Bitcoin Struggles at $85K Amid Market Uncertainty

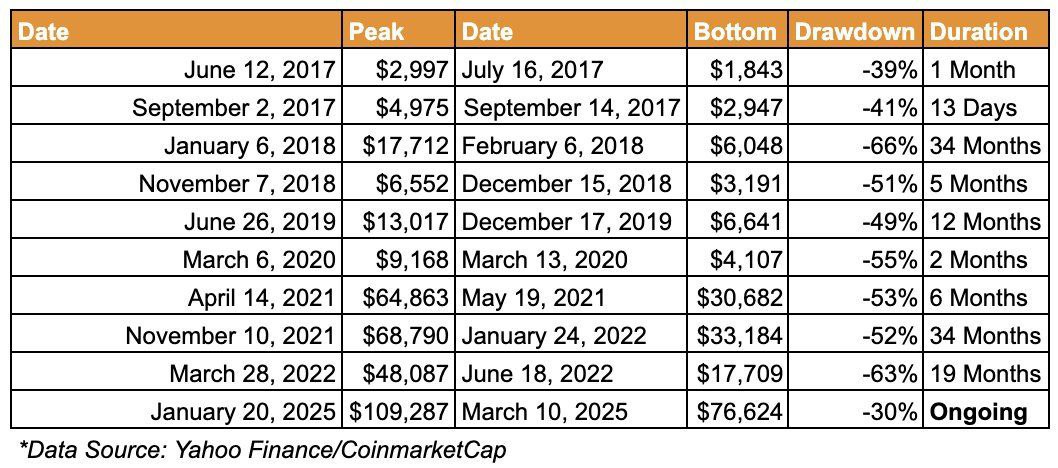

Bitcoin shows market resistance at $85,000 after losing 30% of its value since reaching $109,287 high in January. Market participants cannot agree if Bitcoin will resume its growth path because the cryptocurrency fails to climb above its $85,000 resistance level.

In his research Compass Mining”s Anthony Power predicts that Bitcoin could rise markedly between 2025 late and 2026 early given similar market trends after past halving events despite its price fall.

Fear Greed Index Signals Volatility

Bitcoin has shown strong growth periods that later produced strong price drops throughout its lifetime. Following its record price year in 2017 Bitcoin dropped 80% and after its high in 2021 investors experienced another 75% price loss.

Bitcoin indicators show conflicting data about its future direction at the present time. The MVRV Z-Score shows that Bitcoin holds important value or consolidation levels in its market-to-realized-value measurement. Investors hold onto their Bitcoin holdings for more than twelve months making 63% of existing supply unchanged while awaiting market stability.

Investor feelings towards Bitcoin have moved between extreme fear and extreme greed very quickly. According to the Fear Greed Index the trading sentiment of investors experienced a sharp transition from near-absolute enthusiasm at 90 levels in December 2024 back to intense fear at 15 by January 2025.

Federal Interest in Bitcoin Remains Strong

Market-wide conditions strongly affect Bitcoin price trends. The impact of large investors and US government choices stays strong in shaping Bitcoin prices. Bitcoin exchange-traded funds added 126% value in January 2024 but the funds started leaving cryptocurrency in record amounts early 2025 pointing toward declining institutional backing.

After President Trump created a Strategic Bitcoin Reserve the federal government continues to show interest in digital assets. In the long run Bitcoin has positive prospects despite ongoing market instability.

Anthony Power and other experts predict strong future gains in Bitcoin value. Market experts at Standard Chartered and Bitwise expect Bitcoin to reach $200,000 by 2023 but only if institutional investors return accompanied by clear industry rules.

The current Bitcoin price decline creates additional problems for miners who mine Bitcoin. Bitcoin mining becomes harder and gets less rewarding so miners need effective risk management strategies. The Hashprice contracts provided by Luxor assist miners by protecting them against financial risk.

Дисклеймер: содержание этой статьи отражает исключительно мнение автора и не представляет платформу в каком-либо качестве. Данная статья не должна являться ориентиром при принятии инвестиционных решений.

Вам также может понравиться

Вчера чистый отток из американского спотового биткоин-ETF составил 93,16 млн долларов США

Маск объявляет цель DOGE: сокращение на триллион к концу мая