AI Fortress Layout: How Can Crypto Capital and AI Agents Dance Together?

Web2 kicked off the AI race, while Web3 is accelerating the arrival of the Autonomous Intelligent Agent economy

Original Article Title: Crypto AI Moats: Where Capital and Agents Converge

Original Article Authors: @Defi0xJeff, @steak_studio Lead

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: Cryptographic AI empowers autonomous intelligent agents to manage assets, optimize cash flow, and operate autonomously within the DeFi ecosystem. Compared to Web2 AI, it can access decentralized data, leverage open model collaboration, and accelerate evolution. With the development of DeFi, Darwinian AI, and decentralized infrastructure, AI will not only be an assistant but a direct participant in the on-chain economy, enabling asset holding, trading, and value creation. Crypto AI combines programmable currency with intelligent agents to build a decentralized economic system, accelerating the arrival of autonomous intelligent agent economics and breaking through the limitations of Web2 AI.

The following is the original content (slightly reorganized for readability):

As the market tightens, capital is gradually concentrating on stronger fundamentals, and the next wave of innovation in the AI field is accelerating its collision with the core moat of the crypto world.

Here are several key areas where crypto x AI may further converge, showcasing and solidifying the native AI applications in crypto.

The most direct synergy between AI and crypto: capital efficiency and yield optimization.

DeFi - On-Chain Yield

Stablecoins

RWA

Spot Perpetual Contract Trading

Lending Markets

Yield Markets (Interest / Rewards)

DeFi has always been at the core of the crypto world, providing globally accessible on-chain yield and trading opportunities. The incorporation of AI can more efficiently capture and optimize this value, enabling better utilization of idle capital. For example, DeFi can be used as a tool to hedge against inflation or to generate excess returns through AI strategies.

Stablecoins: as a core use case of cryptocurrency, encompassing nearly all on-chain transaction scenarios.

RWA: tokenizing assets such as government bonds, debt, real estate, DePIN loans, GPU computing power, and bringing them on-chain.

Spot Perpetual Contract Trading: optimizing transaction fees and returns.

Lending Markets: enhancing fund utilization through a more efficient lending mechanism to achieve superior returns.

Yield Market: Introducing a new interest rate market to enhance yield optimization capabilities.

Crypto = DeFi = Capital Flow and Value Accrual. Web3 AI may be better suited for this than closed Web2 systems, as the openness and incentive mechanisms of blockchain and tokenomics allow AI to efficiently manage funds.

Although DeFi AI is still in its early stages, there have been some exciting developments:

· @gizatechxyz's stablecoin yield optimization AI agent has surpassed $1M TVL, with a trading volume of $6M, achieving a yield 83%+ higher than traditional lending strategies.

· @Cod3xOrg has launched the Sophon Spark trading agent competition, where agents compete for a $1.5M reward and enhance their trading capabilities through data-optimized AI.

· @autonolas has introduced Modius Optimus, serving as personal portfolio management AI agents. Their team is the only one supporting users to run AI agents locally and recently launched the $1M Olas Accelerator Program.

· Projects like @HeyAnonai, @AIWayfinder, @slate_ceo, among others, are exploring more user-friendly DeFi gateways, albeit still in the early stages.

Why Are AI Agents Suitable for DeFi?

AI agents can continuously optimize yield and manage risk 24/7, intelligently adjusting positions. MPC (Multi-Protocol Compatible) is driving deep integration of DeFi with AI, enabling AI agents to access on-chain data and integrate more protocols. In the next year, AI agents may handle a significant amount of on-chain transactions, automate DeFi operations, and enhance yield optimization capabilities.

Key Areas to Watch:

Teams driving technological advancements and building developer ecosystems (hackathons, competitions, workshops, etc.).

Teams focusing on privacy, verifiability, and non-custodial models to ensure users truly control AI agents.

Growth metrics of AI agents, such as AUA (Agent Under Management) / TVL (Total Value Locked).

Beyond DeFi, AI is igniting an evolutionary race. Crypto AI is not just a yield optimization tool; it is accelerating the natural selection of AI agents and teams—only the strongest AI agents and teams can survive and thrive.

The Darwinian Law of AI Evolution (Natural Selection)

@opentensor (AI Compute Network)

@AlloraNetwork (Machine Learning / Prediction)

@BitRobotNetwork (Robotics)

Darwinism: The concept that "species evolve through natural selection." In other words, this is the AI team's "Hunger Games" — either driving technological advancement and receiving incentives or being phased out by the market.

Web3 AI provides the most suitable infrastructure for AI evolution, accelerating the process of natural selection through token incentives, inflation/deflation mechanisms. Bittensor has been at the forefront of driving this trend, with many teams building technology around its subnets (such as SN6, 41, 44), especially in the GambleFAI (prediction market) domain, leveraging AI/ML prediction capabilities to gain a competitive edge in the market.

