Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Elixir priceELX

Elixir (ELX) has been listed on Bitget spot trading market, you can quickly sell or buy ELX. Trading Link: ELX/USDT.

New users can get a welcome gift package worth 6200U, Claim it now>>

How do you feel about Elixir today?

Price of Elixir today

What is the highest price of ELX?

What is the lowest price of ELX?

Elixir price prediction

When is a good time to buy ELX? Should I buy or sell ELX now?

What will the price of ELX be in 2026?

What will the price of ELX be in 2031?

Elixir price history (USD)

Lowest price

Lowest price Highest price

Highest price

Elixir market information

Elixir market

Elixir holdings by concentration

Elixir addresses by time held

Elixir ratings

About Elixir (ELX)

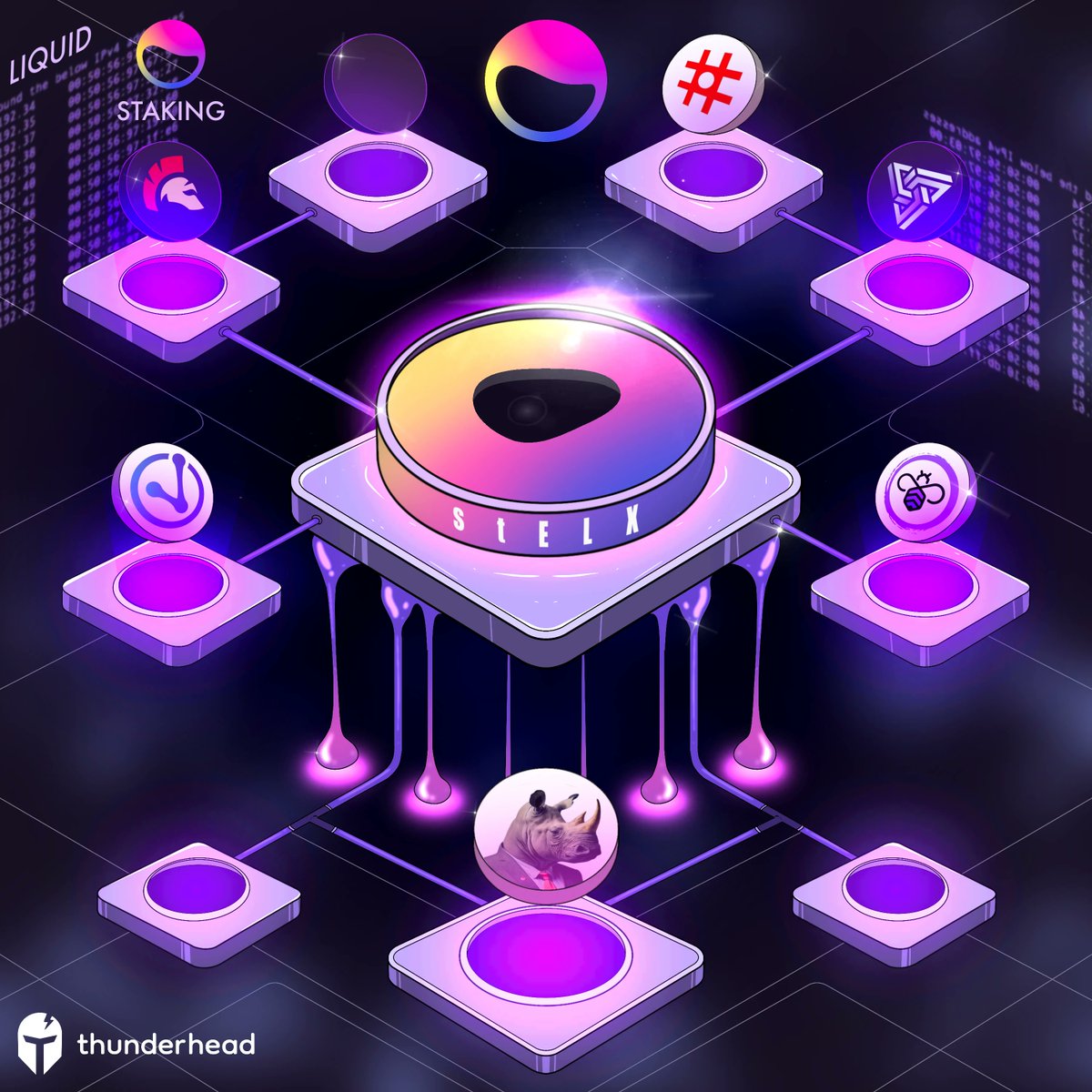

What Is Elixir?

Elixir is a modular liquidity network designed to improve trading efficiency in decentralized finance (DeFi) and centralized exchanges (CEXs). It provides an infrastructure that enhances order book liquidity and allows institutional investors to interact with blockchain-based markets.

A key feature of Elixir is deUSD, a fully collateralized, yield-bearing synthetic dollar. Unlike traditional stablecoins, deUSD does not rely on a direct 1:1 peg with US dollars but instead maintains its value through a combination of liquid assets, including stETH and MakerDAO’s USDS T-Bill protocol. This approach ensures that deUSD remains stable even in volatile market conditions.

Elixir integrates with financial institutions such as BlackRock, Hamilton Lane, and Apollo through a partnership with Securitize. This integration allows real-world assets (RWAs) to enter the crypto economy in a compliant and structured manner. The network is secured by over 30,000 validators, ensuring decentralization and security in its operations.

