Crypto Loans: How to Apply and Manage Borrowed Funds - Website Guide

[Estimated Reading Time: 3 minutes]

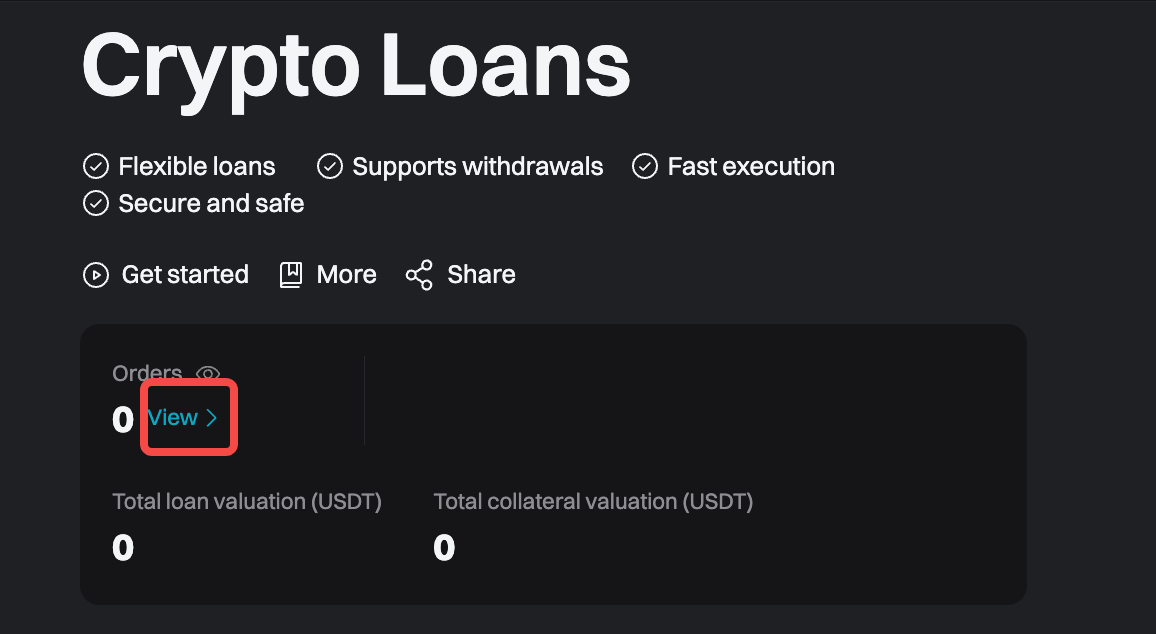

This article explains how to apply for and manage Crypto Loans on Bitget. Learn how to use your crypto assets as collateral, borrow funds, and track your loan status.

What Are Crypto Loans?

Bitget Crypto Loans allow users to borrow cryptocurrencies by using their existing assets as collateral. This enables users to access liquidity without selling their holdings, making it an ideal option for traders and investors who want to maximize capital efficiency.

Key Features of Crypto Loans

-

Flexible and fixed-term loans: Choose between flexible loans with no fixed repayment schedule or fixed-term loans with predetermined durations.

-

Supports multiple cryptocurrencies: Borrow a variety of assets and use different cryptocurrencies as collateral.

-

Fast execution: Get instant approval and quick access to borrowed funds.

-

Collateral protection: Risk management tools, including margin calls and liquidation alerts, help safeguard your assets

How to Apply for a Crypto Loan?

Step 1: Access Crypto Loans

1. Go to the Crypto Loans page: Navigate to Earn > Crypto Loans from the Bitget homepage.

2. Browse loanable assets: Review available cryptocurrencies, loan interest rates, and repayment options.

Step 2: Select Loan Terms

1. Click Borrow: Choose the cryptocurrency you want to borrow from the Market section.

2. Set the loan term: Select between:

-

Flexible loan: No fixed repayment period, allowing you to repay anytime.

-

7-day fixed rate: A short-term loan with a fixed interest rate.

-

30-day fixed rate: A longer-term loan with stable interest charges.

Step 3: Enter Loan Details

1. Choose the loan amount: Enter how much you want to borrow.

2. Select collateral: Enter the amount of collateral you will provide.

3. Review loan risk levels: Check key indicators such as:

-

Initial Loan-to-Value (LTV) ratio

-

Margin call LTV

-

Liquidation LTV

Step 4: Confirm and Borrow

1. Agree to the terms: Read and accept the Bitget Crypto Loan Service Agreement.

2. Click Confirm: Your loan request will be processed, and the borrowed funds will be credited to your account.

How to Manage Your Crypto Loan?

Step 1: View Your Active Loans

1. Go to Crypto Loans and click View to access the Ongoing Loans page.

2. Check your loan details: View your current loan type, collateral value, and repayment status.

Step 2: Repay the Loan

1. Select the loan to repay: Choose an active loan from the Ongoing Loans section.

2. Make repayment: Pay back the borrowed amount along with any accrued interest using the supported repayment options.

Step 3: Adjust Collateral (If Needed)

-

Add collateral: If your collateral value drops and reaches the margin call LTV, you may need to deposit more funds to avoid liquidation.

-

Withdraw excess collateral: If your collateral value increases, you may be eligible to reduce the amount of locked collateral.

FAQs

1. What happens if my collateral value drops?

If the collateral value falls below the required maintenance level, a margin call will be triggered. If additional collateral is not provided, the system may liquidate part of your collateral to cover the loan.

2. Can I repay my loan early?

Yes, early repayment is allowed. Interest is charged based on the borrowing period, so repaying early can reduce total costs.

3. What cryptocurrencies are available for loans?

Bitget offers multiple cryptocurrencies for borrowing and as collateral. Check the Crypto Loans page for the latest supported assets.

4. Is there a maximum borrowing limit?

Yes, borrowing limits depend on factors such as the collateral type, loan-to-value (LTV) ratio, and market conditions.

5. Can I renew my loan?

Fixed-term loans may offer renewal options. You can check the renewal eligibility in the Current Loans section.

Join Bitget, the World's Leading Crypto Exchange and Web 3 Company

Share