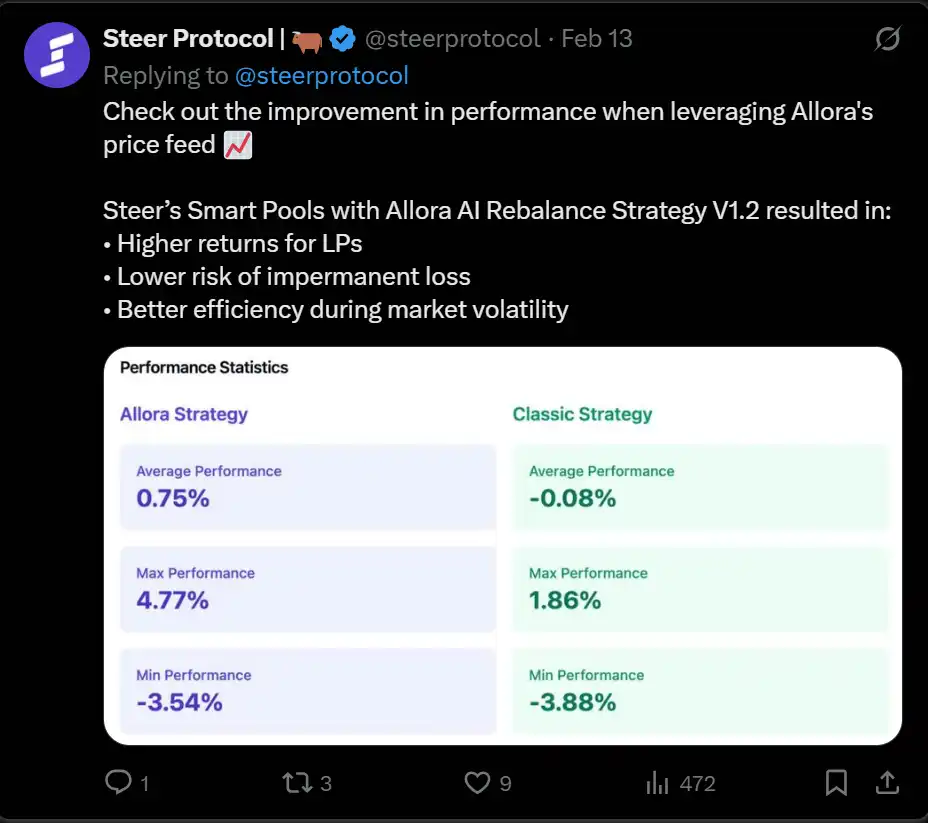

Allora is harnessing the power of machine learning to accelerate and enhance their models, covering a wide range of financial prediction use cases. Allora's model is similar to Bittensor but focuses on financial prediction. Instead of using subnets, it has established "Topics" (specific financial prediction use cases), where development teams can compete in these areas, with the top-performing teams receiving the most incentives.

Best Use Case:

Allora is collaborating with @steerprotocol to utilize AI-driven liquidity provision strategies to maximize returns on holdings while reducing impermanent loss (IL).

Bit Robot is developed by the @frodobots team, who are also the team behind @SamIsMoving (within the @virtuals_io ecosystem). Currently, there is limited information about Bit Robot, but they plan to build an ecosystem similar to Bittensor, focusing on robotics technology. Their subnets will represent different aspects of the robotics field, such as data, hardware, visual models, LLM, etc.

Focus Areas: $TAO price trends, dTAO ecosystem growth, how consumer apps/agents leverage subnet technology, Allora ecosystem integration, case studies, and Token Generation Events (TGE).

Key Elements of Decentralized Infrastructure:

Data

Model Training

Verifiability

Confidentiality

DePIN (GPU)

This type of infrastructure supports open collaboration, open innovation, and prevents the monopolization of technological innovation by a few centralized players. As mentioned in my previous article, with the advancement of DeFAI and Darwinian AI evolution, we will see continued adoption of these infrastructures, especially as more mature and clear use cases emerge.

In the short to medium term, the areas that interest me the most are:

Social Emotional Data:

· @KaitoAI Yap Leaderboard and the recently launched Yaps Open Protocol, allowing teams to build products based on Yap scores

· @aixbt_agent tracking mapping Alpha/Social trends on Twitter

· @cookiedotfun providing AI agent marketplace/social intelligence

On-chain Data:

· Currently, in the on-chain data space, we have not seen an absolute leader like in social emotional data.

Other Data Players

· Data Fetching: @getgrass_io utilizing idle bandwidth for data collection

· Data Ownership: @vana incentivizing data ownership through DataDAOs

· Secure Computation: @nillionnetwork introducing Blind Compute, its applications, and the upcoming $NIL TGE (launching soon)

For further reading on the data space:

About DePIN (GPU)

There are currently two interesting protocols emerging that facilitate the securitization of GPU assets through on-chain lending, helping data centers and operators to massively scale their GPU businesses.

Due to the continued growth of AI, the demand for computing power will never cease, and data centers will always need capital to expand operations. Therefore, projects like @gaib_ai and @metastreetxyz are connecting DeFi liquidity with borrowing demands, enabling on-chain DePIN rewards while providing capital support to GPU operators.

Gaib AI Dollar:

MetaStreet USDAI:

Key Takeaways

Crypto-native AI solves challenges that Web2 AI cannot overcome. Crypto AI not only provides computational power to intelligent agents but also endows them with transactional capabilities, enabling AI to manage assets, optimize cash flows, and autonomously operate in an open and permissionless network. Crypto AI is shaping a brand-new world where intelligent agents can:

· Freely move funds within the DeFi ecosystem without centralized intermediaries;

· Access decentralized data streams unreachable by Web2, gaining access to a richer source of information;

· Evolve faster through open models and collaborative ecosystems compared to closed systems.

In essence, Crypto AI turns scenarios that Web2 AI cannot replicate at scale into reality: the combination of programmable money and autonomous intelligent agents creates a fully verifiable, composable economic system. With the continued maturity of DeFi, Darwinian AI, and decentralized infrastructure, we will see AI not just as an assistant but as a direct participant in on-chain economies.

AI is not just smarter but also capable of autonomously holding, transacting, optimizing, and creating value; this is the true moat of Crypto AI.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Memecoin Hype Diminishes Amid Market Saturation Concerns

Coresky Secures $15M for Meme Coin Incubation

SEC Ends Probe, Immutable (IMX) Jumps 15%

Ripple Drops Cross-Appeal in SEC Lawsuit