How Elixir Works

Elixir operates through a decentralized proof-of-stake (DPoS) consensus mechanism, where validators play a critical role in securing the network and managing liquidity. Several key components define how the ecosystem functions:

Liquidity Infrastructure for Exchanges

Elixir connects with both decentralized and centralized exchanges to improve liquidity for trading pairs. Many DeFi exchanges struggle to attract sufficient market-making activity, leading to poor liquidity and wider bid-ask spreads. By integrating with Elixir-powered liquidity pools, exchanges can improve trading efficiency.

Users can contribute liquidity to Elixir’s network, allowing them to earn passive rewards. Retail investors who provide liquidity help build stronger order books, reducing reliance on centralized market makers.

deUSD: A Synthetic Stable Asset

Elixir’s native synthetic dollar, deUSD, serves as a key element in the ecosystem. Unlike traditional stablecoins that rely on fiat reserves, deUSD is collateralized by a combination of:

- stETH (staked Ethereum), which is hedged through short ETH perpetual futures contracts.

- MakerDAO’s USDS, a stable asset backed by U.S. Treasury bills.

When funding rates become negative, deUSD’s backing shifts into MakerDAO’s T-Bill protocol, ensuring resilience during unfavorable market conditions.

Institutions can mint deUSD by converting tokenized real-world assets (RWAs) into the synthetic dollar, allowing them to participate in DeFi markets without changing their asset exposure. This feature provides native composability for institutions while bringing new capital into DeFi.

Validator Network and Security

Elixir’s network is supported by over 30,000 validators who reach consensus on transactions and liquidity movements. The system requires a 66% consensus threshold for order execution, making it resistant to manipulation.

To maintain security and transparency, Elixir incorporates a fraud-proof mechanism, where auditors monitor network activity. If validators act dishonestly, an on-chain dispute resolution process penalizes them by slashing their stake.

Transition from Centralized to Decentralized Execution

Initially, deUSD’s liquidity and order execution take place on centralized exchange venues using Fireblocks’ off-exchange custody. However, Elixir aims to shift towards fully decentralized execution as DeFi liquidity increases. The long-term goal is to ensure that all collateral management, hedging, and order execution occur entirely on-chain.

What Is the ELX Token?

ELX is the native utility and governance token of the Elixir ecosystem. With a total supply of 1 billion tokens, it serves multiple roles, including staking, governance, and network security.

1. Staking and Validator Participation

- Validators must stake 9,000 ELX tokens to operate within the network.

- The staking mechanism aligns validator incentives with network security, ensuring honest participation.

2. Governance Rights

- ELX holders have decision-making power over network upgrades, fee structures, and liquidity incentives.

-Governance participants influence the long-term development of the Elixir ecosystem.

3. Potential Fee Mechanisms

- Once the network reaches full decentralization, ELX holders will decide whether to introduce protocol fees.

- Any value captured through fees may be distributed to stakers or reinvested into network incentives.

Should You Invest in Elixir?

Investing in Elixir depends on your risk tolerance and belief in its ability to bridge traditional finance and DeFi. The project brings institutional liquidity into crypto, enhances decentralized exchange order books, and offers a yield-bearing synthetic dollar, deUSD. If you are interested in staking, liquidity provision, or exposure to real-world assets in DeFi, Elixir may be worth exploring. However, as with any investment, it is essential to do your own research and assess the potential risks before committing funds.

ELX to local currency

- 1

- 2

- 3

- 4

- 5

How to buy Elixir(ELX)

Create Your Free Bitget Account

Verify Your Account

Convert Elixir to ELX

Trade ELX perpetual futures

After having successfully signed up on Bitget and purchased USDT or ELX tokens, you can start trading derivatives, including ELX futures and margin trading to increase your income.

The current price of ELX is $0.4854, with a 24h price change of -10.90%. Traders can profit by either going long or short onELX futures.

Join ELX copy trading by following elite traders.

Elixir news

Quick Take Securitize is integrating its first oracle, which would make it easier to bridge the onchain funds it issues for institutions like Apollo, BlackRock, Hamilton Lane and KKR into DeFi. RedStone offers a modular, omnichain architecture that makes it easier to launch onto new blockchains.

Buy more

FAQ

What is the current price of Elixir?

What is the 24 hour trading volume of Elixir?

What is the all-time high of Elixir?

Can I buy Elixir on Bitget?

Can I get a steady income from investing in Elixir?

Where can I buy Elixir with the lowest fee?

Where can I buy Elixir (ELX)?

Video section — quick verification, quick trading

Bitget Insights

Related assets

![Pi [IOU]](https://img.bgstatic.com/multiLang/coinPriceLogo/pi.png)

Elixir Social Data

In the last 24 hours, the social media sentiment score for Elixir was 0, and the social media sentiment towards Elixir price trend was Bearish. The overall Elixir social media score was 1,385, which ranks 2881 among all cryptocurrencies.

According to LunarCrush, in the last 24 hours, cryptocurrencies were mentioned on social media a total of 1,058,120 times, with Elixir being mentioned with a frequency ratio of 0%, ranking 2881 among all cryptocurrencies.

In the last 24 hours, there were a total of 1 unique users discussing Elixir, with a total of Elixir mentions of 0. However, compared to the previous 24-hour period, the number of unique users decrease by 0%, and the total number of mentions has decrease by 0%.

On Twitter, there were a total of 1 tweets mentioning Elixir in the last 24 hours. Among them, 0% are bullish on Elixir, 0% are bearish on Elixir, and 100% are neutral on Elixir.

On Reddit, there were 0 posts mentioning Elixir in the last 24 hours. Compared to the previous 24-hour period, the number of mentions decrease by 0% .

All social overview

0