Ethereum Battles Key Resistance as Market Volatility Intensifies

Ethereum prices declined sharply and reached their lowest point in several months when they settled at $1,779.5. Despite recent lows Ethereum indicates a turnaround and trades at $1,912.04. Current price strength for Ethereum may end short-term because it needs to break through an essential resistance point.

Ethereum keeps attracting investors because its total value reached $230.61 billion during a wider market bounce. Whale sell-offs cause high price swings in Ethereum since traders have weak control over its market movements.

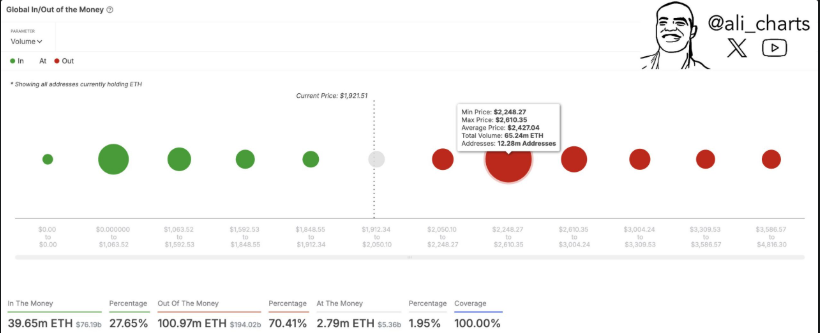

Ethereum Faces Resistance at $2,610 Level

The combined 12.28 million Ethereum wallet owners control 65.24 million ETH tokens as they approach these important resistance value ranges of $2,248.27 up to $2,610.35. Out of all Ethereum holders 70.42% or 100.97 million ETH currently shows losses and 27.65% or 35.84 million ETH shows profits.

The combined risk grows when 1.95% token holders at zero profit choose to sell their tokens along with existing market selling pressure. Ethereum faces big resistance at the $2,610 price level. When Ethereum surpasses $2,610 traders expect a strong upward momentum since the following price points stand as weaker barriers.

According to market analysts ETH needs to go above $2,610 for upcoming price increases that could reach $2,750 or $3,000. ETH”s price maturity after resistance depends on whether the asset can break through $2,610. ETH continues to have a risk-laden path ahead because market instability along with approaching CPI figures will impact investor decisions.

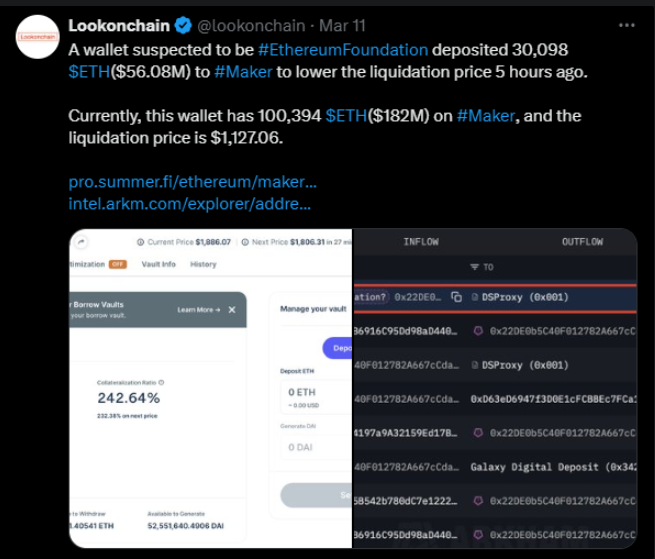

Ethereum Faces Critical Support at $1,500

Ethereum”s price activity depends on whether it maintains its current movement against $1,500 support. Ethereum may hit $1,250 if investors greatly increase their selling. Several additional price drops would follow further ramped-up selling. Ethereum professionals say a fast market decline would affect the entire economy plus force Ethereum Foundation to sell its remaining 182 million ETH if prices hit $1,127.

Ethereum keeps attracting attention within the broader cryptocurrency network. Market momentum for Ethereum may rise if investors consider ETF news and supply deflation while Monthly Market Gauge shows good results. When all possible triggers act together they might make Ethereum push past its current hurdles to achieve greater value.

At this moment Ethereum holds a decisive point but the future trends could move upward or downward. Breaking past $2,610 will create an opportunity for greater growth in the market but a failure to hold this level signals upcoming price drops. Traders and investors need to follow important resistance and support areas to take effective trading positions.

The next steps Ethereum takes will strongly impact other cryptocurrencies in the market. External market conditions will show over the next days if ETH can push through its current challenge or slide into more price declines.

Дисклеймер: содержание этой статьи отражает исключительно мнение автора и не представляет платформу в каком-либо качестве. Данная статья не должна являться ориентиром при принятии инвестиционных решений.