The Rise of BUIDL: What $1B on Ethereum Really Means

- BUIDL’s AUM surpasses $1 billion, fueled by institutional demand and Ethena’s $200 million injection.

- Sky plans a $500 million allocation into BUIDL, signaling rising trust in blockchain-based investment vehicles.

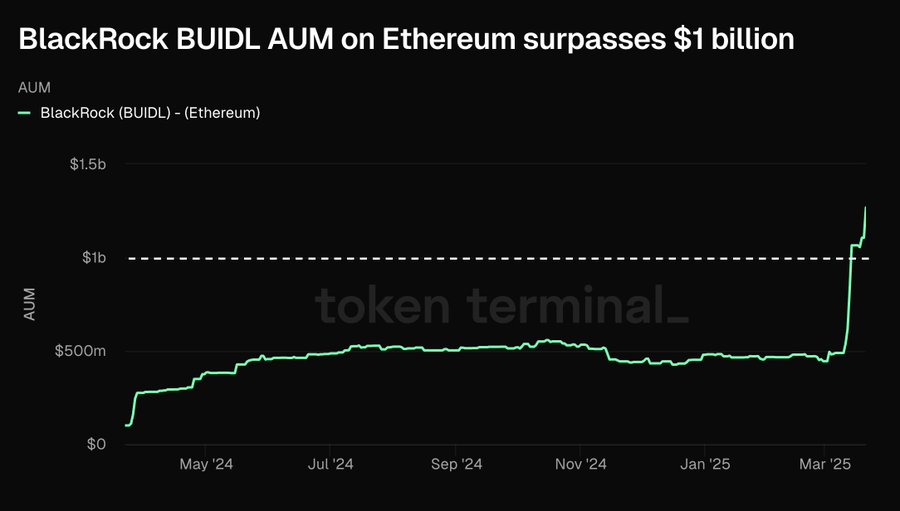

Financial giant BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has surpassed $1 billion in total assets under management (AUM) on the Ethereum network, according to data from Token Terminal .

There’s an interesting sequence of events behind the surge that shows how the traditional banking sector is starting to merge with blockchain infrastructure. While the crypto world and large financial institutions like BlackRock used to be two worlds that were difficult to unite, now they seem to be starting to become teammates.

What Made BUIDL Suddenly So Attractive to Crypto Players?

One of the reasons for BUIDL’s AUM surge in recent months is the influx of funds from the crypto protocol Ethena. The value is significant, amounting to approximately $200 million. It’s like getting a big energy injection in one go.

The presence of Ethena shows that crypto projects are starting to believe and are willing to “save” in products created by large institutions.

Furthermore, the features offered by BUIDL also have their own appeal. This token provides a stable value and pays dividends every month. In other words, this is not just a digital token that goes up and down like a roller coaster, but more like a blockchain-based mutual fund that can be invited to “have coffee together at the end of the month” in the form of dividends.

BUIDL Takes the Lion’s Share in Sky’s $1B Crypto Play

On the other hand, the $1 billion investment plan from Sky (formerly known as MakerDAO) is additional news that has made the crypto world even hotter. Sky plans to allocate half of its funds—about $500 million—into BUIDL. Imagine if a big investor believed in it and immediately bought half a store; of course, the price and exposure would soar.

Interestingly, these funds are not only given to BUIDL. Other projects such as Superstate and Centrifuge will also receive part of the allocation. But still, the largest portion flows to BUIDL. This shows how this project is considered stable and trustworthy.

Injective Makes Institutional Funds Just a Few Clicks Away

Let’s go back a moment to September 2024. As we previously reported , Injective, one of the leading blockchain protocols, introduced the first tokenized index for BlackRock’s BUIDL fund.

More than just a complement, the index allows anyone to access the funds quickly and at low cost. Think of it like an investment app that lets you buy a small “share” of a BlackRock fund with just a few clicks.

This approach opens up broader access to institutional money, which was once accessible only to a select few. It’s like when e-commerce replaced malls, everyone could get in on the action.

Institutional Money Is No Longer Shy Around Blockchain

BUIDL’s AUM spike is clear evidence that institutional interest in asset tokenization is on the rise. No longer just a topic of discussion at tech conferences, tokenization is now part of a serious investment strategy.

It used to be hard to imagine big financial firms wanting to touch blockchain. But now, instead of shying away, they are creating products based on the technology.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

USDC Treasury Mints $250 Million on Solana Blockchain

zkLend Exploiter Claims to Lose $9.6M Stolen Funds to Phishing Scam

The hacker responsible for the $9.6 million exploit of zkLend claims to have lost a significant amount of the stolen funds to a phishing scam that mimicked Tornado Cash.

SpaceX Launches First Manned Mission to Orbit Earth’s Poles, Led by Crypto Entrepreneur

Elon Musk’s SpaceX has embarked on a groundbreaking mission, sending four private astronauts on the first-ever human spaceflight to orbit the North and South Poles.

Bitcoin Mining Shifts to Cleaner Energy as Coal Use Declines

Bitcoin mining has shifted towards cleaner energy sources over the past 13 years.