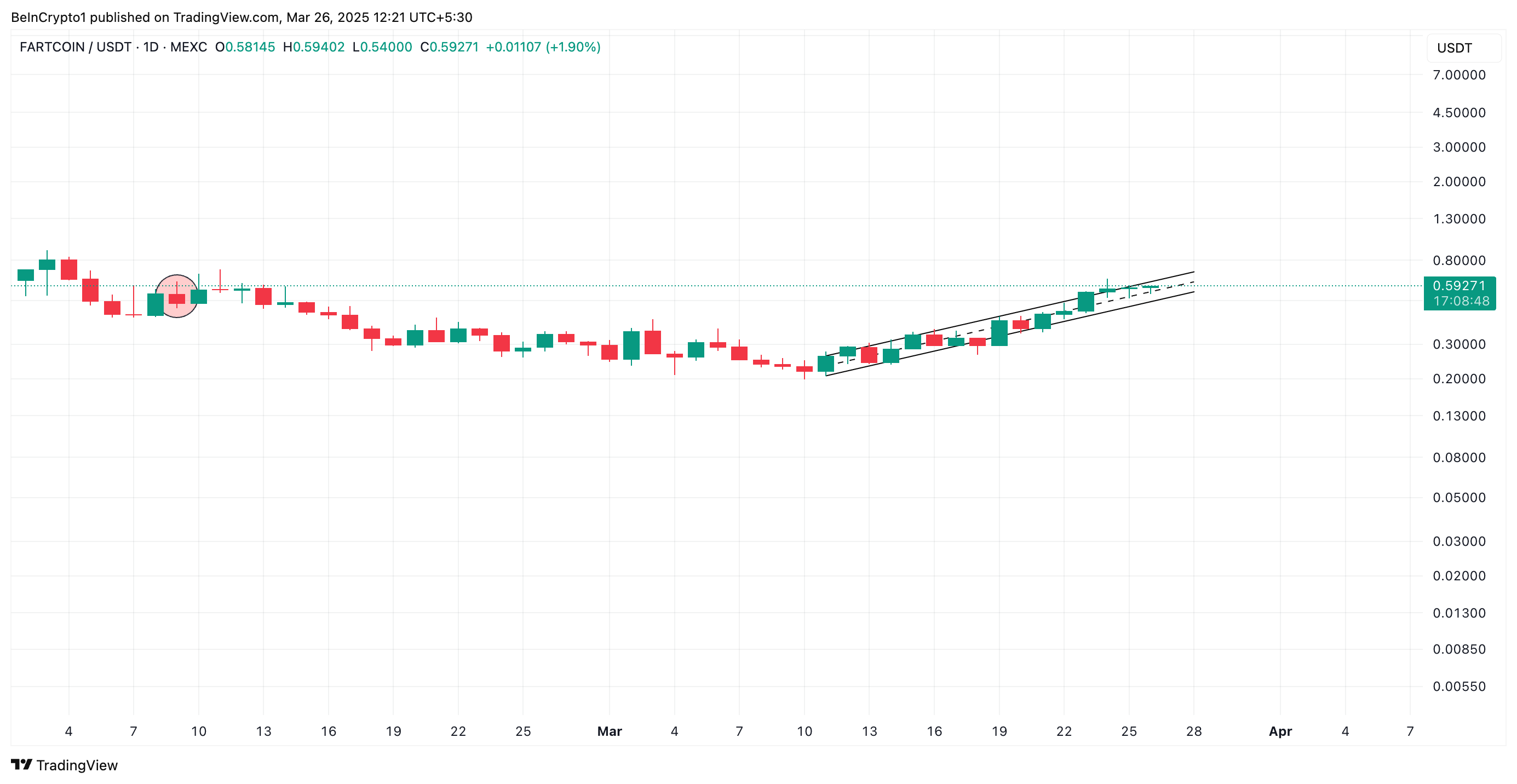

FARTCOIN Sees 11% Surge Amid Meme Coin Frenzy—Could It Target $0.95?